Bank of India sees net loss of Rs 2,341 crore in Q3FY18; reports divergence of Rs 14,057 crore

BOI posted net loss of Rs 2,341.20 crore as against net profit of Rs 101.72 crore in the corresponding period of previous year and net profit of Rs 179.07 crore in the preceding quarter.

State-owned Bank of India (BOI) witnessed a weak December 2017 (Q3FY18) quarter, with a heavy net loss and negative NII due to higher provisions and gross NPAs.

During Q3FY18, BOI posted net loss of Rs 2,341.20 crore as against net profit of Rs 101.72 crore in the corresponding period of previous year and net profit of Rs 179.07 crore in the preceding quarter.

BOI's net interest income (NII) saw decline of 12.62% to Rs 2,501.23 crore in Q3FY18, as against Rs 2,862.61 crore a year ago the same period. On quarterly basis, current NII has tumbled by 14% from Rs 2,908.24 crore in Q2FY18.

On the other hand, provisions for NPA increased by 71.74% to Rs 4,373.06 crore in Q3FY18 versus provisions of Rs 2,546.20 crore a year ago the same period.

Current provisions have more than doubled from Rs 1,866.82 crore in Q2FY18, which would be an increase of 134.25% in Q3FY18.

BOI stated that the bank made provision of Rs 549.29 crore as of December 2017, for the first list of wilful defaulters identified by RBI on June 23, 2017 for Insolvency & Bankruptcy Code (IBC) Act.

Also, for the second list of defaulters headed towards IBC by RBI, BOI has made additional provisions of Rs 256.88 crore as of December 2017. The bank was required to make provision of Rs 513.76 crore for the second list of defaulters, for which BOI says, "remaining provisions shall be made during quarter ending March 31, 2018."

As of December 2017, provision coverage ratio was at 56.96%.

Meantime, gross non-performing assets (NPA) of BOI came in at Rs 64,248.58 crore in Q3FY18, increasing by 24.08% from Rs 51,781.06 crore in Q3FY17, and also higher by 30.30% compared to Rs 49,306.90 crore in Q2FY18.

In percentage terms, gross NPA of BOI is at 16.93% this quarter versus 13.38% in Q3FY17 and 12.62% of Q2FY18.

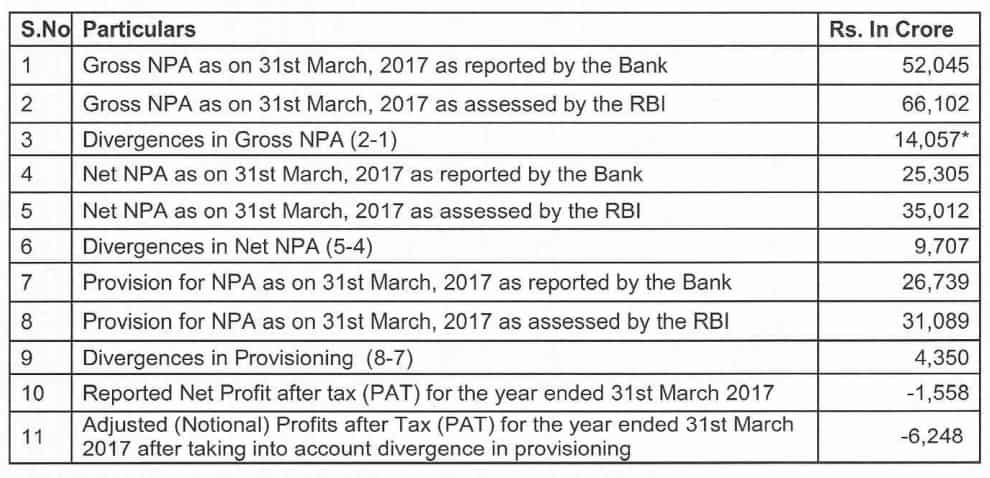

Interestingly, in its financial audit report, BOI also highlighted divergence in gross NPA of Rs 14,057 crore for March 2017 period.

It may be mentioned that BOI had posted gross NPA of Rs 52,045 crore as on March 2017 which was lower from gross NPA of Rs 66,102 crore assessed by the RBI during the period.

Divergence was also seen in net NPA to Rs 9,707 crore as of March 2017. BOI posted net NPA of Rs 25,305 crore in March 2017 which according to RBI should have been at Rs 35,012 crore.

With this, there was divergence also recorded in provisions as of March 2017.

The audit report showed that BOI made provisions of Rs 26,739 crore by end of March 2017, lower from provisions of Rs 31,089 crore assessed by RBI, thus divergence of Rs 4,350 crore.

On the BSE, BOI share price finished at Rs 144.85 per piece up by 1.61%.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

05:58 PM IST

NFO alert: Bandhan Mutual Fund, ABSL AMC and Bank of India MF launch new fund offerings; check minimum investment & other details

NFO alert: Bandhan Mutual Fund, ABSL AMC and Bank of India MF launch new fund offerings; check minimum investment & other details Bank of India raises Rs 5,000 crore in infra bond sale

Bank of India raises Rs 5,000 crore in infra bond sale Bank of India Q4 result: Net profit rises only 7% as non-core income plummets

Bank of India Q4 result: Net profit rises only 7% as non-core income plummets  IMGC ties up with Bank of India to offer mortgage guarantee-backed home loans

IMGC ties up with Bank of India to offer mortgage guarantee-backed home loans Punjab National Bank reports 11.5% loan growth in Q4, BoB's up 12.4%

Punjab National Bank reports 11.5% loan growth in Q4, BoB's up 12.4%