JioPhone: Feature phones will continue to rule the Indian market in 2017

There have already 4-5 manufacturers that are looking to launch their own low cost 4G feature phone in the next few weeks.

Key highlights:

- Conversion from feature phones to smartphones to slow down in 2017

- Launch of JioPhone feature phone with 4G to make the difference

- Other manufacturers join in the fray to launch 4G feature phones

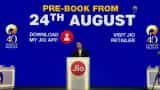

While a bleak picture of the feature phone market was once predicted in India with the growth of cheaper smartphones, with the arrival of 4G feature phones with the launch of JioPhone by Reliance Jio it now seems to have got a second life in the market. This comes after the re-launch of the Nokia 3310 a few months earlier after HMD Global acquired the rights to sell Nokia phones.

India saw 4G (LTE) handsets base cross 150 million in Q2 2017 for the first time. The next 150 million users are estimated to be sold in half that time as 4G VoLTE feature phones will be bringing 4G phones to a much lower price points, according to a recent Counterpoint Research report.

“Feature phone segment still holding strong in India and now with the announcement of LTE based smart feature phone “JioPhone” by Reliance Jio, we estimate that conversion from feature phones to smartphones is likely to slow down in short to mid-term,” said the report.

The introducion of the JioPhone is expected to have effects on the mobile phone industry as a whole. This is as many mobile phone manufacturers have already planned to launch 4G enabled feature phones at very affordable rates.

According to a recent Economic Times report, 4G chipset manufacturer Spreadtrum is already in talks with four-five players for launching their own 4G feature phones.

Lava already has launched a 4G feature phone, while Intex plans to launch its own version of the same for Rs 1,999 by the end of the month.

While the JioPhone is priced at Rs 1,500, the other 4G feature phones are expected to be similarly priced between Rs 1,200-2,000.

Feature phones still form 57% of the mobile handset shipment market in India and cannot be wiped out anytime soon, according to CMR Research Report. Out of the total mobile phones shipments in 2016 at 262 million units, 149 million units were feature phones and the remaining 113 million units were smartphone sales.

However, the market share of feature phones has been slipping over the pass few years. From 59% market share in 2015, feature phones market share had declined to 57%. This was due many people choosing to opt for smartphones over feature phones as prices of smartphones become cheaper in India.

Feature phones share was further expected to decline to 52% by the end of 2017, according to the CMR report. While mobile phones market share grows to 48%.

But with this new development of cheaper feature phones with 4G capabilities enabling people to use the internet, feature phones seem to be making a comeback in the market. This is especially in the rural market which is has the majority of India's population and is price sensitive.

Earlier, the change from feature phones to smartphones need to be made as the former did not support good internet connection speeds. With this development many still using feature phones in India will not switch over to smartphones easily.

Samsung is the leading player in feature phones with 24.5% market share, followed by Indian manufacturers such as Lava with 12.3% and Intex with 11% market share. The other 52.2% market share in feature phones is shared by other 103 brands.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

04:54 PM IST

After JioPhone now Intex launches 4G feature phone priced at Rs 1500

After JioPhone now Intex launches 4G feature phone priced at Rs 1500 JioPhone pre-booking deadline nears; here’s how you can get one

JioPhone pre-booking deadline nears; here’s how you can get one JioPhone: After telecom companies, Reliance will now force feature phone makers to up their game

JioPhone: After telecom companies, Reliance will now force feature phone makers to up their game After JioPhone, Airtel looks to partner with phone makers for 4G enabled feature phones

After JioPhone, Airtel looks to partner with phone makers for 4G enabled feature phones Reliance Jio’s 4G feature phone may be available for pre-bookings from July 22

Reliance Jio’s 4G feature phone may be available for pre-bookings from July 22