7th Pay Commission HRA approved: We help you calculate

As the House Rent Allowance at the reduced rates may not be sufficient for employees falling in lower pay bracket, it has been decided that HRA shall not be less than Rs 5400, Rs 3600 and Rs 1800 for X, Y and Z category of cities respectively.

The central government employees have finally got the good news which they have been waiting for over an year. Union Cabinet on Wednesday approved the recommendations of 7th Pay Commission on allowance.

Union Cabinet meet which was chaired by Prime Minister Narendra Modi approved the recommendations of the 7th Pay Commission with 34 modifications. The government said that the revised allowance will come into effect from July 1, 2017. This revision will affect more than 48 lakh central government employees.

Cabinet Committee on Economic Affairs said, "The modifications are based on suggestions made by the Committee of Allowances in its report submitted to Finance Minister on 27th April, 2017 and the Empowered Committee of Secretaries set up to screen the recommendations of 7th CPC."

The modifications approved by the Government in the recommendations of the 7th CPC on allowances will lead to a modest increase of Rs 1448.23 crore per annum over the projections made by the 7th CPC.

The 7th CPC, in its report, had projected the additional financial implication on allowances at Rs 29,300 crore per annum. The combined additional financial implication on account of the 7th CPC recommendations along with the modifications approved by the Cabinet is estimated at Rs 30748.23 crore per annum.

Moreover, the government has also decided not to abolish 12 of the 53 allowances which were recommended to be abolished by the 7th CPC. The decision to retain these allowances has been taken keeping in view the specific functional requirements of Railways, Posts and Scientific Departments such as Space and Atomic Energy.

"It has also been decided that 3 of the 37 allowances recommended to be subsumed by the 7th CPC will continue as separate identities. This has been done on account of the unique nature of these allowances. The rates of these allowances have also been enhanced as per the formula adopted by the 7th CPC. This will benefit over one lakh employees belonging to specific categories in Railways, Posts, Defence and Scientific Departments," CCEA said.

For most of the allowances that were retained, the 7th CPC recommended a raise commensurate with inflation as reflected in the rates of Dearness Allowance (DA).

Accordingly, fully DA-indexed allowances such as Transport Allowance were not given any raise. Allowances not indexed to DA were raised by a factor of 2.25 and the partially indexed ones by a factor of 1.5. The quantum of allowances paid as a percentage of pay was rationalised by a factor of 0.8.

HRA is currently paid 30% for X (population of 50 lakh & above), 20% for Y (5 to 50 lakh) and 10% for Z (below 5 lakh) category of cities. 7th CPC has recommended reduction in the existing rates to 24% for X, 16% for Y and 8% for Z category of cities.

As the HRA at the reduced rates may not be sufficient for employees falling in lower pay bracket, it has been decided that HRA shall not be less than Rs 5400, Rs 3600 and Rs 1800 for X, Y and Z category of cities respectively.

ALSO READ: 7th Pay Commission: Decision on higher HRA allowance likely as Cabinet meets today

This floor rate has been calculated 30%, 20% and 10% of the minimum pay of Rs18000. This will benefit more than 7.5 lakh employees belonging to Levels 1 to 3.

7th CPC had also recommended that HRA rates will be revised upwards in two phases to 27%, 18% and 9% when DA crosses 50% and to 30%, 20% and 10% when DA crosses 100%.

"Keeping in view the current inflation trends, the Government has decided that these rates will be revised upwards when DA crosses 25% and 50% respectively. This will benefit all employees who do not reside in government accommodation and get HRA," CCEA said.

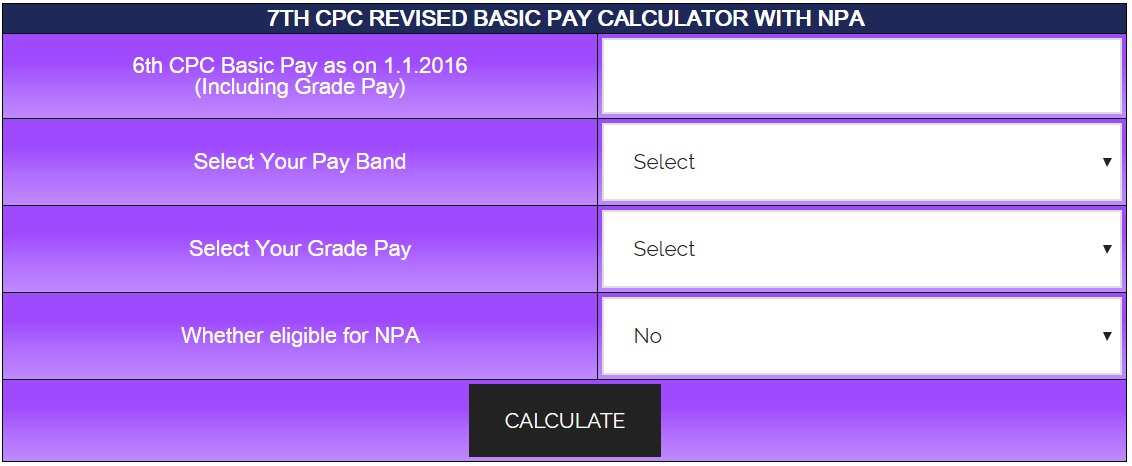

Now, if you are a central government employee and thinking how much more you will get it, then here's how you can calculate.

1. Enter your Basic Pay as on January 1, 2016 including grade pay.

2. Select you Pay Band

3. Select your Grade Pay

4. Select 'Yes' or 'No' whether you are eligible for non-practicing allowance

5. Click Calculate.

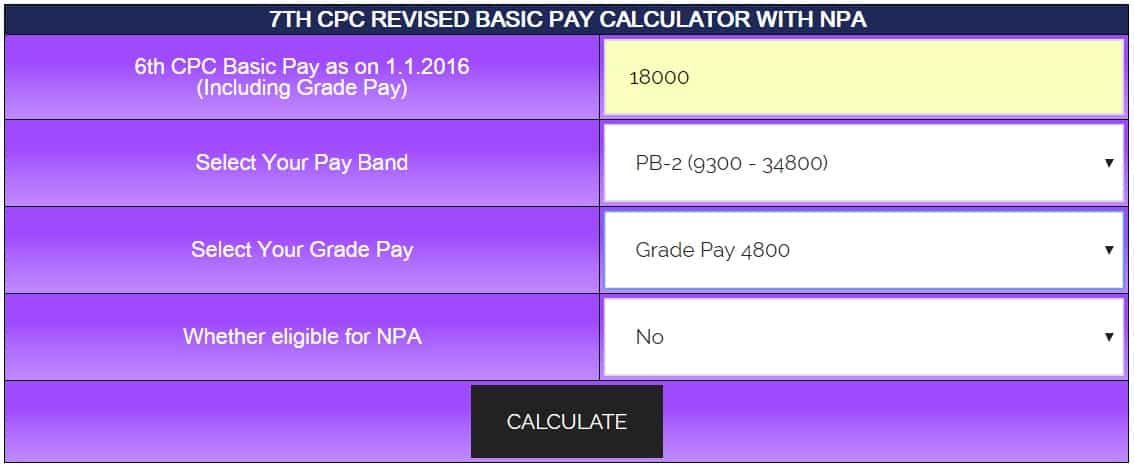

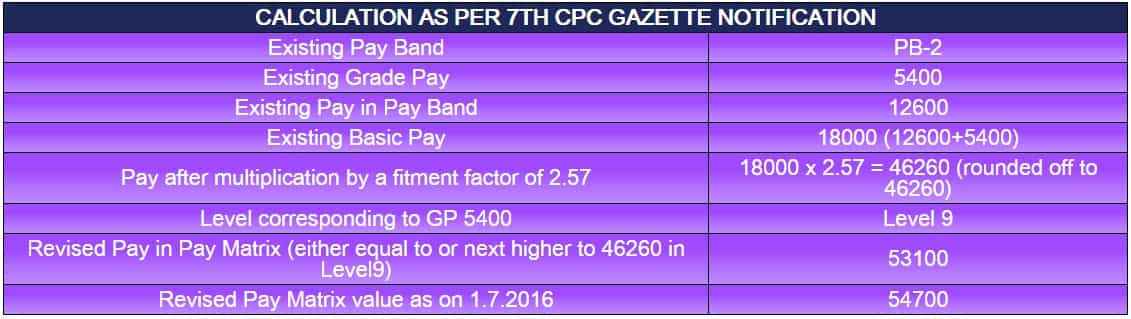

Here's an example. For instance, your basic pay is Rs 18,000 as on January 1, 2016, this is how much you will get.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

09:01 PM IST

Will 8th Pay Commission be implemented? Salary revision, DA hike and other key details central govt employees need to know

Will 8th Pay Commission be implemented? Salary revision, DA hike and other key details central govt employees need to know 7th Pay Commission: How much gratuity one will get on salaries of Rs 20,000, Rs 30,000 and Rs 50,000; see calculation

7th Pay Commission: How much gratuity one will get on salaries of Rs 20,000, Rs 30,000 and Rs 50,000; see calculation 7th Pay Commission: How much gratuity one can get on Rs 15K and 20K basic salaries; know calculations

7th Pay Commission: How much gratuity one can get on Rs 15K and 20K basic salaries; know calculations 7th Pay Commission: Centre hikes HRA for its employees; know city-wise limits

7th Pay Commission: Centre hikes HRA for its employees; know city-wise limits DA Hike Announced: How is dearness allowance calculated for central government employees?

DA Hike Announced: How is dearness allowance calculated for central government employees?