Arun Jaitley launches Bharat-22 ETF

Finance Minister Arun Jaitley on Friday launched Bharat-22 ETF (Exchange Traded Fund).

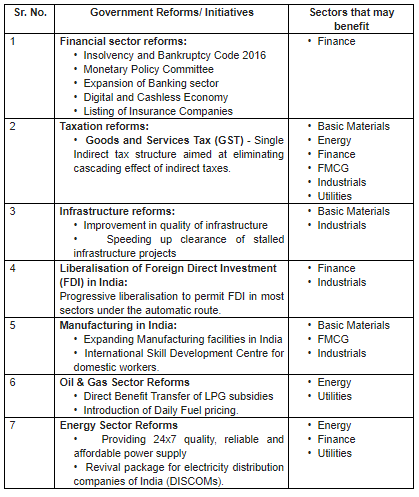

In the Budget Speech of 2017-18, Jaitley had promised to use ETF as a vehicle for further disinvestment of shares. "The target for CPSE’s disinvestment in 2017-18 was set at Rs 72,500 crore. During the current Financial Year 2017-18, the Government has realised approx Rs 9,300 crore through nine disinvestment transactions so far," Finance Ministry said.

The index will comprise of 22 companies with 'finance' component at 20.3% weightage. Companies in this segment are: State Bank of India, Axis Bank, Bank of Baroda, Rural Electrification Corporation, Power Finance Corp and Indian Bank.

'Energy' has the second highest weightage of 17.5% with Nalco, ONGC, Indian Oil Corporation, BPCL and Coal India as its constituents.

This is followed by FMCG companies, namely, ITC, Bharat Electronics, Engineers India and NBCC forming 22.6% share.

Six 'utility' companies comprising Power Grid Corporation, NTPC Ltd, Gail India, NHPC, NLC India and SVJN at 20% share.

90% of the equities included are traded in futures and ICICI Prudential is the fund manager.

Globally ETF Assets have grown significantly. Globally today there are $4 trillion worth Assets Under Management (AUM). These are expected to touch $7 trillion by 2021. Large Investors (Sovereign/Pension Funds) prefer investing in ETFs due to the benefits of ETF being Low cost & Less risky; being Highly Liquid assets; Transparent Investment and that these can be traded at Real Time Market Price, the statement said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

05:02 PM IST

Can Govt achieve its disinvestment target this year?

Can Govt achieve its disinvestment target this year?