Income Tax filing: Here's what you need to remember; Sahaj, Aadhaar, PAN

Quoting Aadhaar card for filing IT returns will become mandatory from July 1. Here's what you need to keep in mind

Key Highlights:

- Aadhaar becomes mandatory from July 01, 2017

- Individuals having income up to Rs 50 lakh can opt for ITR-1 Sahaj

- PAN must be linked with Aadhaar if you have one

July 31, 2017 is the last day to file income tax returns for assessment year 2017-18. Apart from linking your Aadhaar number with your PAN, we bring you a host of issues that you need to keep in mind before filing your income tax returns.

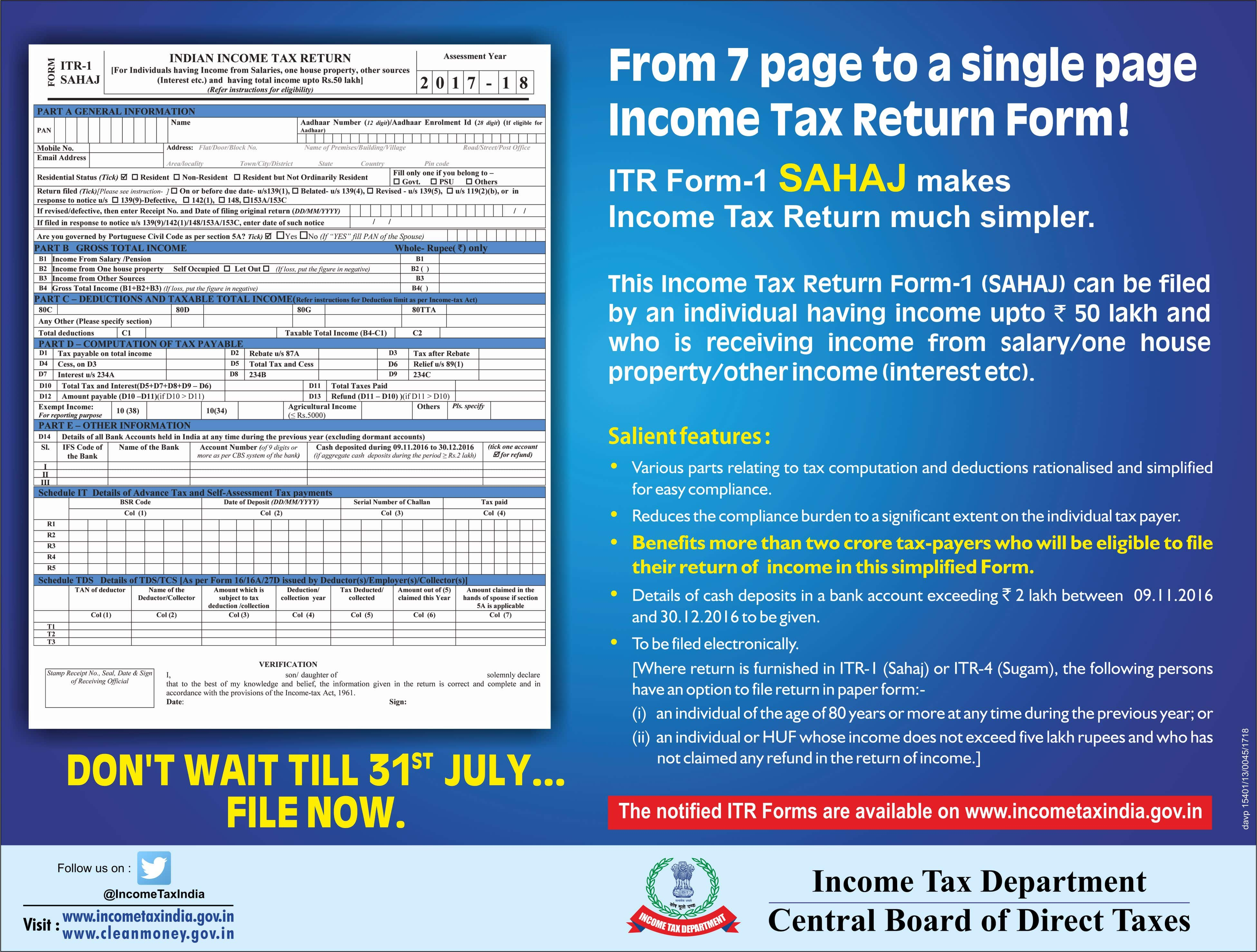

The Income Tax Department has listed features of Income Tax Return Form – 1 Sahaj.

It said, “From seven page to a single page Income Tax Return form. ITR Form-1 SAHAJ makes income tax return much simpler.”

Some of the features are – it form reduces the compliance burden to a significant extent on the individual tax payer.

Benefits more than 2 crore tax-payers who will be eligible to file their return of income in this simplified forms.

Salaried tax payers are needed to file for IT returns electronically.

Who are eligible:

Individual having income up to Rs 50 lakh from the following sources:

1 Income from salary or pension.

2 Income from one house property excluding cases where loss is brought forward from previous years.

3 Income from other sources excluding winning any kind of lottery or income received from like race horses.

Offline filing for ITR-1 is applicable to an individual at the age of 80 years or more at any time during the previous year.

Also individual and HUF (housing undivided family) whose income does not exceed Rs 5 lakhs and who has not claimed any refund in the return of income.

Changes made in ITR-1 for financial year 2017-18 (FY18).

A taxpayer is required to quote Aadhaar number for filing ITR-1. In case if they do not possess the Aadhaar number then he or she can quote Enrollment ID of Aadhaar application Form in the ITR.

There is a new column for reporting cash deposited by tax payers in their bank accounts between November 9 - December 30, 2016 (demonetisation period) has been introduced.

However, taxpayer are required to fill up this column only if they have deposited Rs 2 lakh or more during the demonetisation period.

Details of all the savings and current accounts held at any time during the previous year must be provided. However, it is not mandatory to provide details of dormant accounts which are not operational for more than 3 years.

Savings and account number are needed to be as per Core Banking Solution (CBS) system of the bank.

Schedules of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) have been merged into one in order to make ITR 1 shorter and simpler.

New columns are also inserted to report dividend income and long-term capital gains exempt under Section 10(34) and Section 10(38) respectively.

It is mandatory to e file tax returns for individuals having long term capital of Rs 2.5 lakhs or more,even though their taxable income may be below Rs 2.5 lakhs.

Click here to have a look at the ITR-1 SAHAJ form.

What is the structure of ITR 1 Form ?

Part A – General Information

Part B – Gross total Income

Part C – Deductions and taxable total income

Part D – Computation of Tax Payable

Part E – Other Information

Schedule IT – Detail of Advance tax and Self Assessment Tax payments

Schedule TDS – Detail of TDS/TCS

Also Read: Aadhaar is must for income tax returns if you have one; Here's how you can file it online

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

09:34 AM IST

Zomato gets Rs 803.4 crore tax demand from GST authorities

Zomato gets Rs 803.4 crore tax demand from GST authorities  Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November

Income tax refunds jump 46.3% to Rs 3.04 lakh crore in April-November No proposal on income tax relief for senior citizens under consideration: Centre

No proposal on income tax relief for senior citizens under consideration: Centre  Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  This is India's only tax-free state, residents earn crores without paying Income Tax

This is India's only tax-free state, residents earn crores without paying Income Tax