FMCG Equity mutual funds gave higher returns than Sensex, Nifty in five years, have a look

Equity Mutual Funds, which are directly linked with equity markets, despite its high risk factor, managed to give robust returns to its investors. FMCG Mutual Funds was the best performed sector in last five years surpassing Sensex, Nifty returns.

FMCG Equity mutual funds have given highest returns in five years to its investors as compared to any other sector.

Equity Mutual Funds invests in equity stocks/shares of companies. As they are directly linked with stock markets, they are prone to high risk. Despite that, equity mutual funds have turned fortunes of its investors.

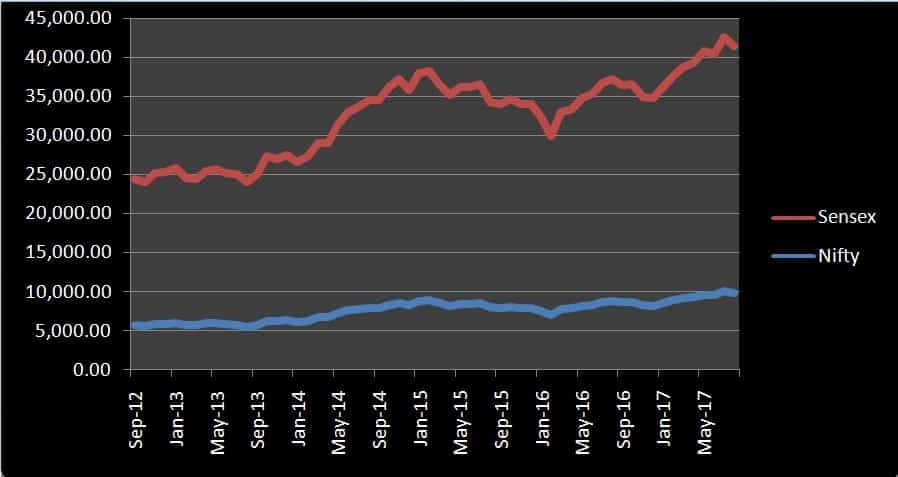

In the recent times, equity markets have filled investors' pockets when BSE Sensex and NSE Nifty touched record-high.

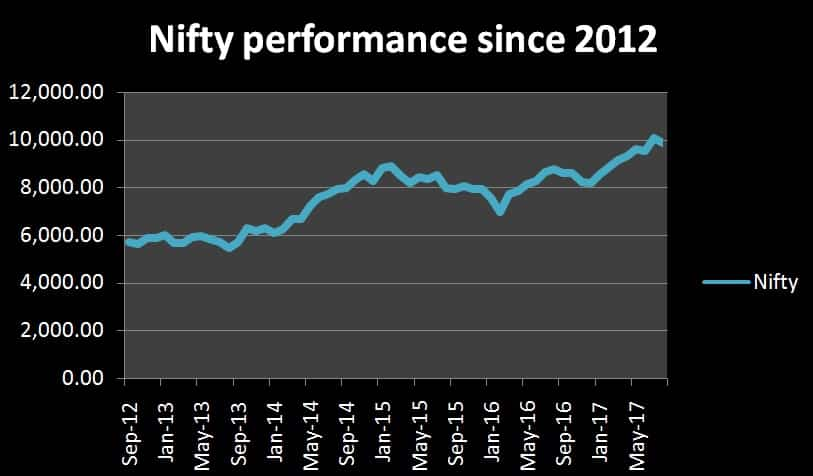

If you look at the data, in the last five years, Nifty has given returns of 75.3%. The benchmark during the same time in 2012 was trading at 5703.30-mark. However, last month this year it touched 10,000-level.

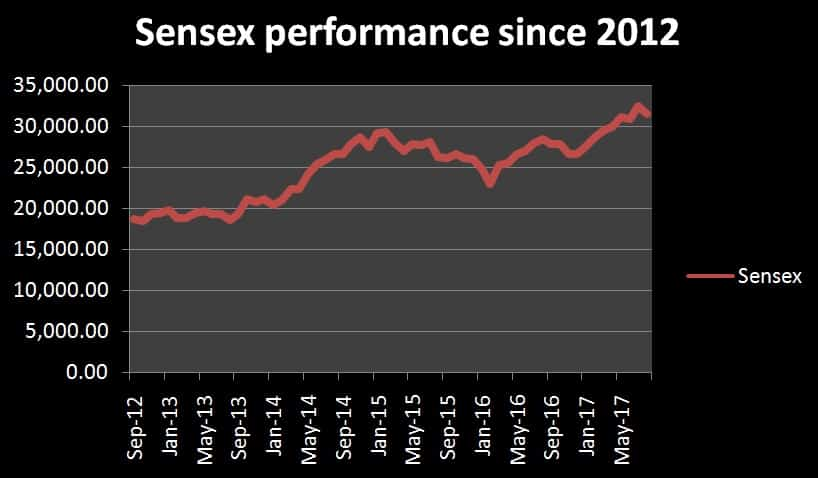

Similarly, during the same period in 2012, Sensex was trading at 17,465.60 while it touched 32,000-mark last month. In five years, Sensex has given returns of 83% to its invesors.

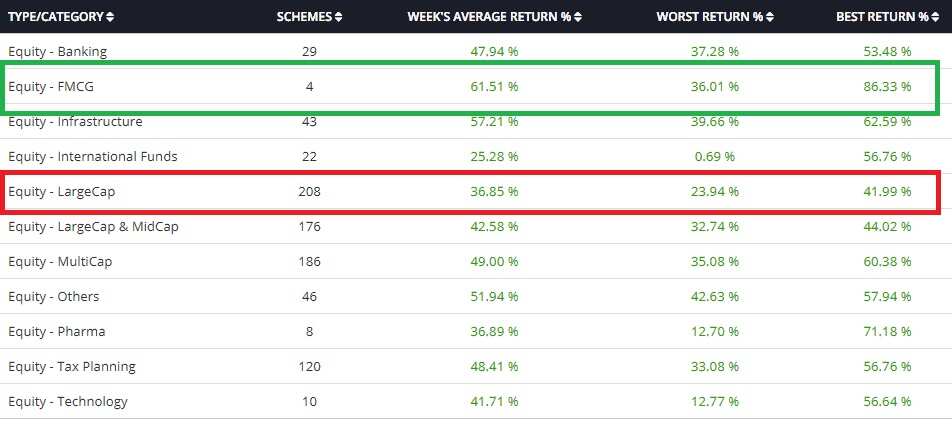

Surpassing both the bourses, FMCG Equuity mutual funds have given returns of 86.33% in five years to its investors.

Clearly, FMCG equity mutual funds have given the highest returns as compared to other sectors. Second best performer is Pharma mutual funds, which gave return of 71.18%. The lowest return have been generated by Large cap equity mutual funds, with just 41.99% in five years.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:59 AM IST

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund The role of mutual funds in achieving financial independence

The role of mutual funds in achieving financial independence