This is how to fix bank frauds; What ex RBI honcho wants

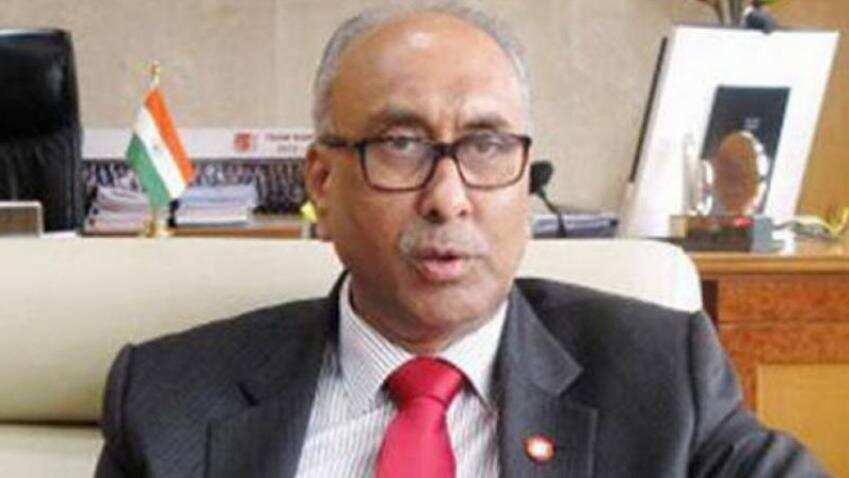

RBI deputy governor S S Mundra said that conditions were not right for privatisation of state-run lenders due to the socio-economic situation of India

It is the right time to consider a holding company for Indian public sector banks to manage the country's fraud-hit and cash-strapped financial industry, former RBI deputy governor S S Mundra said. Mundra, however, said that conditions were not right for privatisation of state-run lenders due to the socio-economic situation of India. "Time is ripe now to hold discussions on a holding company for banks. Let the bank holding company start with the government majority and it should have a majority in individual bank," Mundra said the State Bank of India-sponsored Mint Asia Global Banking Conclave here last night.

In step two, the government should do away with the majority in the holding company. "I think that should be the road map and this might take 15-20 years," said Mundra.

He agreed with SBI chairman Rajnish Kumar that conditions were not right for privatisation of the Public Sector Banks (PSBs). "Clearly privatisation (of PSB) is no panacea; that is quite clear," added Mundra at the conclave attended by some 200 members of the Indian business community here.

"Given India's current socio-economic condition, it is not right (time) for privatisation. May be after 20 years, you will have the right situation," said Kumar during a panel discussion. While the government's recapitalisation of cash-strapped banks is going on, the Punjab National Bank (PNB) fraud, the country's worst in banking history, surfaced last month, shocking the financial industry as much the public sector.

Both the top bankers agreed PNB fraud was the worst to hit the industry. Kumar said the crisis situation should be sorted out, perhaps over the next two years, and build confidence in the banks, before considering consolidation of the industry. They agreed the banking sector was sound.

Kumar also called for improving governance, quality of bank boards and executive levels. "Once they have regained a certain confidence, after about two years, and (perhaps) that time could be the right time for some consolidation," said Kumar.

Mundra felt that seven to eight banks should be consolidated in the 21-PSB industry, which, nevertheless, has done well in financing the country's massive infrastructure development.

"There can definitely be a consolidation that can be done and can happen. But you don't consolidate everybody," added Kumar.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

04:52 PM IST

RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI, Maldives Monetary Authority sign pact to promote use of local currencies RBI cautions public about 'deepfake' video of governor being circulated on social media

RBI cautions public about 'deepfake' video of governor being circulated on social media RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Consumer inflation worsens to 6.21% in October from 5.49% in previous month

Consumer inflation worsens to 6.21% in October from 5.49% in previous month Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public