Stock Market HIGHLIGHTS: Sensex, Nifty crack as selling pressure engulfs street; bank, auto, pharma, IT stocks suffer most

Stock Market HIGHLIGHTS: Indian shares traded sharply lower on Friday amid weak global cues as selling pressure took over across sectors with banks, auto, IT and FMCG bearing maximum brunt. The 30-share benchmark S&P BSE Sensex closed 461 points lower, or 0.75 per cent down, at 61,337.81, while the broader 50-share NSE Nifty50 was down by 145 points, or 0.79 per cent lower to finish at 18,269.

Here are key takeaways from the day's session:

1) In the 50-stock Nifty50 45 stocks declined. The top losers were Mahindra & Mahindra, Adani Ports, BPCL, Asian Paints and Dr Reddy's Laboratories while top gainers were Tata Motors, Hindustan Unilever, Nestle India, HDFC Bank and UPL.

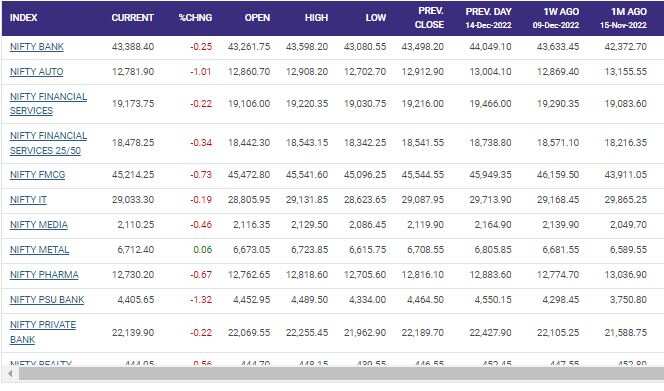

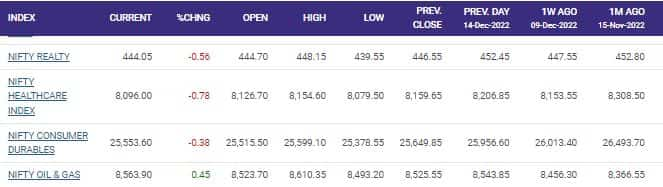

2) All 15 Nifty sectoral indices closed in the red. The worst performers were Nifty PSU Bank (-2.46 per cent), Nifty Auto (- 1.40 per cent), Nifty Pharma (-1.25 per cent) and Nifty Realty (-1.18 per cent).

3) The broader markets also witnessed profit booking with Nifty Mid Cap 100 underperforming benchmark Nifty50. It ended at 31,995, down nearly 550 points or 1.65 per cent. Meanwhile, Nifty Small Cap 100 was trading at 10,036.05, down nearly 50 points or 0.45 per cent.

4) India VIX, a measure of volatility in Nifty was up 2.45 per cent at 14.07.

5) Out of 3,662 stocks that traded on BSE, 1,415 stocks advanced while 2,115 stocks declined while 132 remained unchanged.

6) Rupee drops 9 paise to 82.85 (provisional) against US dollar according to a PTI report.

7) In global markets, Germany's Dax was trading at 13,880.90, down 105.35 or 0.75 per cent. Nikkei 225 crashed today to end over 500 points or 2 per cent lower, China's Shanghai Composite ended flat, though with a negative bias.

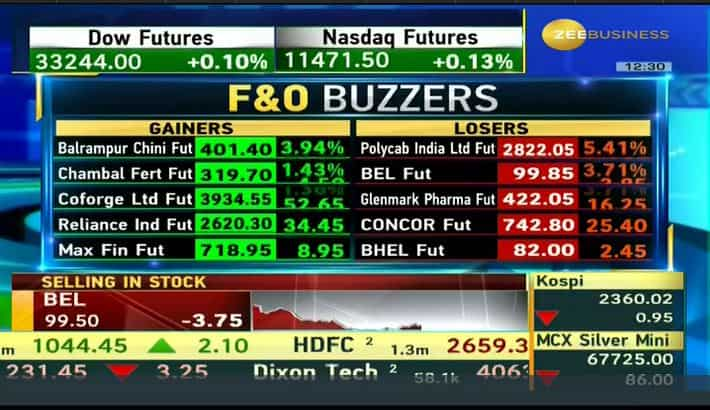

8) MCX Gold futures were trading with limited gains. The February futures were trading at Rs 54128 per gram and were up by Rs 21 from the Thursday closing level. Meanwhile, March Silver futures were down by Rs 723 or over 1 per cent at Rs 67095.

9) December Crude Oil futures were trading at Rs 6145 per barrel and were down by Rs 241 or 3.77 per cent.

Catch all the LIVE action from the stock markets here. For all other news related to business, politics, tech, auto sports and others, visit Zeebiz.com.

Stock Market HIGHLIGHTS: Indian shares traded sharply lower on Friday amid weak global cues as selling pressure took over across sectors with banks, auto, IT and FMCG bearing maximum brunt. The 30-share benchmark S&P BSE Sensex closed 461 points lower, or 0.75 per cent down, at 61,337.81, while the broader 50-share NSE Nifty50 was down by 145 points, or 0.79 per cent lower to finish at 18,269.

Here are key takeaways from the day's session:

1) In the 50-stock Nifty50 45 stocks declined. The top losers were Mahindra & Mahindra, Adani Ports, BPCL, Asian Paints and Dr Reddy's Laboratories while top gainers were Tata Motors, Hindustan Unilever, Nestle India, HDFC Bank and UPL.

2) All 15 Nifty sectoral indices closed in the red. The worst performers were Nifty PSU Bank (-2.46 per cent), Nifty Auto (- 1.40 per cent), Nifty Pharma (-1.25 per cent) and Nifty Realty (-1.18 per cent).

3) The broader markets also witnessed profit booking with Nifty Mid Cap 100 underperforming benchmark Nifty50. It ended at 31,995, down nearly 550 points or 1.65 per cent. Meanwhile, Nifty Small Cap 100 was trading at 10,036.05, down nearly 50 points or 0.45 per cent.

4) India VIX, a measure of volatility in Nifty was up 2.45 per cent at 14.07.

5) Out of 3,662 stocks that traded on BSE, 1,415 stocks advanced while 2,115 stocks declined while 132 remained unchanged.

6) Rupee drops 9 paise to 82.85 (provisional) against US dollar according to a PTI report.

7) In global markets, Germany's Dax was trading at 13,880.90, down 105.35 or 0.75 per cent. Nikkei 225 crashed today to end over 500 points or 2 per cent lower, China's Shanghai Composite ended flat, though with a negative bias.

8) MCX Gold futures were trading with limited gains. The February futures were trading at Rs 54128 per gram and were up by Rs 21 from the Thursday closing level. Meanwhile, March Silver futures were down by Rs 723 or over 1 per cent at Rs 67095.

9) December Crude Oil futures were trading at Rs 6145 per barrel and were down by Rs 241 or 3.77 per cent.

Catch all the LIVE action from the stock markets here. For all other news related to business, politics, tech, auto sports and others, visit Zeebiz.com.

Latest Updates

Markets LIVE - PSU banks take breather after a strong rally

Profit booking was seen in PSU Bank stocks after having a dream run. The public sector banks have outperformed many of their sectoral peers.

In the 12-stock index, only 2 gained today as the overall market felt selling pressure. Uco bank and Indian Overseas Bank were the only gainers today. Union Bank, Punjab & Sind Bank and Maharashtra Bank were the worst performers.

Markets LIVE - Nifty Sectoral Indices

Out of the 15 sectoral indices, Only Nifty Oil & Gas index was trading in the green with 8 advances and 7 declines in the 15-stock index. The biggest gainers were Aegis Logistics followed by ONGC and Adani Total Gas. The losers were IGL, Gujarat Gas and Hindustan Petroleum.

Markets LIVE - Why GMM Pfaudler has tanked? Should you buy it?

GMM Pfaudler shares tanked 18 per cent intraday on the NSE on news of a likely block deal where nearly 1.34 crore shares will be on the block at a price of Rs 1700 per share. The stock was trading at Rs 1,654 on the NSE and was off day’s lows. The stock was down by Rs 270 or 14 per cent around 11:30 am.

Notwithstanding the crash, market expert Siddharth Sedani sees this as a buying opportunity in GMM Pfaudler. This stock was earlier recommended by him in popular Zee Business segment ‘Sid Ki Sip’.

Markets LIVE - Historical View on how stocks have moved after Sensex rebalancing

Sensex rebalancing will come into effect after the stock markets close today. The stock which will be eliminated from the index is Dr Reddy's Laboratories while Tata Motors will become a part of this index. It is expected that there is an inflow of passive funds in Tata Motors while outflow from Dr Reddy's.

Company Inflow/Outflow

Tata Motors +1230 cr

Dr. Reddy -930 cr

Previous Rebalancings in Sensex

Period Inclusion Exclusion

19 December 2022 Tata Motors Dr Reddy

20 June 2022 No change

20 December 2021 Wipro Bajaj Auto

21 June 2021 Tata Steel ONGC

21 December 2020 Dr Reddy Tata Steel

Trends after rebalancing

Changes made in December 2021

Wipro (included) Bajaj Auto (excluded)

1 day -0.72% -2.33%

1 week +5.55% -0.82%

1 month -8.30% +4.10%

3 months -10.40% +14.80%

June 2021 rebalancing

Tata Steel (included) ONGC (excluded)

1 day +1.27% +0.58%

1 week +6.60% +0.57%

1 month +12.60% -6.30%

3 months +19.10% +12.50%

December 2020 Rebalancing

Dr Reddy (included) Tata Steel (excluded)

1 day -3.06% -5.61%

1 week -0.44% +0.44%

1 month -3.23% +6.50%

3 months -19.10% +17.50%

The exclusive research has been done by Zee Business' Kushal Gupta

Stocks to Buy - What brokerages recommend?

- Credit Suisse on ICICI Bank (CMP : 909)

Maintain Outperform, Target 1075

- Credit Suisse on SBI (CMP: 616)

Maintain Outperform, Target 730

- CLSA on Mahindra & Mahindra (CMP: 1287)

Maintain Buy, Target raised to 1558 from 1539

-CLSA on Tata Motors (CMP: 417)

Maintain Outperform, Target raised to 500 from 491

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Markets LIVE - What top brokerages recommend?

BoFA Securities on HDFC Bank (CMP : 1632)

Maintain Buy, Target 1900

(Management Meet Takeaways)

Well positioned to deliver ahead of market expectations

Earnings delivery to be ahead of market expectations

Merger & beyond – focus shifts to execution & synergy

Standalone – branches, digital, NIMs, op leverage

Risk-reward is very attractive at current valuations

- Jefferies on Shriram Transport Finance Co (CMP: 1393)

Maintain Hold, Target raised to 1365 from 1225

Post-merger, loan book of merged entity Shriram Fin rises by 27%

Revise FY23/25 EPS by -4%/4% factoring in merger

Believe AUM should grow at 15% CAGR over Fy23-23

With Some NIM Pressure , Shriram should deliver Moderate 13% EPS CAGR

Shriram should deliver 14% RoE over FY23-25

Risk of potential supply form large non-promoter shareholders stays an overhang

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Stock in Focus - GM PFaudler

GMM Faudler shares crashed over 14 per cent intraday on Friday on news of a bulk deal. A bulk deal is likley to happen at price of Rs 1700 per share according to media reports citing sources. Around 1.34 shares are likely to be on the block. Axis Capital has been appointed as a broker for this deal.

Markets LIVE: Trading Strategy of Anuj Gupta of IIFL Securities

Dow @ 33440

Support 33200 / 33000

Resistance 33700 / 34950

Sideways

SGX Nifty @ 18399

Suppprt 18250 / 18100

Resistance 18500 / 18620

Sideways

Bank Nifty @ 43576

Support 43200 / 42800

Resistance 44900 / 45100

Sideways

USDINR @ 82.79

Support 82.50 / 82.30

Resistance 82.95 / 83 10

Sideways

SELL MCX GOLD FEBRUARY AT 54500 STOP LOSS 54950 TARGET 53700

Sell MCX Silver March AT 68500 STOP LOSS 69100 TARGET 67000

SELL MCX CRUDEOIL DECEMBER AT 6450 STOP LOSS 6600 TARGET 6200

Sell MCX COPPER DECEMBER AT 708 STOP LOSS 714 TARGET 697

Sell NSE NIFTY AT 18500 STOP LOSS 18620 TARGET 18250

SELL NSE BANKNIFTY AT 44900 STOP LOSS 45100 TARGET 43200

BUY NSE USDINR AT 82.50 STOP LOSS 82.30 TARGET 83.00

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)