Financial Planning: A mutual fund that doubled your money in five years

Choosing the right type of mutual fund for your investment needs will depend on your investment goal. Franklin India Feeder - Franklin U.S. Opportunities Fund (Growth) is one of top performers which gave a return of 102.65% in five years.

Everyone tries to find the best investment options for their money and long term financial planning. Although investing in mutual funds has its own risks as its linked to the fortunes of the stock markets they are still considered a safe bet if you want to grow your money more than what a usual fixed deposit or banks' deposit interest rate would offer.

However, there are mutual funds that have grown so much in the past five years that they whave literally doubled the money of people who invested in those.

One such fund Franklin India Feeder - Franklin U.S. Opportunities Fund (Growth). The fund belongs to Equity asset class from Franklin Templeton Mutual Fund family.

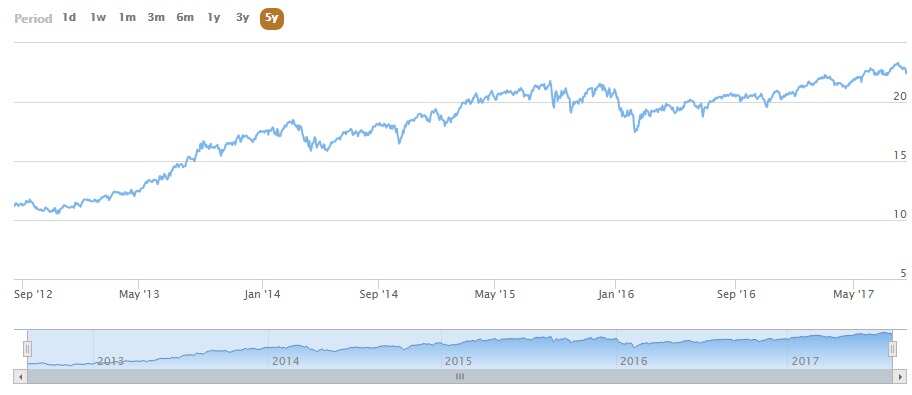

The fund in the last five years has given absolute return of 102.65%. In 2012, the fund had net asset value of 11.17. Presently, the NAV is 22.62. The fund's asset size is Rs 566.03 crore.

The open ended fund seeks to provide capital appreciation by investing predominantly in units of Franklin U. S. Opportunities Fund, an overseas Franklin Templeton mutual fund, which primarily invests in securities in the United States of America.

When we say open ended fund, which means these are funds in which units are open for purchase or redemption through the year. All purchases/redemption of these fund units are done at prevailing NAVs. These funds are preferred since they offer liquidity to investors.

This fund principally invests in small, medium and large capitalisation U.S. companies with strong growth potential across a wide range of sectors.

The minimum investment requirement is just Rs 5000. An investor has an option of Systematic Investment Plan (12 cheques each of Rs.500/- or more or a minimum of 6 cheques each of Rs.1,000/- or more), Systematic Transfer Plan and Systematic Withdrawal Plan, to enter the fund.

Apart from this, what makes this fund even more profitable is its tax benefits. According to Franklin Templeton India, the fund has three tax benefits:

- Long term capital gains (LTCG) tax @20% (plus surcharge, if applicable and cess) with indexation if units held for more than 36 months

- Short term capital gains (STCG) tax at the income tax slab rate if units are held for less than 36 months

- Investor does not pay any tax on dividends but a Dividend Distribution Tax (DDT) is deducted at source @28.84% (25% + 12% surcharge + 3% education cess)

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Sukanya Samriddhi Yojana vs PPF: Rs 1 lakh/year investment for 15 years; which can create larger corpus on maturity?

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

10:40 AM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence