Apex Frozen Foods IPO opens today; should you subscribe?

Ahead of IPO, Apex Frozen Foods managed to raise over Rs 43 crore from anchor investors. It has allotted 24.90 lakh equity shares to three anchor investors at Rs 175 per piece, totalling Rs 43.57 crore.

Apex Frozen Foods, which is into business of production and exports of aquaculture products, is all set to open its initial public offering (IPO) on Tuesday to raise nearly Rs 152 crore by divesting 28% stake. The three day IPO will close on August 24.

On listing, the promoters will own 72.2% of the company, while the rest will be held by public shareholders. The price band is set in the range of Rs 171 to Rs 175 per share.

Ahead of IPO, the company managed to raise over Rs 43 crore from anchor investors. It has allotted 24.90 lakh equity shares to three anchor investors at Rs 175 per piece, totalling Rs 43.57 crore.

Reliance Capital Trustee Company Ltd, HSBC Midcap Equity Fund, HSBC India Opportunities Fund and ITPL --Invesco India Contra Fund, are the anchor investors. The lead manager is Karvy Investor Services Limited.

The objective of this IPO as per the company is to set up a new shrimp processing unit with a proposed capacity of 20,000 MTPA at East Godavari District, Andhra Pradesh and General Corporate Purposes.

The immediate listed competitor of the company is Avanti Foods and Waterbase Ltd.

Should you subscribe?

The company offers mainly variants of processed white shrimp under brands namely Bay fresh, Bay Harvest and BayPremium.

With increasing per capita income, the demand for exotic seafood such as oyster and shrimp is rising. Which means, increasing per capita consumption and steadily rising population is expected to contribute to market growth of the company.

According to a report by GEPL Capital, the company source approximately 15%-20% of their raw material requirements through their own farming efforts. Their in-house farming and association with their associate farmers enable reliable and uninterrupted supply of raw shrimp.

All their operational facilities are located in proximity to one another, thereby enabling smooth transition of products to each stage of the product life cycle. Their facility is approximately 20Kms from Kakinada port and approximately 150Kms from Vishakapatnam port,thereby providing a substantial logistical advantage for the transport of their finished product.

The Company has numerous ponds situated in a total extent of 1,337.69 acres with 105.78 acres of owned land and 1,231.91 acres of leased land. This farming at their ponds allows them to procure raw materials and ensures that their business of shrimp processing is cost effective.

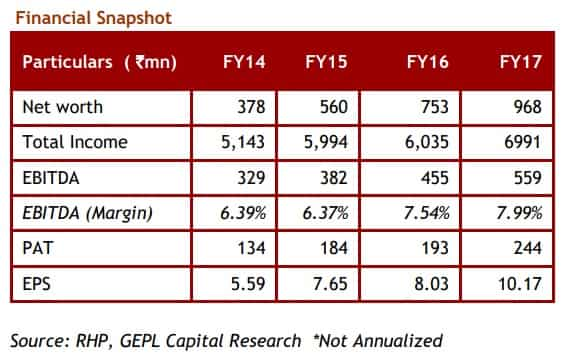

Giving it a thumbs-up, the report said, "Apex Frozen Foods Limited stands to gain from operating leverage. At a P/E of 17.20xs of FY17 Earning. We believe that Apex demands a discount to its domestic peers. We assign a Subscribe rating to the IPO."

Apex strategically focuses on the market of USA, the largest importer of aqua culture products in the world.

Looking at the risk factors, the company's aquaculture farms operate in an environment sensitive industry. They do not possess any control on the bio security measures employed at different level of operations. Improper measures may lead to risk of development of new infections/ diseases and the shrimp it produces may be prone to certain diseases, epidemic, bacteria and viruses spread in the environment.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

10:09 AM IST

Aquaculture stocks Apex Frozen, Avanti Feeds extend previous day’s gains

Aquaculture stocks Apex Frozen, Avanti Feeds extend previous day’s gains Zee Business Analyst Decodes: What makes shrimp companies like Waterbase, Avanti Feeds & Apex Frozen Foods lucrative?

Zee Business Analyst Decodes: What makes shrimp companies like Waterbase, Avanti Feeds & Apex Frozen Foods lucrative? Apex Frozen Foods makes robust Dalal Street debut; shares jump 20% from issue price

Apex Frozen Foods makes robust Dalal Street debut; shares jump 20% from issue price