UIDAI suspends Airtel, Airtel Bank's Aadhaar-linked e-KYC services

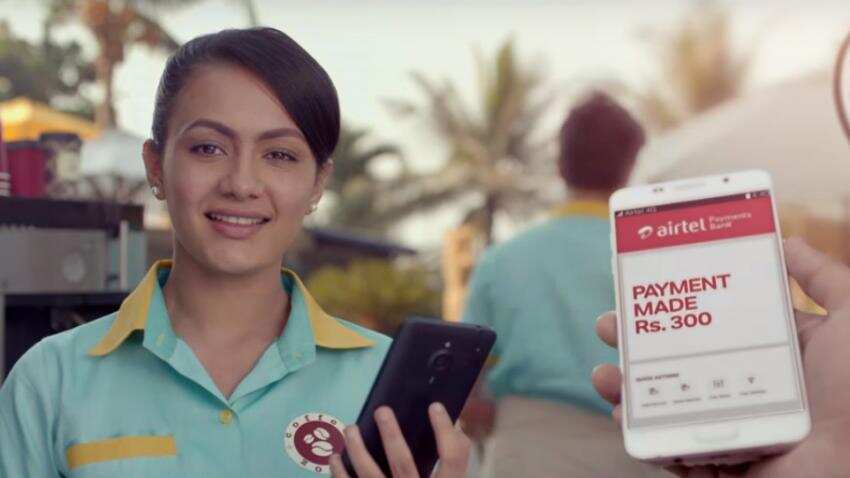

The Unique Identification Authority of India (UIDAI) has temporarily suspended telecom major Bharti Airtel and Airtel Payments Bank`s "Aadhaar linked e-KYC" services for alleged misuse of the facility.

"We can confirm that we have received interim order from the UIDAI regarding temporary suspension of Aadhaar linked e-KYC services till their satisfaction on certain processes relating to Airtel Payments Bank`s onboarding of customers," the company said in a statement on Saturday.

"We are engaging with the authority and are hopeful of an early resolution. We are also undertaking to complete the said actions on priority and have commenced with checks of our process flows. Being compliant to all guidelines is paramount to us," the statement added.

According to sources, UIDAI`s interim order comes after some customers of the telecom major alleged that the company had opened their bank account in Airtel Payments Bank when they used the "Aadhaar linked e-KYC services" without their consent.

The "Aadhaar linked e-KYC" service of UIDAI provides an instant, electronic, non-repudiable proof of identity and proof of address along with date of birth and gender, resident`s mobile number and email address to the service provider.

Aadhaar authentication and e-KYC services are available to different sectors and government organisations under a licence.

Bharti Airtel uses the Aadhaar data base for the purposes of mobile services KYC under a licence agreement, while Airtel Payments Bank which is a separate entity is an authorised KYC User Agency (KUA) and Authentication User Agency (AUA) of UIDAI having signed the licence agreement.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

09:16 AM IST

Airtel become first private telecom to connect Kupwara, Baramulla, Bandipore

Airtel become first private telecom to connect Kupwara, Baramulla, Bandipore  Bharti Airtel leads Nifty 50 gainers; surges 6% intra-day, nears 18-month high

Bharti Airtel leads Nifty 50 gainers; surges 6% intra-day, nears 18-month high  Telecos can claim tax credit for excise duties paid on towers, infra items: Supreme Court

Telecos can claim tax credit for excise duties paid on towers, infra items: Supreme Court Bharti Airtel shares dip 3.18% despite robust Q2 earnings; global brokerages remain bullish

Bharti Airtel shares dip 3.18% despite robust Q2 earnings; global brokerages remain bullish Airtel, Nokia, MediaTek complete trials combining use of TDD, FDD bands for Uplink on latest generation chipset

Airtel, Nokia, MediaTek complete trials combining use of TDD, FDD bands for Uplink on latest generation chipset