Modi govt's Atal Pension Yojana (APY): How to get Rs 60,000 pension with just Rs 210/month investment, Income Tax Return benefit

Atal Pension Yojana (APY) offers pension benefits in multiples of Rs 1000 up to Rs 5000 per month

Atal Pension Yojana (APY) offers pension benefits in multiples of Rs 1000 up to Rs 5000 per month, according to the Pension Fund Regulatory and Development Authority website. The scheme was launched by Prime Minister Narendra Modi-led Union government in 2015. The scheme caters to all citizens of India, especially those in the unorganised sector who do not have any formal pension provision. The scheme encourages these workers to save voluntarily for their retirement.

APY is the government of India's scheme administered by PFRDA through NPS architecture. By an investment of just Rs 210 per year, a subscriber joining at the age of 18, can get Rs 60000/year pension upon retirement.

Here's are key things to know to make the best out of the scheme (Details provided by PFRDA website:

Atal Pension Yojana - How to open account: The accounts can be opened through the bank where the saving bank account is maintained.

Atal Pension Yojana - How much to invest? Subscribers’ joining at the age of 18 need to contribute Rs 42 and Rs 210 on a monthly basis to get a minimum guaranteed monthly pension of Rs 1000 and Rs 5000 respectively. The monthly contribution is payable by auto debit facility from the subscribers' savings bank account.

Atal Pension Yojana minimum guaranteed monthly pension: APY guarantees minimum monthly pension between Rs 1000-Rs 5000 to the subscriber and to the spouse after the death of the subscriber (Maximum Rs 60000 per year). The corpus is to be returned to the nominees after the death of both.

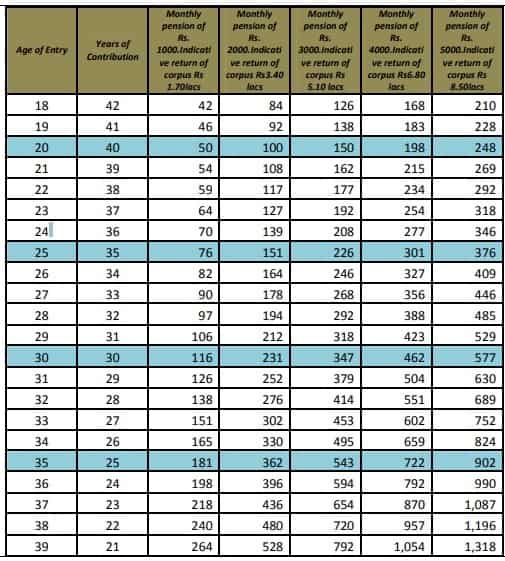

Atal Pension Yojana chart

Atal Pension Yojana mode of investment

One can make a monthly, quarterly and half-yearly investment in APY. It is always beneficial to subscribe to the scheme at the earliest.

How to subscribe to Atal Pension Yojana

You need to have a saving account with a bank or post office. The premature exit is allowed before the age of 60 years.

Atal Pension Yojana Income tax benefits:

You can claim income tax benefit for contributions paid in the Atal Pension Yojana under Section 80 CC (1B) of Income Tax Act.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

04:47 PM IST

Atal Pension Yojana gross enrolments cross 7 crore mark

Atal Pension Yojana gross enrolments cross 7 crore mark Gross enrolments under Atal Pension Yojana cross 7 crore mark

Gross enrolments under Atal Pension Yojana cross 7 crore mark Atal Pension Yojana subscriber base expands to 6.9 crore, corpus at Rs 35,149 crore

Atal Pension Yojana subscriber base expands to 6.9 crore, corpus at Rs 35,149 crore NPS: Can I open more than one National Pension Scheme account? Are there some options available? Check details here

NPS: Can I open more than one National Pension Scheme account? Are there some options available? Check details here Atal Pension Yojana (APY): How to get Rs 2K, 4K and Rs 5K monthly pension under APY

Atal Pension Yojana (APY): How to get Rs 2K, 4K and Rs 5K monthly pension under APY