Bharti Airtel's Q1 earnings explained in six charts

Blaming Reliance Jio's free offers and higher spectrum costs, Bharti Airtel said the company posted 74.8% yoy decline in consolidated net profit to Rs 367 crore.

Key highlights:

- Bharti Airtel's net profit decline by 75% in Q1

- Net debt of Bharti Airtel stands at Rs 87840.4 crore in Q1

- Total revenue declines by 14% in Q1

Bharti Airtel posted consolidated net profit of Rs 367 crore, down 74.8% compared to Rs 1,462 crore in the corresponding period of the previous year. Total revenues declined by 14.04% to Rs 21,958.10 crore versus Rs 25,546.50 crore a year ago same period.

Gopal Vittal, MD and CEO, India & South Asia, said, “The pricing disruption in the Indian telecom market caused by the entry of a new operator continued with industry revenues declining over 15% Y-o-Y, creating further stress on sector profitability, cash flows and leverage.”

Pricing disruption in the telecom market has been mentioned as major reason by Airtel since the last three quarters.

Mukesh Ambani's Reliance Jio since the launch on September 05, 2016, have been taken as a threat for other incumbent operators which also includes Bharti Airtel due to its free offers.

Here's how, Rjio's free offers impacted Bharti Airtel's earnings in last three quarters.

Bharti Airtel's earning growth which stood Rs 1,554.30 crore in Q1FY16 came down to Rs 1,462 crore in Q1FY17 and further reached to three-digit to Rs 367.3 crore in Q1FY18.

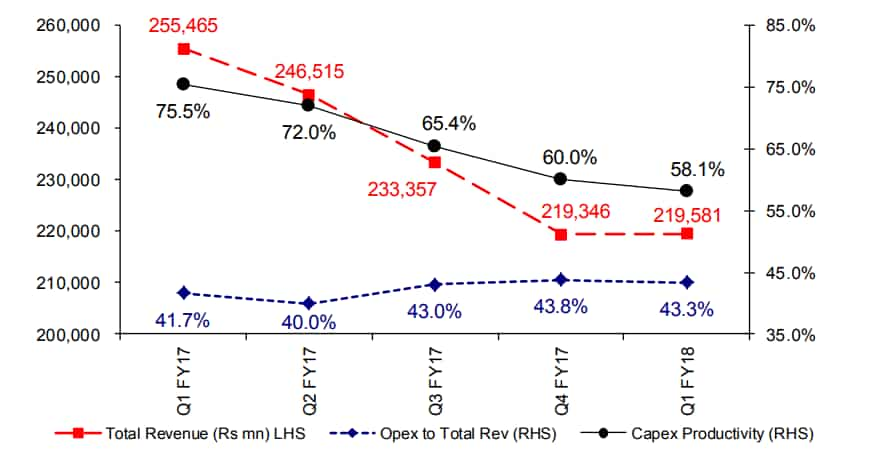

Bharti Airtel witnessed a growth of 7.92% in Q1FY17 which fell to a negative 14.04%. Since the start of Q1FY17, the company has been facing subsequent decline in its total revenues.

Capex to Revenue ratio measures a company's investments in property, plant, equipment and other capital assets to its total sales. The ratio shows how aggressively the company is re-investing its revenue back into productive assets.

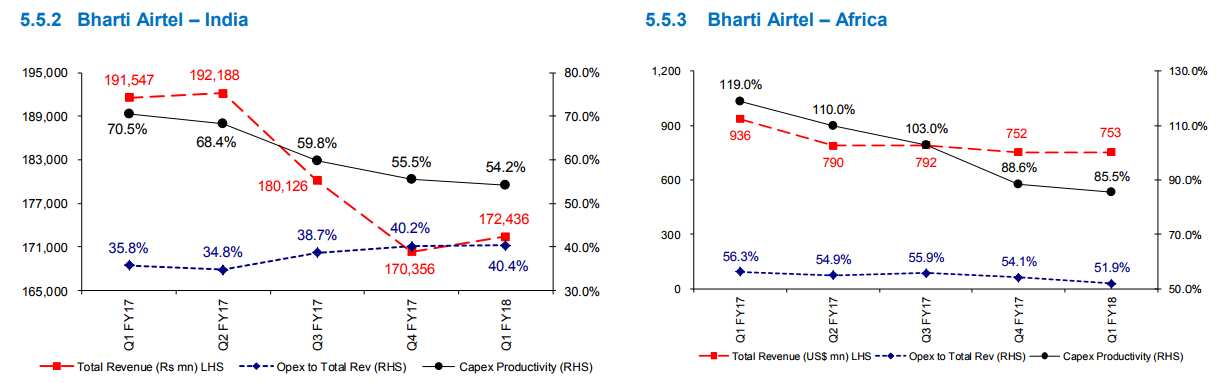

On geographical basis, India and Africa operations have seen downward trend since past few quarters.

Africa revenues were at Rs 4,850 crore, down 22% year-on-year and 4% quarter-on-quarter (QoQ) basis due to currency movements. Africa EBITDA of Rs 1,360 crore which was down 3% yoy but rose by 4%.

While, India's wireless revenue was at Rs 12,910 crore declining by 14.2% yoy and 0.4% qoq. EBITDA margin at 34.3% contracted 810 basis point s yoy and 260 basis points qoq due to high SG&A costs

In Q1FY17, EBITDA of Bharti Airtel which grew by over 16% (Rs 9,591.3 crore) compared to Q1FY16 – where EBITDA stood at Rs 8,261.7 crore, has dropped to 7,823.1 crore – declining 18.43% in Q1FY18.

On year-on-year basis, net debt has increased to Rs 87,840.40 crore as against Rs 83,491.5 crore a year ago same period. Free cash flow has more than halved in Q1FY18 at Rs 1,237.4 crore.

Jimeet Modi, CEO, SAMCO Securities on RJio said, “The predatory strategy to capture telecom space is quite aggressive and highly disruptive. Considering the size and scale of Reliance it will capture a lion’s share of the market pie and therefore will disrupt many other ancillary businesses also."

He added, "The pricing and launch of smart phone at effective zero cost will certainly impact and erode long term profitability of companies in telecom and cable segment."

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

01:44 PM IST

Airtel become first private telecom to connect Kupwara, Baramulla, Bandipore

Airtel become first private telecom to connect Kupwara, Baramulla, Bandipore  Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag

Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag  Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week Bharti Airtel hits 7-week high; shares surge 4% on heavy volumes

Bharti Airtel hits 7-week high; shares surge 4% on heavy volumes Airtel flags 8 billion spam calls, 800 million spam SMSes

Airtel flags 8 billion spam calls, 800 million spam SMSes