DCB Bank reports 24% drop in Q4FY17; bad loan rises marginally

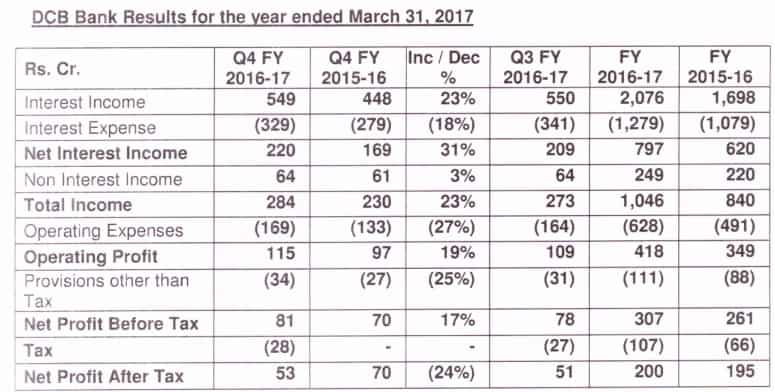

The profit before tax (PBT) was at Rs 81 crore in Q4FY17, an increase of 17% as compared to Rs 70 crore in Q4FY16.

DCB Bank on Friday reported a profit after tax (PAT) of Rs 53 crore, a drop of 24%, during the quarter ended on March 31, as against of Rs 70 crore in the previous quarter.

The profit before tax (PBT) was at Rs 81 crore in Q4FY17, an increase of 17% as compared to Rs 70 crore in Q4FY16.

For the full financial year, the bank registered PAT of Rs 200 crore, a rise of just 3% as compared to Rs 300 crore during the financial year 2015-2016. However, the PBT for FY17 was at Rs 307 crore, also a rise of 17% as against Rs 261 crore in FY16.

According to the financial report submitted by bank to exchanges, the net interest income of the bank rose by 29% to Rs 797 crore in FY17, while non-interest income was up by 13% to Rs 220 crore in the last fiscal.

The gross non-performing asset ratio was at 1.59% as on March, 2017 as compared to 1.51% as on March, 2016. The net NPA remained at 0.79% as on FY17 from 0.75% as on FY16.

Commenting on the performance of the bank, Murali M Natrajan, Managing Director & CEO said, "We have completed almost 70% of the 150 new branches roll out plan announced in October 2015. Our aims to cross 300+ branches by December 2017. Business growth and momentum in Q4FY17 was better than Q3FY17. As of now NPAs remain in control we continue to remain watchful."

As per the data released, the CASA ratio increased to 24.31% in FY17 as against 23.38% as on FY16. Saving accounts year-on-year growth rate of 36%.

Motilal Oswal in its research report had said that they were expecting loan growth of 22% on y-o-y basis and deposit growth of 28% on y-o-y basis. " We expect NII to grow 24% YoY, led by strong loan growth, although margins are expected to contract ~10bp QoQ/YoY owing to pressure on yields."

On Thursday, the shares of the company closed at Rs 179.65 per piece, down 1.07% or Rs 1.95 on BSE.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

07:16 PM IST

DCB Bank Q4 results: Company reports 9.85% rise in net profit at Rs 156 crore

DCB Bank Q4 results: Company reports 9.85% rise in net profit at Rs 156 crore DCB Bank Q4 dividend: Lender's stock closes 10% higher after board announces Rs 1.25 dividend

DCB Bank Q4 dividend: Lender's stock closes 10% higher after board announces Rs 1.25 dividend DCB Bank logs 13% rise in net profit to Rs 127 crore in Q2

DCB Bank logs 13% rise in net profit to Rs 127 crore in Q2  DCB Bank raises MCLR rates across tenors by 27 basis points

DCB Bank raises MCLR rates across tenors by 27 basis points  Stocks to buy with Anil Singhvi: Sanjiv Bhasin picks DCB Bank, Hero Moto, SAIL - Check price target

Stocks to buy with Anil Singhvi: Sanjiv Bhasin picks DCB Bank, Hero Moto, SAIL - Check price target