Share Buybacks: Everything you need to know as an investor

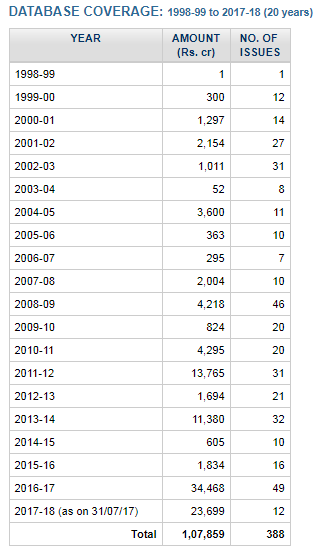

Two IT firms namely Infosys and Wipro will soon hit the buyback market with spending totaling up to Rs 24,000 crore. In last fiscal year, this market has reached to an 18-year high.

Key Highlights:

- Infosys and Wipro together will spend about Rs 24,000 crore for share buyback

- Between April - July 2017, 12 companies have spent Rs 23,699 crore repurchase of shares

- Share buyback reached to an 18-year high at nearly Rs 34,500 crore.

Start of financial year 2017-18 (FY18) has been good for investors as companies like Wipro and Infosfys have announced share buybacks.

Data compiled by Prime Database show that between April – July 2017, a total of 12 companies have opted for share buybacks spending up to Rs 23,699 crore.

Not to forget, in May 2017, IT-giant Tata Consultancy Services (TCS) spent nearly Rs 16,000 crore thereby making it the largest share buyback in the history of India.

In fiscal FY17, share buyback reached an 18-year high with 49 companies spending nearly Rs 34,500 crore compared to just Rs 1,834 crore in FY16 and Rs 605 crore in FY15.

This would be the highest spending made by India Inc since the time this market became known in the year 1998.

Outlook also looks promising as two IT-giants Wipro and Infosys together will spend Rs 24,000 crore this fiscal for share buybacks.

Infosys has approved the share buyback of Rs 13,000 crore – which accounts up 20.51% of its total paid up capital and free reserves.

The company plans to purchase up to 113,043,478 equity shares aggregating up to 4.92% of the paid-up equity capital at a price of Rs 1,150 per share.

On July 20, Wipro stated that it plans to purchase about 34,37,50,000 equity shares valuing up to Rs 11,000 crore – being 7.06% of paid-up capital at Rs 320 per share.

While share buybacks are a good way to reward investors, there is still a lot of confusion on share buybacks actually work and how can small and retail investors make the most of them.

What is a share buyback?

A company makes a buyback or repurchase shares from its existing shareholders usually at a market price or premium.

Such is done usually in traditional open-market purchase or tender route. Both promoters and public shareholders can offer their shares in tender buyback, however only public shareholders can take part in open-market as per rules of Securities and Exchange Board of India (Sebi).

In tender buyback – a company fixes a price and accept shares on a proportionate basis directly from shareholders in the buyback period. While in open-market, a higher price band is decided for the shares offered, among which some are purchased by a company (they cannot the entire amount announced) from the market within a specific time-frame.

Objective:

One of the common objective of adapting this portal is to control the drop in the value of a company's stock price – by reducing the supply of stock. This in return drives price-over-equity (PE) ratio and also improves the earnings per share (EPS) of a company.

Pranav Haldea, Managing Director of PRIME Database said that there are a few reasons for it; firstly, share buyback has become a more lucrative way to return money to shareholders than dividend.

Another reason is that the amount of ideal cash a company holds in their balance sheet, as these affects ratios like Return on Equity (RoE), Return on Asset (RoA), etc.

What's in it for retail investors?

Mostly, buyback prices has been decided at a premium – which provides an opportunity to retail investors to exit the stock of a particular company with an intention to book some profits.

As per Value Research report, if the premium price of a buyback is intended to signal a belief that the stock is undervalue and one assumes that the management will continue to work towards improving shareholder value, then they are suggested to remain invested especially in case of long-term investor.

The report added, “Tendering to a buyback makes more sense if you feel the share price in the market is overvalued, or you don't believe there are opportunities to grow earnings at the same pace going forward.”

By end of the day, it is all about the fundamentals and intentions of the company announcing the buyback. A investor needs to understand the underlying reason before deciding on a course of action whenever a buyback is made.

How does a share buy back work?

Under tender buyback – if a promoter is willing to offer their shares, then a specified date for the purpose of determining the names of shareholders to whom letters of offer share be sent.

As per Sebi's guidelines, offer letter details should be submitted along-with prescribed fees – at least 21 days before dispatch of letters of offer to shareholders. Buyback offer will remain open for minimum 15 days and maximum 30 days. Within 15 days of closure of offer for buy back, payment should be made or regret letters should be sent to the shareholders.

In open-market buyback, a company needs to appoint a merchant banker. While making public announcement, it should be made at least 7 days prior to commencement of buy back.

A copy of the announcement needs to be filed with SEBI along-with prescribed fee within 2 days of such announcement.

Other rules are - during buy-back programme bonus shares are not allowed, payments needs to be made through cash or cheque, once announcement made the offer would not be withdrawn, shares which are locked-in cannot be repurchased.

Details like number of shares bought, price, total amount invested in buy back, details of shareholders from whom more than 1% of the total shares were bought and the consequent change in the capital structure needs to be disclosed, as per Sebi.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

12:32 PM IST

Share Market News: Infosys, Indigo Paints, GIC, Infibeam, other stocks to track today

Share Market News: Infosys, Indigo Paints, GIC, Infibeam, other stocks to track today  Jai Corp stock set to trade ex-buyback on Tuesday

Jai Corp stock set to trade ex-buyback on Tuesday Share Market News: RailTel, Samvardhana Motherson, MGL, 14 other stocks due to trade ex-dividend on Wednesday; see list

Share Market News: RailTel, Samvardhana Motherson, MGL, 14 other stocks due to trade ex-dividend on Wednesday; see list  Bonus, Share Split, Dividend Stocks: 50+ scrips to trade ex-date on Friday; BHEL, Equitas SFB, Kalyan Jewellers, BPCL, CEAT on the list

Bonus, Share Split, Dividend Stocks: 50+ scrips to trade ex-date on Friday; BHEL, Equitas SFB, Kalyan Jewellers, BPCL, CEAT on the list  Share buybacks no longer to woo investors: here’s why

Share buybacks no longer to woo investors: here’s why