Nomura sees Rs 470 per share gains after HUL announces foray into health & wellness business

HUL will acquire 51 per cent stake through a combination of primary infusion and secondary buy-outs for a cash consideration of Rs 264 crore. Balance 49 per cent will be acquired at the end of 36 months on pre-agreed valuation criteria, the company said in its exchange filing

Hindustan Unilever Limited’s (HUL:NSE) foray into health and wellness segment augurs well for this fast moving consumer goods company. Multiple brokerages have recommended this stock with Nomura remaining most bullish on this counter. It has recommended a buy on HUL for a price target of Rs 3175, estimating Rs 470 per share gains.

Jefferies and City are almost equally bullish on this counter. Both have recommended a buy on HUL for a price target of Rs 3050, estimating Rs 350 per share upside.

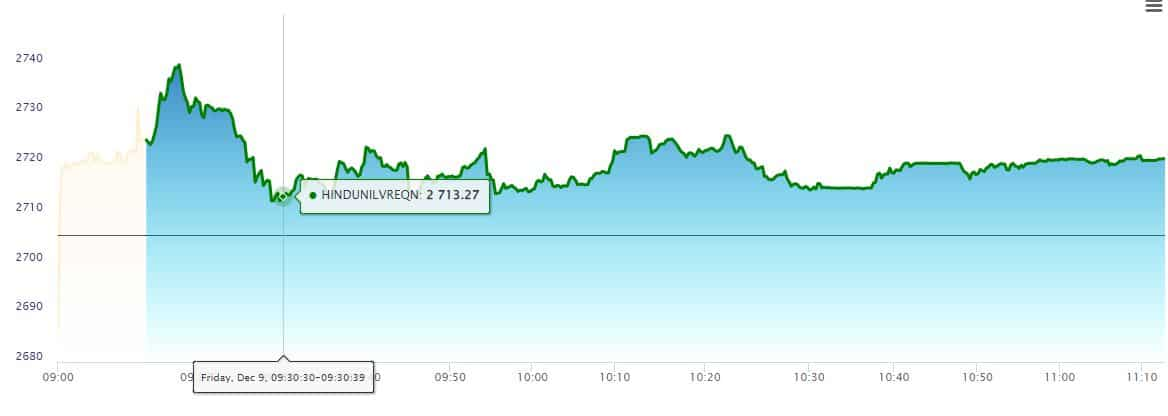

The stock was recommended at a price of Rs 2705.

On Thursday, HUL reported to exchanges about its plan to acquire stake in two health & wellbeing companies - Zywie Ventures Private Limited (OZiva) Nutritionalab Private Limited (Wellbeing Nutrition).

HUL will acquire 51 per cent stake through a combination of primary infusion and secondary buy-outs for a cash consideration of Rs 264 crore. Balance 49 per cent will be acquired at the end of 36 months on pre-agreed valuation criteria, the company said in its exchange filing.

It will acquire 19.8 per cent stake in Wellbeing for a cash consideration of Rs 70 crore the filing said.

Meanwhile, CLSA maintains an ‘Outperform’ rating with a price target of Rs 2950. The brokerage said that HUL is looking to participate in high growth segments. The market for vitamins, minerals and supplements is expected to reach Rs 300 billion in next 5 yrs, it said

Recommendation from other brokerages

- JP Morgan maintains Overweight with a price target of Rs 2800

- Morgan Stanley maintains Equalweight for a target of Rs 2230

Technical View

Technical analyst Nilesh Jain holds a positive view on this stock recommending a buy for a positional target of Rs 2900. The upside is open till Rs 3000. The chart structure appears positive, Jain said.

The Assistant Vice President - Lead Derivative and Technical Research at Centrum Broking said that the stock has seen a breakout at levels around Rs 2700 and from the falling trendline channel. The breakout has come after a 1-year consolidation period.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

04:39 PM IST

Should you buy or sell Bajaj Finance, HUL, other stocks now? Here is what brokerages suggest

Should you buy or sell Bajaj Finance, HUL, other stocks now? Here is what brokerages suggest Double-digit growth forecasted for HUL's ice cream business? All eyes on premiumisation strategy

Double-digit growth forecasted for HUL's ice cream business? All eyes on premiumisation strategy HUL Board approves demerger of Ice Cream business into an independent listed entity

HUL Board approves demerger of Ice Cream business into an independent listed entity  HUL, Britannia, Tata Consumer stocks fall up to 3%; is increasing inflation a concern?

HUL, Britannia, Tata Consumer stocks fall up to 3%; is increasing inflation a concern? FINAL TRADE: Sensex flat, Nifty slips below 24,400 as FIIs continue to sell; HUL tanks over 5%

FINAL TRADE: Sensex flat, Nifty slips below 24,400 as FIIs continue to sell; HUL tanks over 5%