Aditya Birla Nuvo-Grasim merger: Stock down 20% as shareholders vent their anger at a raw deal

Total consolidated income of the company also rose by 9% to Rs 9,088.55 crore in April-June quarter from Rs 8,365.70 crore during the same quarter in 2015-16.

The shareholders of Aditya Birla Gorup have spoken.

A day after KM Birla, Chairman, Aditya Birla Group announced a complex deal to merge and demerge businesses in Aditya Birla Nuvo (ABNL), Aditya Birla Finance Services (ABFSL) and Grasim Industries, to create a behemoth of a company, shareholders have given their thumbs down to the deal. Share price of ABNL dropped 20% in opening trade against a market that opened well in green.

At 0946 hours the shares of the company were trading at Rs 1255.65 per piece, down 19.80% on BSE. While, Grasim shares were trading at Rs 4391 per piece, down 3.26% during early sessions.

On Thursday, the merger news came in following the announcement of financial results for the quarter ended on June 30 by Grasim Industries. The company's net profit jumped 64% to Rs 830.22 crore as against Rs 507.60 crore in the quarter ended on June 30, 2015.

Total consolidated income of the company also rose by 9% to Rs 9,088.55 crore in April-June quarter from Rs 8,365.70 crore during the same quarter in 2015-16.

The merger plan

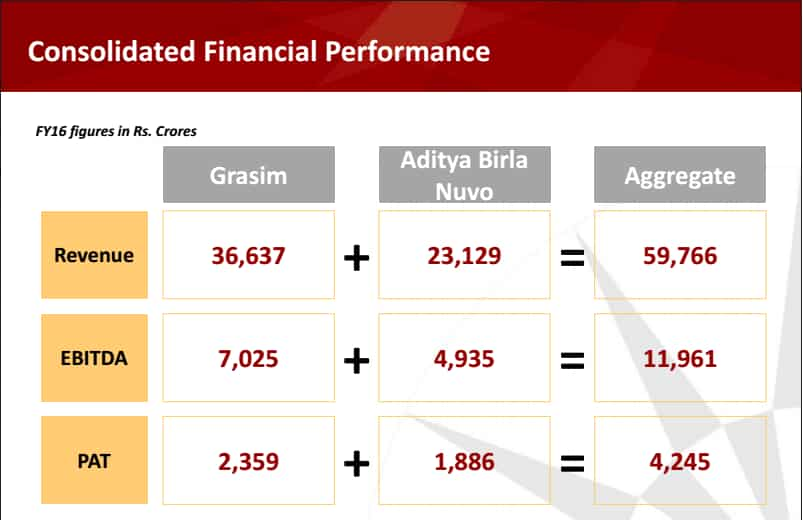

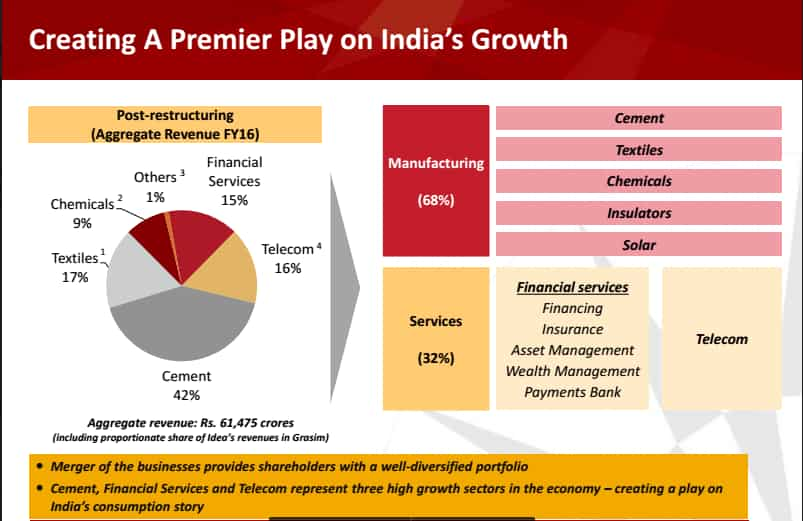

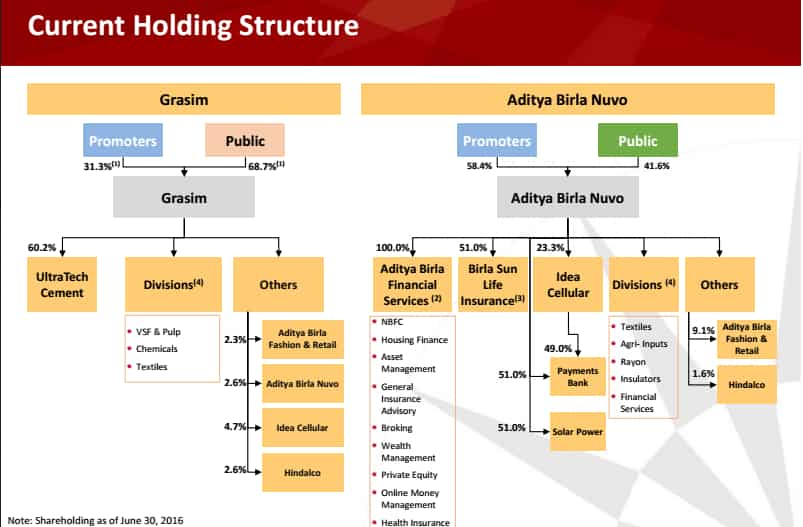

On Thursday, the Aditya Birla Group announced the merger of Aditya Birla Nuvo Ltd with Grasim Industries Ltd and the subsequent demerger and listing of its financial services business through a composite scheme of arrangement.

The Board of Directors of three companies -- Grasim Industries, Aditya Birla Nuvo and Aditya Birla financial Services Ltd -- at their respective board meetings approved the scheme.

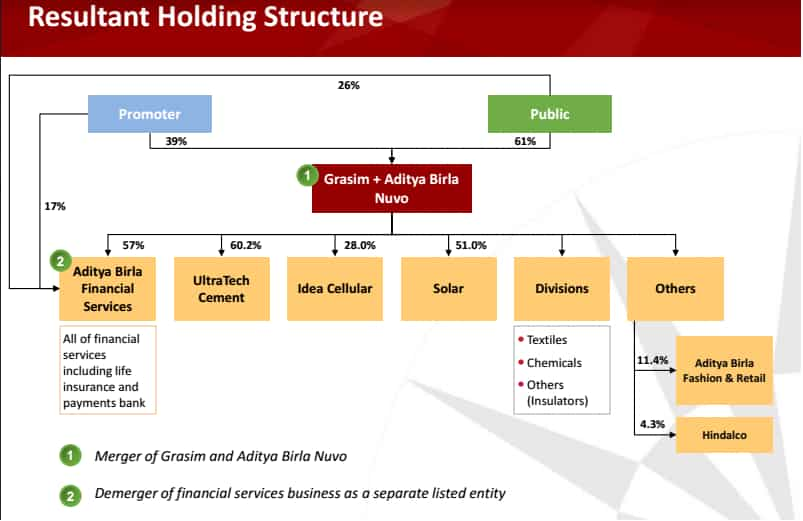

The restructuring involves two steps namely merger of Aditya Birla Nuvo with Grasim Industries and demerger of its financial services business resulting in a listed financial services company with 57% owned by post-merger Grasim Industries and the remaining shares held by post-merger Grasim Industries shareholders on a proportionate basis.

The transaction is likely to be completed by Q4FY17/Q1FY18.

What will shareholders get?

The Board also approved share-swap ratio for the restructuring.

For merger of Aditya Birla Nuvo with Grasim Industries, each shareholder of Aditya Birla Nuvo will get three new equity shares of Grasim Industries for every 10 equity shares held in Aditya Birla Nuvo.

Apart from this, AB Nuvo’s shareholders will also get 2.1 shares of ABFSL (Aditya Birla Financial Services) for every one share they hold in the company.

With this, the Grasim's shareholders will get only seven shares for every one shareholder in the company.

Is it beneficial for Grasim's shareholders?

The restructuring may not be as beneficial for Grasim Industries as well as for the shareholders, an Emkay research report titled 'Good results overshadowed by restructuring, downgrade to 'REDUCE' said.

Sanjeev Kumar Singh, Research Analyst of Emkay, in the report said, that the proposed structure may not earn profits for Grasim as the unrelated business segments are getting transferred into the company. Urea and Insulators are completely unrelated business segments.

Further, the transfer of AB Nuvo's 23.3% stake in Idea, telecom arm of Aditya Birla Group in Grasim Industries is "unwarranted and there will negligible benefits accruing to the present shareholders of the company", Singh said.

Calling Grasim as "dumping ground for new business verticals for the promoters", Singh mentioned that the merger of ABFSL into Grasim and subsequent de-merger of the same looks puzzling except for the fact that promoters’ holding will be higher in ABFSL. For shareholders of Grasim, there is no option to choose whether they want stake in financial services business or not.

"Grasim which commands 45-50% HoldCo discount for its holding in UltraTech, will now

become a holding company for ABFSL as well and have higher stake in Idea (28% from 4.7%). Its holding in ABFSL and Idea will probably be assigned similar Hold discounts".

So, the concern here is that if Idea needs money for future plans, Grasim will provide that money because of strong balance sheet. But, this may again increase in equity stake in Idea in this process, the report said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

10:03 AM IST

Aditya Birla Nuvo to merge with Grasim; to demerge financial services business

Aditya Birla Nuvo to merge with Grasim; to demerge financial services business Aditya Birla denies biggest restructuring plan, AB Nuvo shares down

Aditya Birla denies biggest restructuring plan, AB Nuvo shares down Can Forever 21 make Aditya Birla India’s biggest fashion player?

Can Forever 21 make Aditya Birla India’s biggest fashion player? Aditya Birla Nuvo Q4 net profit at Rs 327 crore

Aditya Birla Nuvo Q4 net profit at Rs 327 crore Aditya Birla's Grasim Q4 net profit jumps 40% to Rs 724 crore

Aditya Birla's Grasim Q4 net profit jumps 40% to Rs 724 crore