Start young: Financial independence for first time investors should begin with SIPs

Are you fresh out of college with a job in hand and dreams of going on those foreign vacations and driving your dream car?

Naturally, your first hard-earned first salary is splurged on parties and buying gadgets that you may want but not need.

Slowly and surely your credit card debt begins to mount and before you know it, its an endless loop of meeting bills and other sundry payments.

This is why you should apply just a bit of discipline and begin investing your money in small sums from day one.

And this is where a systematic investment plan or an SIP comes in the picture.

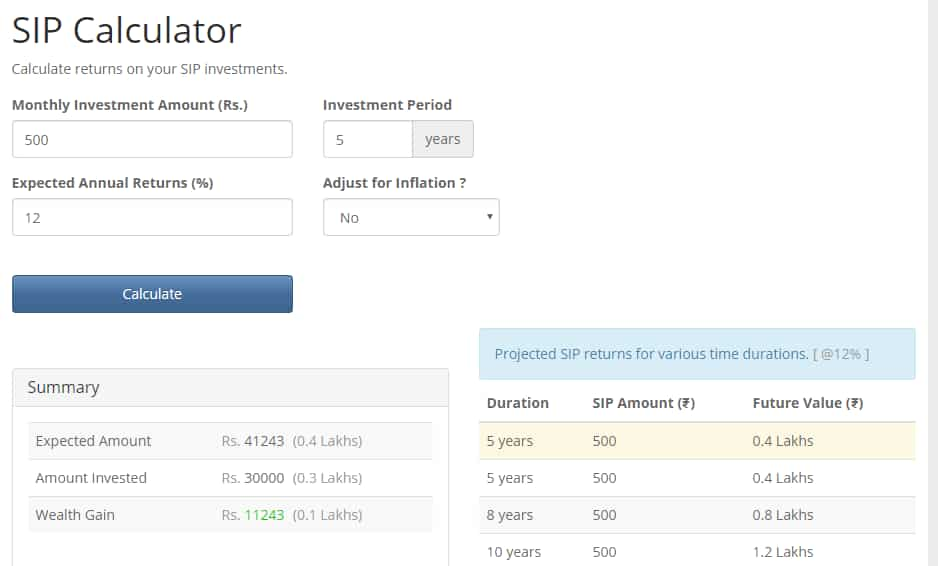

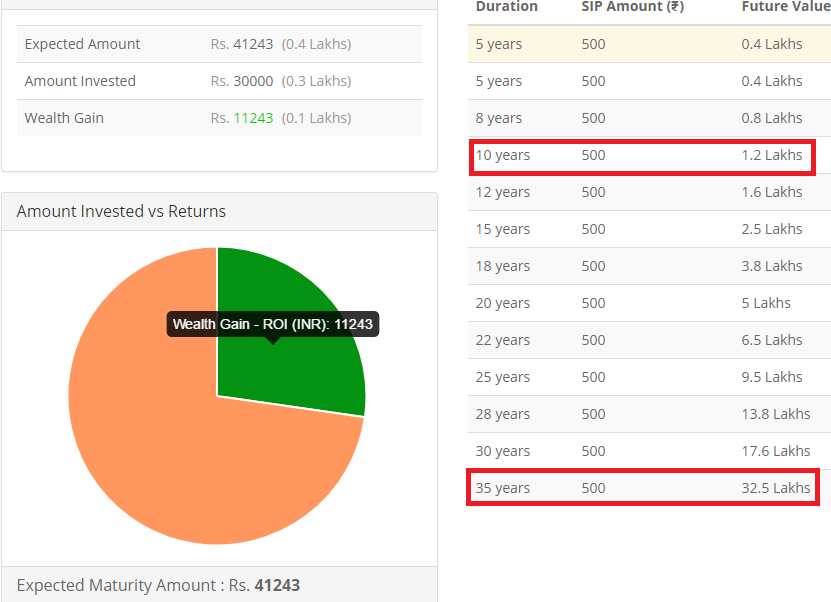

You can start an SIP with money as low as Rs 500 a month.

According to Bankbazaar.com, the returns generated by SIP mutual funds have been around 12% to 22% in the last 5 to 10 years.

With the power of compouding, this Rs 500 a month (Rs 6000 a year) will become Rs 40,000 in five years and Rs 1.2 lakh in a decade for an annual returns of 12%.

Isn't that cool?

However, for anyone, the most difficult part is to make investments a habit.

We tend to procrastinate, which leads to break our investment routine. So, if you are a first timer, SIPs will help you in maintain that routine.

A small amount every month is easier to invest than a big amount in one go. The investment happens automatically and you save and invest, instead of spending.

FIND MUTUAL FUND NAVs AND RETURNS HERE.

In a SIP, an investor has to deposit a small sum every month or every quarter and the amount of investment can be as low as Rs 500. If you choose a mutual fund scheme and invest in SIP, based on the plan that you have opted for they will allocate your money in debt or equity.

Speaking with Zeebiz, Archit Gupta, Founder & CEO ClearTax.com, said, "An SIP allows you to spread your investment over a period of time. You will be able to invest at different levels of the market. If the markets are high, you get fewer units. If the markets are low, you get more units for the same amount. This way, your overall cost of investment gets averaged out."

ALSO READ: An SIP can help you save entire interest amount on your home loan

"SIPs are the best option for first-time investors because they insulate you from catching a market peak, they allow you to benefit from rupee cost averaging and they help you develop the habit of investing regularly," Gupta added.

Thus, start your SIPs today and save up enough for your future plans.

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

10:55 AM IST

5 types of SIPs one should know about and when to choose them to meet your financial goals

5 types of SIPs one should know about and when to choose them to meet your financial goals Building a retirement corpus: How much should you invest at different life stages to build a corpus of Rs 4 crore; see examples

Building a retirement corpus: How much should you invest at different life stages to build a corpus of Rs 4 crore; see examples Mutual funds collect Rs 66,364 core through NFOs in FY24

Mutual funds collect Rs 66,364 core through NFOs in FY24 SIP calculator: Here's how Rs 110/day investment can help you become crorepati at 55

SIP calculator: Here's how Rs 110/day investment can help you become crorepati at 55 SIP Calculator: How much you can earn in 5, 10, 15, 20 or 25 years by investing Rs 25,000 in SIP, expert's view

SIP Calculator: How much you can earn in 5, 10, 15, 20 or 25 years by investing Rs 25,000 in SIP, expert's view