Zee Business Stock, Trading Guide: 10 things to know before market opens on 17 November 2022

Meanwhile, sectoral indices traded mixed wherein metal, media and realty lost over a percent each. Besides, the prevailing underperformance of the broader indices continues to weigh on the sentiment during today’s session.

Zee Business Stock and Trading Guide: The Indian markets traded lackluster and ended unchanged, in absence of any major trigger. After the initial downtick, the Nifty and Sensex oscillated in a narrow range till the end and finally settled at 18,409 and 61,980 levels on Wednesday.

Meanwhile, sectoral indices traded mixed wherein metal, media and realty lost over a percent each. Besides, the prevailing underperformance of the broader indices continues to weigh on the sentiment during today’s session.

Here is a list of things to watch out for on 17 November 2022

What should investors do?

The recent move in the index lacks decisiveness and shows an early sign of exhaustion too however we recommend following the trend until it reverses.

We’re seeing select heavyweights and midcap counters attracting buying interest while the rest are either trading in a range or witnessing pressure and feel it’s prudent to restrict positions and focus on overnight risk management.

- Ajit Mishra, VP - Research, Religare Broking Ltd

Key support & resistance levels for Nifty50:

The Nifty50 closed 0.03 per cent higher at 18,409. Key Pivot points (Fibonacci) support for the index is placed at 18361.26, 18338.14 and 18300.7, while resistance is placed at 18436.14, 18459.26, and 18496.7.

Key support & resistance levels for Nifty Bank:

The Nifty Bank closed 0.4 per cent higher at 42,535. Key Pivot points (Fibonacci) support for the index is placed at 42360.62, 42286.16, and 42165.64, while resistance is placed 42601.66, 42676.12, and 42796.64.

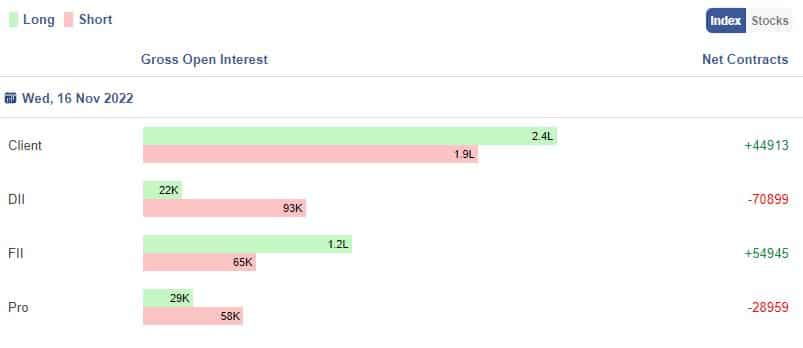

Gross Open Interest:

Open Interest means the number of contracts open or outstanding in futures trading in NSE at any one time. One seller and one buyer together create one contract.

Here the gross values of Open Interest Positions taken by the four participants namely Client are Clients are the retail individual investors who invest in the derivatives instruments, DIIs are domestic individual investors, FIIs are foreign institutional investors and Pro are the proprietors and brokerage firms who trade on their own behalf.

Image Source – Stockedge

Stocks in News:

Nazara Technologies: Ajay Pratap Singh has been appointed CEO of Sportskeeda, the global sports and esports media platform owned by the company.

Balrampur Chini commences commercial production of industrial alcohol at Maizapur Unit. The unit distillery has a capacity of 320 KLPD.

SBI signs €150 million agreement with KfW. The loan agreement will finance #solar power projects in India under Indo-German Solar Partnership

Paytm: Soft Bank likely to sell shares worth $215 m in the company via Block Deal – sources

Aurobindo Pharma receives an Establishment Inspection Report (EIR) from US FDA classifying the inspection as Voluntary Action Indicated (VAI) for Andhra Pradesh unit.

Nitco says JM Financial ARC is acting in its capacity as trustee of JMFARC-LVB Ceramics Trust) - Financial Creditor.

Suven Life Sciences announces randomization of the 1st patient in the Phase-3 global clinical trial of Masupirdine (SUVN-502) for the treatment of agitation in patients with dementia of Alzheimer's Type.

Phoenix Mills arm gets Rs 200 cr investment from Canada Fund.

Tata Motors: JLR CEO resigns for personal reasons, leaving on December 31, 2022.

Asain Paints enters into technology tie-up with KBR (Kellogg Brown & Root) for manufacturing of Vinyl Acetate Monomer in India.

Hind Zinc approves 2nd interim dividend of Rs15.50/Sh for FY23 amounting to Rs 6549.24 cr.

Wipro signs pact with employee representatives on setting up a European Works Council

Corporate Action

Bayer Crop Science: Ex-date interim dividend 1000% at Rs 100 per share

MRF: Ex-date interim dividend 30% at Rs 3 per share

Page Industries: Ex-date interim dividend 700% at Rs 70 per share

Sundaram Fastener: Ex-date interim dividend 200% at Rs 2 per share

Quess Corp: Ex-date interim dividend 80% at Rs 8 per share

FII Activity on Wednesday:

Foreign portfolio investors (FPIs) remained net sellers for Rs 386.06 crore in the Indian markets while Domestic Institutional Investors (DIIs) were net buyers to the tune of Rs 1437.4 crore, provisional data showed on the NSE.

FII Index and Stock F&O:

Image Source - Stockedge

Bulk Deals:

Bikaji Foods Intern Ltd: Goldman Sachs Funds - Goldman Sachs India Equity Portfolio bought 17,45,354 equity shares in the company at the weighted average price Rs 324.5 per share on the NSE, the bulk deals data showed.

Global Health Limited: Nomura India Investment Fund Mother Fund A/C bought 15,00,000 equity shares in the company at the weighted average price Rs 414.57 per share on the NSE, the bulk deals data showed.

CMS Info Systems Limited: Smallcap World Fund INC sold 30,01,000 equity shares in the company at the weighted average price Rs 333.05 per share on the NSE, the bulk deals data showed.

Amiable Logistics (I) Ltd: Anmol Share Broking Private Limited bought 19,200 equity shares in the company at the weighted average price Rs 132.98 per share on the NSE, the bulk deals data showed.

Stocks under F&O ban on NSE

Balrampur Chini, BHEL, Delta Corp, GNFC, PNB and Indiabulls Housing Finance are placed under the F&O ban for Thursday. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

11:43 PM IST

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share

Bell Ringing Celebration: Anil Singhvi rings bell at BSE as Zee Business creates history with record 77.4% market share Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday

Zee Business viewership reaches new milestone, market guru Anil Singhvi set to lead special coverage from 8 am on Tuesday Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Tata Motors, MGL, LIC, Zomato, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on CIL, Inox Wind, Britannia, Dr Reddy's, Escorts Kubota, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on IOCL, Coal India, DLF, UBL, Cyient, over a dozen other stocks today