RERA Act: Only 9 states, 6 union territories submit their notified rules

Highlights:1. The government implemented the RERA Act across India on May 1, 2017

2. The Act makes compulsory registration of all ongoing and upcoming real estate projects

3. Developers have to disclose project related details such as project plan, layout, and government approvals related information to the customers, etc.,

In an attempt to bring transparency, accountability and efficiency in the country's real estate sector, the Government of India implemented the long-pending Real Estate Regulation and Development Act (RERA Act) nationwide on May 1 this year but most states have missed the government's deadline to submit their notified rules.

Rajya Sabha, the upper house of Indian Parliament, had passed the RERA Act in March 2016.

The RERA Act is primarily aimed at addressing the grievances of property buyers and is being touted as a pro-consumer law.

"#RERA promotes accountability, transparency & efficiency in the sector. Buyer set to be King. Promoter benefits from king’s confidence," Union Minister for Urban Development, Housing and Urban Poverty Alleviation, Information & Broadcasting M Venkaiah Naidu said on Twitter on April 30 .

#RERA promotes accountability, transparency & efficiency in the sector. Buyer set to be King. Promoter benefits from king’s confidence. 2/n

— M Venkaiah Naidu (@MVenkaiahNaidu) April 30, 2017

"#RERA forges a happy, mutually beneficially alliance between buyers & developers. Rights & duties of buyers, promoters clearly defined," Naidu added.

#RERA forges a happy, mutually beneficially alliance between buyers & developers. Rights & duties of buyers, promoters clearly defined. 5/n

— M Venkaiah Naidu (@MVenkaiahNaidu) April 30, 2017

However, even though the government has implemented the RERA Act 2016 nationwide on May 1 only nine states and six union territories have notified their RERA Act rules to the Ministry of Urban Development and Housing, cited Crisil in a research note released on May 2.

According to Crisil, nine states namely -Andhra Pradesh, Bihar, Gujarat, Kerala, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, and Uttar Pradesh and six union territories -- Andaman and Nicobar Islands, Chandigarh, Dadra and Nagar Haveli, Daman and Diu, Lakshadweep, and National Capital Territory of Delhi-- have notifed their RERA Act rules to the Ministry of Urban Development and Housing.

ALSO READ: Here are 10 key things to know about RERA Act

The Act will improve the sector's credibility score and provide the security among stakeholders, the ratings agency said.

Crisil in its note has further said that it research has found "that many states have either diluted a few crucial aspects of the Act, or given insufficient emphasis to its provisions in their rules."

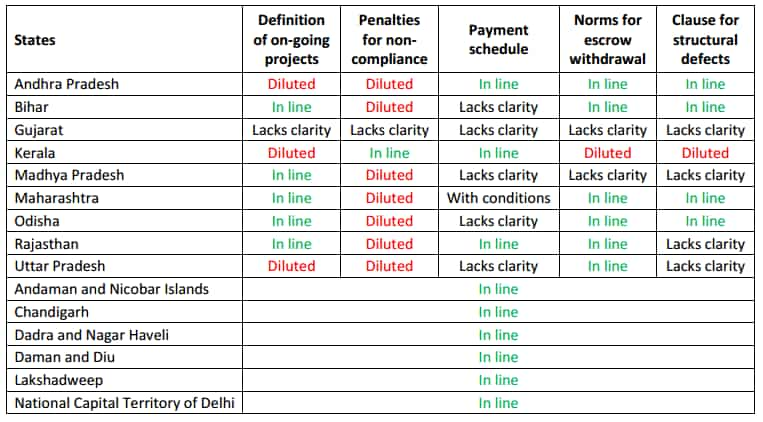

The ratings agency had conducted assessment of all nine states and six union territories on their notified RERA Act rules on five aspects such as definition of on-going projects, penalties for non-compliance, payment schedule, norms for escrow withdrawal and clause for structural defects.

It found that aspects such as definition of on-going projects, penalties for non-compliance, etc., have been diluted by most states in their notified rules to the government, it said in a note.

Summary of Crisil Research’s assessment of state-specific notified rules:

States like Andhra Pradesh, Kerala and Uttar Pradesh have altered definition of on-going projects in their notified rules, cited Crisil.

In fact, Gujarat has lacked clarity on all five aspects in its notified RERA Act rules while Madhya Pradesh lacked clarity on payment schedule, norms for escrow withdrawal and clause for structural defects, it said.

Similarly, states like Madhya Pradesh, Maharashtra, Odisha, Rajasthan,Uttar Pradesh have diluted aspect penalties for non-compliance in their notified rules.

"Apparently what has happened in this case is that states have diluted these provisions in favour of builders. For example, certain states have kept existing and ongoing projects outside the ambit of RERA, largely diluting its impact," Angel Broking senior research analyst-Infrastructure, Capital goods and Real Estate Abhishek Lodhiya, said in a statement.

"Out of the 13 states and union territories (UTs) that have so far notified the RERA rules, there has been some element of dilution in most of the states. For example, Gujarat has exempted all projects launched before November 2016 from the ambit of RERA. Uttar Pradesh (UP) has exempted such real estate projects. Maharashtra has also given the RERA Authority the powers to withhold any document from public viewing, something not provided for in the RERA Act," Lodhiya said.

In a nutshell, with the diluted version and limited implementation, it is uncertain how impactful the RERA will be and will it solve the whole purpose of safeguarding home buyers on an all-India basis, he added.

Commenting on implementation of RERA Act, Mahindra Lifespaces VP-CRM and Marketing Sunil Sharma, said in a press release," The setting up of a Real Estate Regulatory Authority in each state will bring in increased accountability in markets, thereby improving the sector’s credibility score and re-instating a sense of security amongst all stakeholders."

ALSO READ: RERA may revive real estate sector in second half: Experts

"Furthermore, mandatory disclosure of project details, including those of the promoter, land status and clearances, is geared towards protecting consumer rights," Sharma added.

He further said, "Focused action on time-bound, transparent approvals and single window clearances can further aid efficient project execution and delivery.

Echoing similar opinion, Puranik Builders managing director Shaliesh Puranik, said in a release, "This Act will give a substantial fillip to the confidence of various stakeholders including fund providers, like banks, financial institutions and private equity funds, and will thereby help in increasing foreign investment."

"The RERA roll out will have a positive impact on new project launches. Buyers will have complete clarity on the new project, something that was ambiguous earlier," Puranik said.

As per Crisil research, here's how implementation of RERA Act 2016 will benefit property buyers:

1.It includes projects that are ongoing on the date of commencement of the Act that is May 1, 2017 and for which the completion certificate (CC) has not been issued

2. RERA 2016 recommends imprisonment for a term which may extend up to three years, or fine which may extend up to 10% of the estimated cost of the real estate project, or both, in case of non-compliance with the Act

3. The Act makes compulsory registration of all ongoing and upcoming real estate projects

4. Developers have to disclose project related details, including: project plan, layout, and government approvals related information to the customers such as sanctioned floor space index (FSI), number of buildings and wings, number of floors in each building, etc.

5. Buyers to pay only for the carpet area

ALSO READ: Residential realty likely to witness weak sales, commercial & retail segment to record stable growth in 2017: Care Ratings

6. Consent of two-third allottees to be taken for any major addition or alteration

7. The delivery of the project has to be on time, as mentioned in the agreement

8. Any structural defect, or any other obligations of the promoter as per the agreement for sale, brought to notice of promoter within five years from possession to be rectified free of cost

9. Buyers have to comply with payment schedule mentioned in model sale agreement (which mandates them to pay upto 30% of total consideration on execution of agreement, and additional upto 15% of total consideration on completion of plinth work; remaining payment to be as per clauses mentioned in the model sale agreement)

10. 70% of the money received from buyers, for a particular project, to be transferred to an escrow account

11. Withdrawals to be in proportion with the completion of the project and it needs to be certified by engineer, architect and practicing chartered accountant

13. Developers have to register their projects with RERA before advertising or marketing

14. Brokers/ agents are to be registered with RERA

15. Project details to be updated quarterly on RERA website

16. In case of delay, developers have to pay interest to home buyers at State Bank of India's highest marginal cost of lending rate plus 2%

17. Developer may terminate the agreement in case of three payment defaults by buyers (by giving 15 days' notice)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

02:04 PM IST

Here are 10 key things to know about RERA Act

Here are 10 key things to know about RERA Act RERA may revive real estate sector in second half: Experts

RERA may revive real estate sector in second half: Experts Real Estate: No new launches in Mumbai, Gurugram & Noida as unsold houses peak

Real Estate: No new launches in Mumbai, Gurugram & Noida as unsold houses peak Here are 5 key things you should look forward to in India's real estate sector this week

Here are 5 key things you should look forward to in India's real estate sector this week  About 886 total real estate projects face delays; Punjab records maximum delays of 48 months: Assocham

About 886 total real estate projects face delays; Punjab records maximum delays of 48 months: Assocham