Disinvestment receipts to touch Rs 45,000 crore: Jaitley

"It's true this government does not make a song and dance about disinvestment. I fix a target in every Budget...This year, I am going to touch Rs 45,000 crore in one year," he said at a panel discussion on TV channel Times Now.

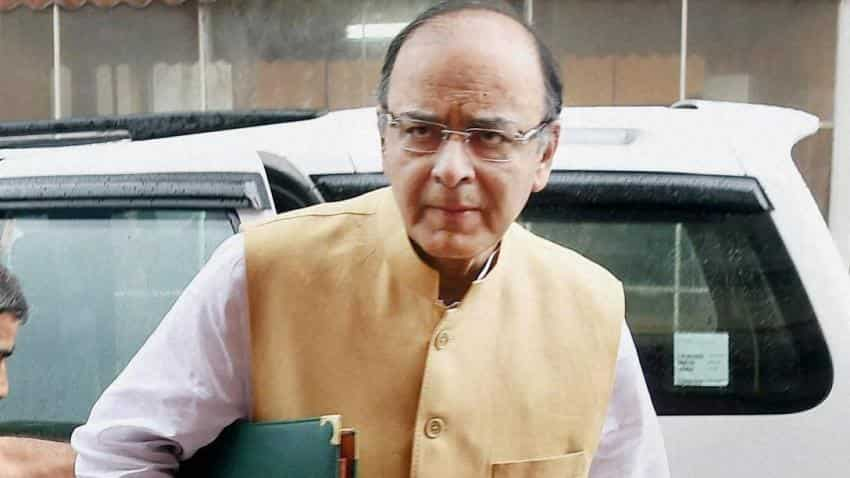

With less than two months to go for the current financial year to come to a close, Finance Minister Arun Jaitley has exuded confidence that receipts from PSU disinvestment will touch Rs 45,000 crore in 2016-17.

About Rs 30,000 crore have been raised through minority share sale by way of OFS, share buyback and CPSE ETF, so far in the current fiscal.

"It's true this government does not make a song and dance about disinvestment. I fix a target in every Budget...This year, I am going to touch Rs 45,000 crore in one year," he said at a panel discussion on TV channel Times Now.

Referring to his Budget Speech, Jaitley said that he had announced listing of a large number of PSUs on the stock exchanges.

"So, PSUs which are not listed, will now be going into the stock exchange...(and) once they go into stock exchange again will necessarily entail disinvestment of each one of them, and some of them are huge," the Finance Minister said.

In his Budget speech on February 1, the Finance Minister had also said that the government will put in place a revised mechanism and procedure to ensure time-bound listing of identified CPSEs as listing will foster greater public accountability and unlock their true value.

The government aims to raise Rs 72,500 crore through disinvestment of PSUs, including listing of three railway PSUs -- IRCTC, IRFC and IRCON -- during 2017-18.

Besides, the government also plans to sell its stake in five PSU general insurance companies which is expected to fetch about Rs 11,000 core.

Fiscal 2016-17 is the seventh year in a row when the government would not be meeting the disinvestment target fixed in the Budget. As much as Rs 56,500 crore was budgeted to be raised through PSU disinvestment in the current fiscal.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Retirement Planning: SIP+SWP combination; Rs 15,000 monthly SIP for 25 years and then Rs 1,52,000 monthly income for 30 years

Retirement Calculator: 40 years of age, Rs 50,000 monthly expenses; what should be retirement corpus and monthly investment

SBI 444-day FD vs Union Bank of India 333-day FD: Know maturity amount on Rs 4 lakh and Rs 8 lakh investments for general and senior citizens

EPF vs SIP vs PPF Calculator: Rs 12,000 monthly investment for 30 years; which can create highest retirement corpus

Home loan EMI vs Mutual Fund SIP Calculator: Rs 70 lakh home loan EMI for 20 years or SIP equal to EMI for 10 years; which can be easier route to buy home; know maths

10:04 AM IST

Electoral bonds: Governments need to clarify on a few matters urgently

Electoral bonds: Governments need to clarify on a few matters urgently  NITI to lend support in development of 10 big infra projects

NITI to lend support in development of 10 big infra projects Cheaper interest rates fail to spur home loans demand

Cheaper interest rates fail to spur home loans demand  Demonetisation likely to be credit positive for India, Moody's says

Demonetisation likely to be credit positive for India, Moody's says Reliance Infra expects defence to become its leading business vertical

Reliance Infra expects defence to become its leading business vertical