Brexit, US visa headwinds to drag Q3 revenues of IT sector down

While Q3 is a weaker quarter for the IT sector, headwinds such as a muted macro economic environment, Brexit and the US visa concerns are expected to hit earnings during this quarter.

The IT industry has been going through a rough time during the Q3 quarter. The BSE IT index continues to under-perform in comparison to the Sensex on a 6 months and 1-year basis.

This is due to the headwinds that the industry faces from muted global macro economic environment, Brexit and the transition of existing business to new technologies, said Urmi Shah, IT Sector Analyst in an IDBI Capital Research IT Services Sector report. She adds that the sector is likely to be hit by more issues such as the adverse visa rules. This is as there is news that the Republican Party is likely to reintroduce the H1B Visa restrictions bill in the US Senate when US when President elect-Donald Trump takes office.

Besides these headwinds, Q3 is expected to be a seasonally weak quarter for IT companies and this is expected to take revenues down further.

“Weak seasonality coupled with cross currency headwinds will impact December 2016 quarter revenue performance of Indian IT Services players, we expect 0.6% to 2.7% constant currency quarter-on-quarter (QoQ) growth with 100 to 150 basis points QoQ cross currency headwinds for Tier I players,” said analysts Manik Taneja and Ruchi Burde in an Emkay IT Services report.

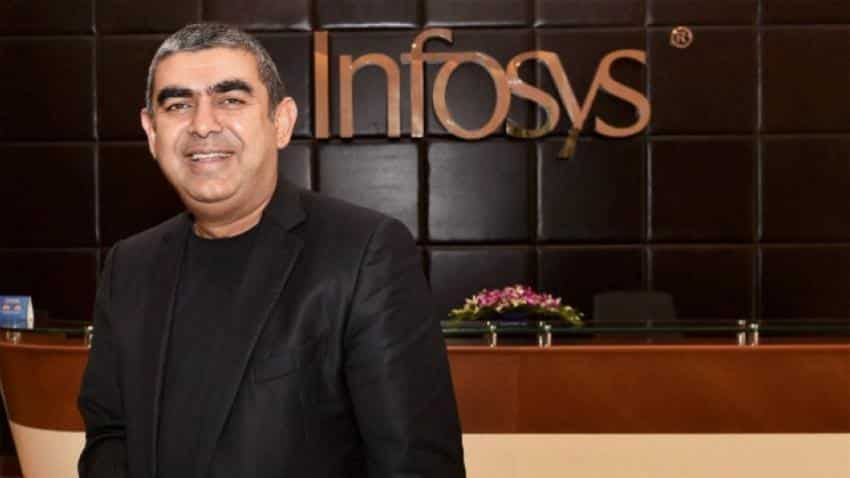

They expect HCL Technologies to report only a 2.7% QoQ growth, while Infosys is expected to report an even lower growth of 0.6% QoQ. “While weak seasonality will drive moderation in sequential growth rates for

Tier I players, we estimate marginal improvement in constant currency (cc) YoY growth trajectory to 8.9% for Dec’16E quarter V/s 8.3% YoY cc growth in Sep’16 quarter,” said the Emkay report.

For tier II IT players it expects a 0.8% QoQ growth during Q3 with Persistent Technologies at the top end. However, the IDBI report expects Tech Mahindra to grow at 3.5% QoQ led by its core-business growth of 3% QoQ.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

12:59 PM IST

Indian IT sector slumps as fears of Donald Trump's victory comes true

Indian IT sector slumps as fears of Donald Trump's victory comes true IT sector slows in Q1 but low debt to save the day this fiscal

IT sector slows in Q1 but low debt to save the day this fiscal Q1 snapshot: IT sector’s revenue growth to remain stable

Q1 snapshot: IT sector’s revenue growth to remain stable  David Kennedy's departure from Infosys is a cause for concern, InGovern says

David Kennedy's departure from Infosys is a cause for concern, InGovern says Infosys Wipro, HCL Tech saw decline in market cap days after Q2

Infosys Wipro, HCL Tech saw decline in market cap days after Q2