IPOs continue their winning streak in 2017

Avenue Supermart, with its listing on March 21, has crossed Rs 800-level giving returns of 167% to its investors.

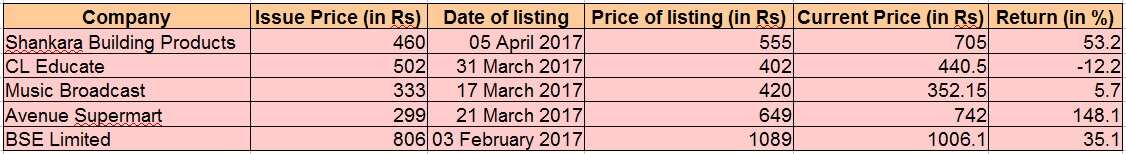

Its been four months of 2017 and four out of five companies that listed on Indian markets this calendar year are trading much higher than their issue price.

BSE had set an issue price of Rs 806 per piece and on Thursday April 27 2017, shares of the exchange closed at Rs 1006.1 per piece. Since its listing in February 3, shares of BSE have risen 35.1%.

On March 17, FM Radio City's parent company Music Broadcast was listed at Rs 420 as against the issue price of Rs 333 per piece. Shares of the company were trading at Rs 325.15 per piece, giving returns of 5.7% to its investors on Thursday.

Avenue Supermart, with its listing on March 21, has crossed Rs 800-level giving returns of 167% to its investors. On Thursday, shares of the company were trading at Rs 742 per piece.

Only CL Educate failed to woo investors post listing.

It is the only company this year that listed on a discount. The company had set the issue price at Rs 502 per share and today the shares of the company were trading at Rs 440.5 per piece, giving negative returns of 12.2% to its investors.

Shankara Buildings was trading at Rs 705 per piece, giving returns of 53.2% in just three weeks of its listing.

Sharing the outlook for the IPOs, Pranav Haldea, Managing Director, PRIME Database, in one of its recent research report had said, "2017-18 looks very promising. Already at the beginning of the year, there are 13 companies holding SEBI approval wanting to raise over Rs. 9,230 crore and another 10 companies wanting to raise about Rs. 16,736 crore awaiting SEBI approval. Many more filings are expected in the near future."

According to a report by Live Mint, India has emerged as one of the most active regional markets for initial public offerings (IPOs) with 26 such offerings in the first three months of 2017.

Quoting Vish Dhingra, executive director, EY Global, the report said, "With positive macroeconomic factors, continuing regulatory and tax reforms and a robust investor and business sentiment, 2017 promises to be a healthy IPO year."

Apart from private companies, the government has been pushing for listing of public sector undertakings (PSUs). As directed by the Finance Minister Arun Jaitley in his Budget 2017 speech in February, the government has identified six profit making PSUs, including four from defence sector, for accessing the capital market in the current fiscal and listing on stock exchanges.

The government had set a target of Rs 46,500 crore to be mobilised through minority stake sale and Rs 15,000 crore from strategic disinvestment.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

04:30 PM IST

Muthoot Microfin IPO subscribed 82% on first day of offer

Muthoot Microfin IPO subscribed 82% on first day of offer EXPLAINED | What makes a company withdraw or shelve its IPO plan

EXPLAINED | What makes a company withdraw or shelve its IPO plan Aeroflex Industries to raise Rs 350 crore via IPO; take a quick look

Aeroflex Industries to raise Rs 350 crore via IPO; take a quick look  Udayshivakumar Infra IPO opens: check out subscription status, issue price band, bidding lot size, listing date

Udayshivakumar Infra IPO opens: check out subscription status, issue price band, bidding lot size, listing date Drone maker ideaForge Technology files preliminary papers with SEBI to raise funds via IPO

Drone maker ideaForge Technology files preliminary papers with SEBI to raise funds via IPO