Auto Sales Oct 2021 Roundup: Lacklustre first leg of festive season; CVs continue to shine

The base month of October 2020 marked a rapid revival in almost all sectors barring Commercial Vehicles (CVs). Last year by this time, in line with fast rural recovery, two-wheelers (2Ws) and tractors had majorly recovered leading to a high base in October. Also, the festive season last year was better than this year. Last year, Passenger Vehicles (PVs) recovery was led by the pent-up demand in both rural and urban markets, while this year managements of Original Equipment Manufactures (OEMs) mentioned that the pent-up demand has ended by September this year.

In FY 22, post the much more intense Wave 2 of the pandemic in April and May, the rural markets are still badly impacted and are taking more time to recover than expected. Therefore, over a high base of last year and low demand this year, the rural based segments of tractors and 2Ws are showing lesser growth or declines in some cases.

On the PV front, most of the OEMs are facing scarcity of semiconductors. Therefore, they cannot cater to the robust demand which we sensed during our interactions with the dealers. However, sequentially the supply issue seems to have improved/eased as we are seeing a strong mom growth in all the sectors.

The only bright spot we observed this month again was the CVs, which have all their driving parameters in place and are recovering at a good pace. Even in FY21, the segment saw a late recovery, which is helping the CV numbers look even stronger yoy.

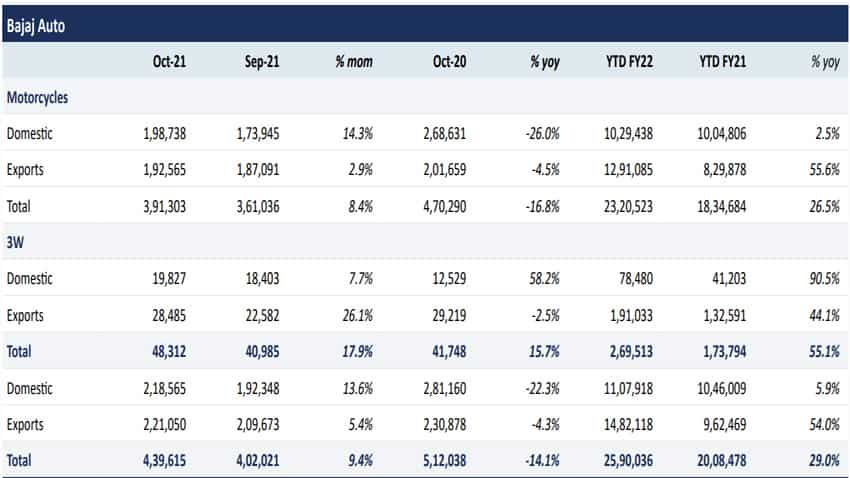

Bajaj Auto

In 2W segment, Bajaj reported a fall of 26% yoy for its domestic motorcycles while in exports it declined by 4.5% yoy. Bajaj, its 3W segment expanded by 58% yoy domestically. According to LKP Research, stocks specifically, we prefer Bajaj Auto in 2W exports markets in the 2Ws as its growth is well driven by exports and 3Ws, while on the PV side.

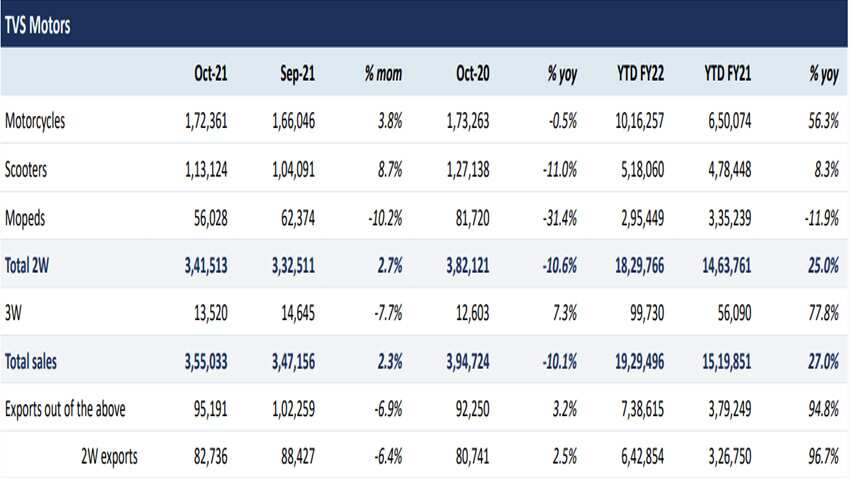

TVS Motors

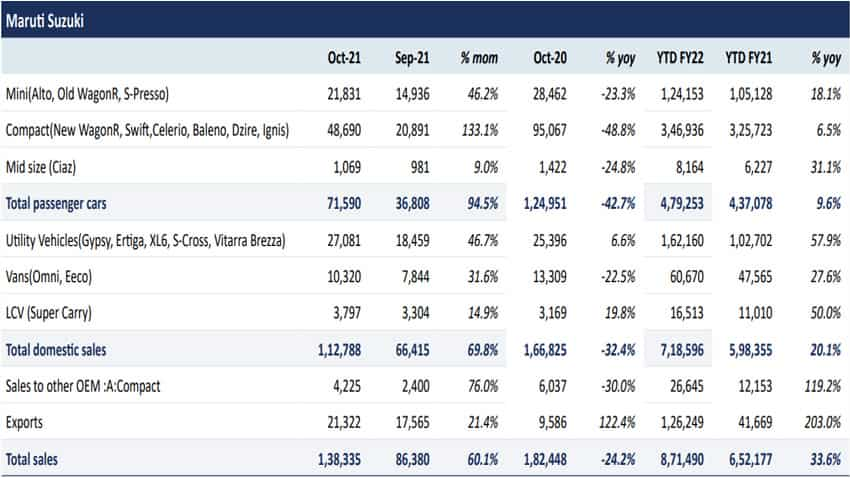

Maruti Suzuki

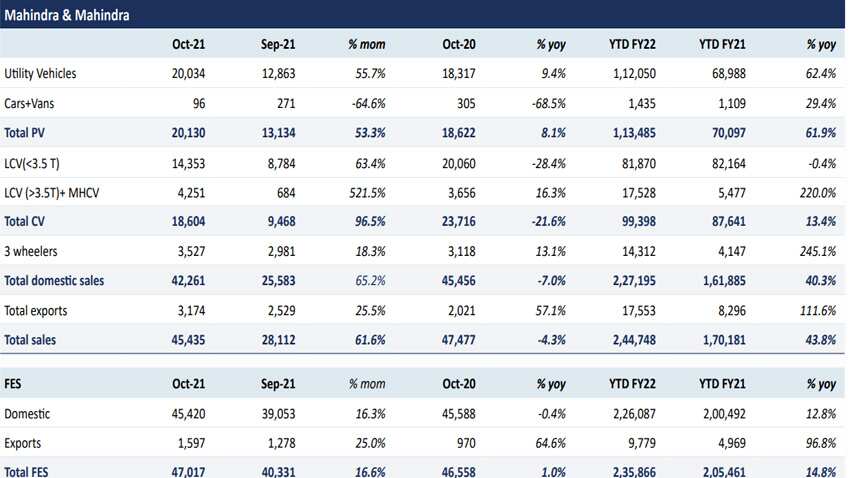

Mahindra & Mahindra

Mahindra & Mahindra's (M&M) SUV segment grew by 9.4% yoy while reported 55% growth mom as their recent launch of the XUV 7oo has gained good strength after its launch in August. M&M’s 3W business also gained momentum as they grew 13% yoy and 18% mom to 3,527 units. CV division however posted de-growth as LCVs disappointed after consecutively for the second month. LKP Research believes that this was due to high base of last year as LCVs were the consistently strong performers ever since the first wave due to robust demand for e-commerce products, FMCG and pharmaceutical goods. M&M’s tractor business in the domestic markets remained flattish yoy while grew by 16% mom as the buying season for the Rabi crop has started. LKP Research said: "We like M&M because of its thrust on rural markets through its leadership in tractors business, prudent capital allocation and a robust growth strategy in UVs."

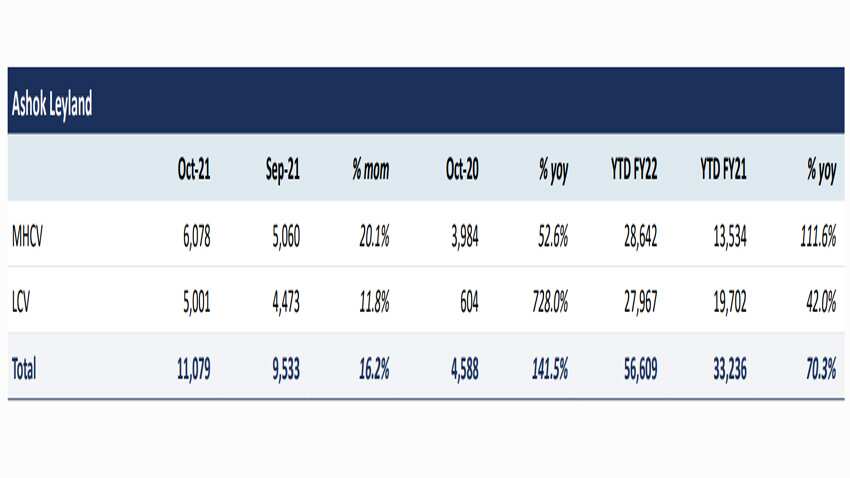

Ashok Leyland

The M&HCV segment saw a splendid growth of 52% yoy for Ashok Leyland. Sequentially it grew by 20% for Ashok Leyland. This is due to rapid growth in the macro indicators like construction, mining, real estate and farming sectors. Also freight availability has been increasing and infrastructure activities are on an up-move. LKP Research said: "We like Ashok Leyland within CVs as it has a diversified revenue base deriving from LCVs, defense, MHCVs and spares. Also, the recovery and growth in its monthly numbers is thick and fast."

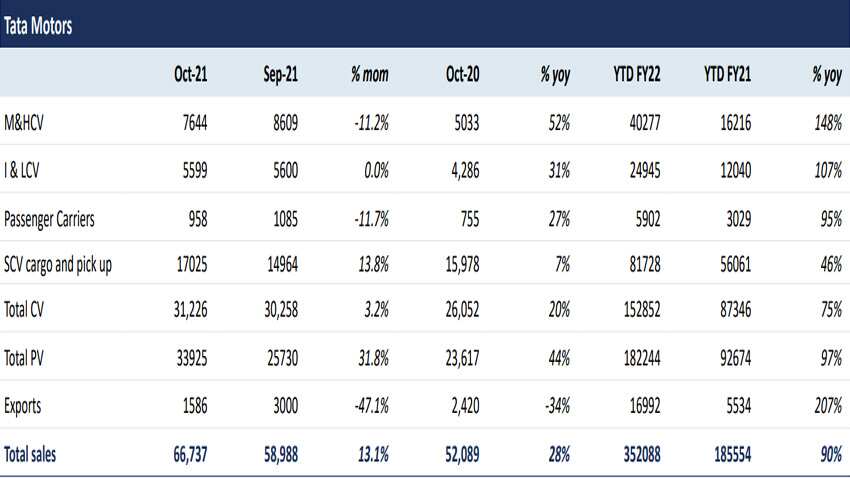

Tata Motors

Tata Motors' PV segment however saw a 44% yoy growth on continued success of its EV Nexon and new launch of the SUV ‘Punch’ on 20th October. Tata Motors is seeing a strong PV business, along with a very healthy revival in MHCVs. Every dip in these stocks in the short term (driven by pandemic, supply chain issues etc), shall provide good opportunities for investors to enter into them from medium to long term perspective, as per LKP Research.