Rs 1,374 crore vanished in 3 days! LIC takes biggest hit in PNB’s free fall

A steep 40 per cent drop in the Punjab National Bank's stock in the last three days weighed heavy on its largest shareholder, Life Insurance Corporation of India (LIC).

LIC suffered a notional loss of as much as Rs 1,374 crore in the last three sessions since February 14.

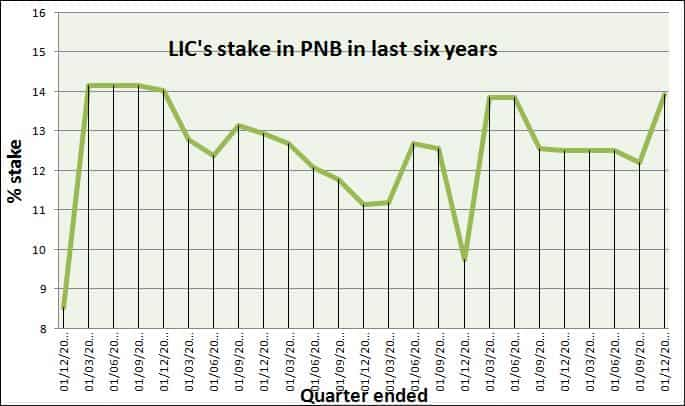

LIC, the biggest 'public shareholder' in PNB, holds 13.93 per cent stake in the bank, followed by HDFC Trustee Company Limited (4.2% stake) and Lazard Emerging Markets Equity Portfolio (2.2 per cent stake), data available with BSE for the quarter ended December 31, 2017 showed.

ALSO READ: 38% slump in 3 days! Avoid PNB in short-term, say experts

The state-run insurer has been hiking its stake in PNB for the last few years. Since 2011, LIC's stake in PNB has gone up from 8 per cent to 14 per cent.

LIC's stake in the bank is worth Rs 4089.76 crore today, compared with Rs 5463.72 on February 14.

Meanwhile, the market capitalisation of PNB eroded about Rs 10,000 crore from Rs 39,209 crore as on February 12 to Rs 29,400-odd crore today. The market value that PNB lost nearly equals the financial fraud PNB detected earlier this week at its Mumbai branch.

To explain the fraud in brief, PNB’s officials had issued unauthorised Letter of Undertaking (LoUs) in favour of three companies, run by billionaire Nirav Modi namely Solar Exports, Steller Diamonds and Diamond R Us for availing buyers’ credit.

ALSO READ: PNB fraud: What is it, how it happened, and will it snowball?

PNB employees misused the SWIFT network to transmit messages to other banks bypassing the core banking system (CBS), and duping the management about the same.

On these LoUs, overseas branches of Allahabad Bank, Axis Bank, etc, credited PNB’s Nostro account, from where funds were moved to certain overseas parties. Axis Bank on Thursday clarified, saying it had sold all its LoUs before the issue surfaced and there is no financial implication relating to this case.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:34 PM IST

Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Hamps Bio shares debut at 90% premium on BSE SME platform

Hamps Bio shares debut at 90% premium on BSE SME platform Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today

Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today Swiggy shares rise nearly 2% after Axis Capital initiates ‘buy’ rating

Swiggy shares rise nearly 2% after Axis Capital initiates ‘buy’ rating GIFT Nifty futures down 100 points; markets to track Fed meeting, Chinese data

GIFT Nifty futures down 100 points; markets to track Fed meeting, Chinese data