Share Market HIGHLIGHTS: Sensex ends volatile day 208 pts lower, Nifty cracks below 18,300; LIC up 1% ahead of Q4 results

Share Market HIGHLIGHTS: The equity market ended with over 0.30 per cent losses on May 24, Wednesday, amid selling in blue chip counters such as HDFC duo, ICICI Bank, and Reliance Industries. Besides, weak global cues, too, dented investor sentiment. As per a Reuters report, global stocks lurched downwards as US debt ceiling negotiations dragged on without resolution, stoking a general malaise in markets that saw safe-haven assets like the dollar and gold hold near recent highs.

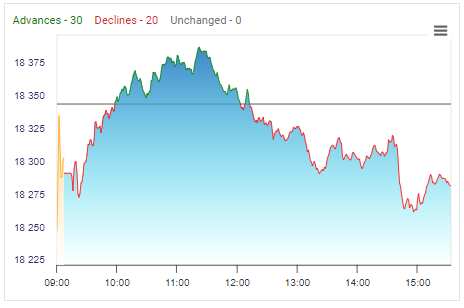

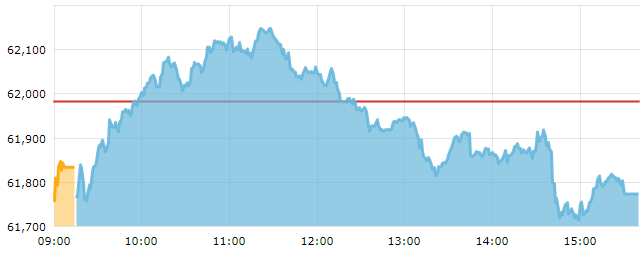

The S&P BSE Sensex ended at 61,773.78, down 208 points, or 0.34 per cent while NSE's Nifty settled at 18,285.40, down 62.6 points, or 0.34 per cent.

Catch minute-by-minute updates of all the action in the Indian share market today, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stocks to buy and trade recommendations only on Zeebiz.com's blog:

Share Market HIGHLIGHTS: The equity market ended with over 0.30 per cent losses on May 24, Wednesday, amid selling in blue chip counters such as HDFC duo, ICICI Bank, and Reliance Industries. Besides, weak global cues, too, dented investor sentiment. As per a Reuters report, global stocks lurched downwards as US debt ceiling negotiations dragged on without resolution, stoking a general malaise in markets that saw safe-haven assets like the dollar and gold hold near recent highs.

The S&P BSE Sensex ended at 61,773.78, down 208 points, or 0.34 per cent while NSE's Nifty settled at 18,285.40, down 62.6 points, or 0.34 per cent.

Catch minute-by-minute updates of all the action in the Indian share market today, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stocks to buy and trade recommendations only on Zeebiz.com's blog:

Latest Updates

Thank you! That's all today on Zeebiz.com's blog on the Indian share market

For all other news related to business, politics, tech, sports and auto, follow us on Twitter, Facebook, LinkedIn and Instagram.

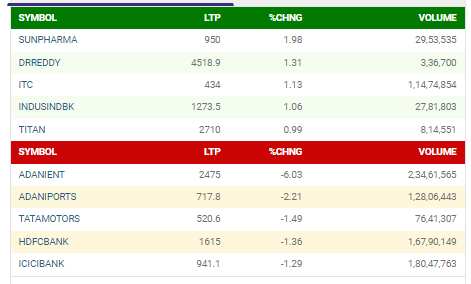

Share Market HIGHLIGHTS | Adani Enterprises, Adani Ports, Tata Motors emerge as top losers; Sun Pharma, Dr Reddy's, ITC rise most in 50-scrip blue-chip basket

Adani Enterprises, Adani Ports, Tata Motors and HDFC Bank are among the top losers, down nearly 6-1 per cent. On the other hand, Sun Pharma, Dr Reddy's, ITC and IndusInd Bank are among the top gainers in the Nifty basket, trading with gains of around 2-1 per cent.

Source: NSE

Hindalco Industries reports 37% YoY drop in Q4 PAT; announces 300% dividend for FY23

Hindalco Industries Q4 results: Hindalco Industries on May 24, Wednesday, reported a 37 per cent year-on-year (YoY) drop in consolidated net profit or profit after tax (PAT) of Rs 2,411 crore. However, on a sequential basis, the profit jumped 77 per cent. Consolidated revenue stood at Rs 55,857 crore, which was unchanged on a YoY basis but was up 5 per cent sequentially, the company said in its earnings release. Read more

Nifty Today LIVE |HDFC twins, RIL, ICICI Bank among top draggers

HDFC twins, RIL, ICICI Bank and Kotak Bank are among the top draggers in both the Sensex and Nifty baskets at this hour. On the contrary, ITC, Sun Pharma Titan and Maruti Suzuki are the top movers.

Here's a look at the heatmap in the 50-scrip universe by weight:

Source: NSE

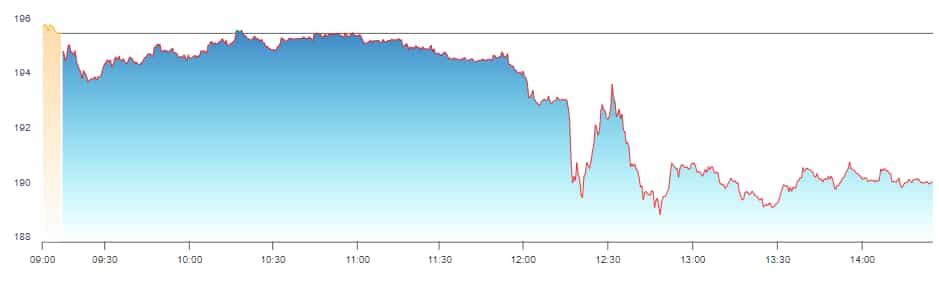

Share Market Today LIVE | India Cements slides deeper into the red as Q4 loss far exceeds analysts' estimates

India Cements shares drop nearly 3 per cent as Q4 loss far exceeds analysts' estimates. The stock quotes Rs 190.15, down by 2.81 per cent or Rs 5.50.

Source: NSE

Share Market Today LIVE | TVS Motor, L&T Finance, Ramco Cements, Poonawalla Fincorp hit 52-week highs

Here are some of the other stocks that also scaled 52-week peaks:

- Apollo Tyres

- Ceat

- Cholamandalam Financial

- ELGI Equipments

- Kajaria Ceramics

- Mahindra CIE

- Narayana Hrudayalaya

Avanti Feeds Q4 result: Net profit rises 11% to Rs 93 crore

Avanti Feeds on May 24, 2023, reported a consolidated net profit of Rs 93.34 crore for the Q4FY23, up 10.65 per cent against Rs 84.35 crore logged in the year-ago period. Revenue from operations stood at Rs 1,093 crore, down 18 per cent against Rs 1,332 crore registered in the March 2022 quarter. Read more

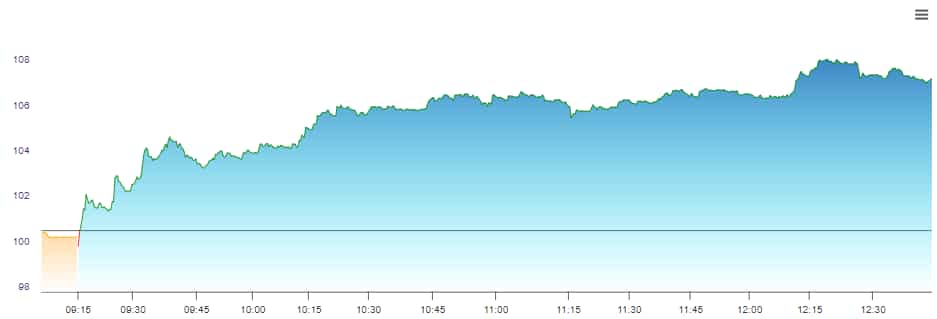

Engineers India shares rise as much as 7.5 per cent to a 52-week high of Rs 108.3 apiece on BSE

The stock holds on to much of its intraday gains in early afternoon deals trading in huge volumes, quoting 6.9 per cent higher at Rs 107.7 apiece on the bourse. As many as 23.7 lakh Engineers India shares have changed hands so far today, as against a daily average of 11.5 lakh over the past two weeks, according to provisional exchange data.

Source: NSE

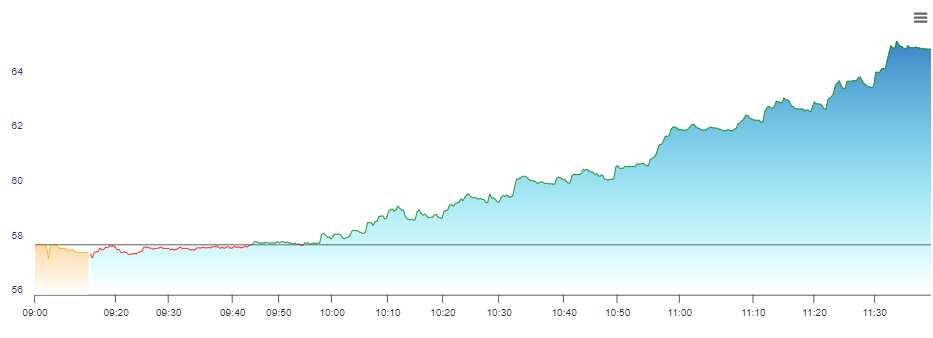

Suzlon Energy bags order of 300 MW from Torrent Power

Suzlon Energy shares surges over 8 per cent after the company received an order from Torrent Power of 300 MW.

"This is to inform that Suzlon secures a major order of 300 MW from Torrent Power Limited, a Torrent Group Company. The press release in this regard is attached herewith," the company's regulatory filing reads.

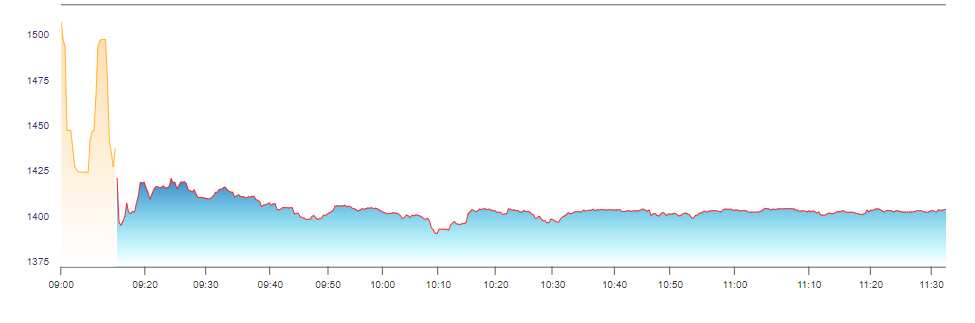

Polyplex Corp down 8.5% on weak Q4 results, promoters selling stake

Polyplex Corp shares are down 8.5 per cent on Wednesday after the company posted weak seat of Q4 results.

Source: NSE

Polyplex Corp reported a decline of 11.6 per cent year-on-year (YoY) in its consolidated revenue to Rs 1,667.07 crore against Rs 1,885.87 crore logged in Q4FY2023. The company's earnings before interest, taxes, depreciation, and amortisation (EBITDA) declined by 85.39 per cent to Rs 55.37 crore from Rs 379.03 registered in the year-ago period.

The company reported a 95.9 per cent fall in Profit after tax (PAT) to Rs 7.61 crore from Rs 185.78 crore a year ago. The company's margin — a key measure of profitability for a business — has dropped to 3.32% per cent from 20.09% per cent.

Promoter to sell 24.3 per cent stake to AGP Holdco ltd for 1,380 crore. Deal struck at approx Rs 1,810 (at 19.2 per cent premium). Zee Business Analyst Varun Dubey recommends buying the stock for a target of Rs 1,570 with a stop loss at Rs 1,510.

India's economic growth will be close to 6.5% in FY23-24 says RBI Governor Shaktikanta Das

India's economic growth in the current fiscal (FY23-24) will be close to 6.5 per cent, the Reserve Bank of India (RBI) Governor Shaktikanta Das said at the annual session of Confederation of Indian Industry (CII) on May 24, 2023. The governor further said that inflation has moderated but there is no room for complacency. Read more

Share Market Today LIVE | SBI Life, Tata Power, Balkrishna Industries, Jubilant FoodWorks among analysts' top picks

In conversation with Zee Business Managing Editor Anil Singhvi, market experts Rakesh Bansal, Ambareesh Baliga, Vishvesh Chauhan and Sumeet Bagadia share their top recommendations for the day in this special segment, Pick of the Day. Read more