Sensex today: Late sell-off in markets on trade war fears; index tanks 351 points; metal stocks lose most

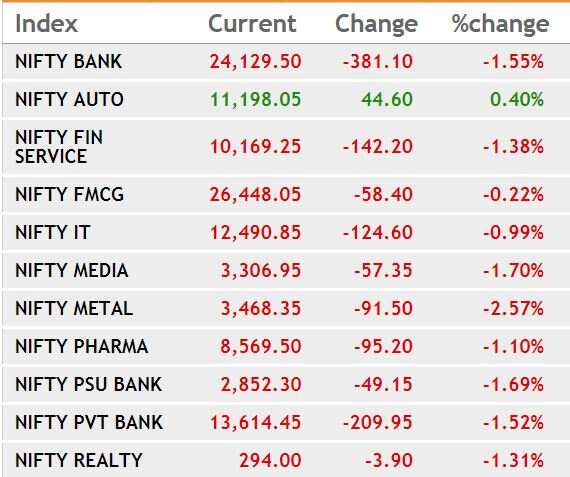

The benchmark indices pared all intraday gains to end in red with the Nifty50 dipping below its crucial 10,150 mark as investors turned cautious ahead of the Reserve Bank of India (RBI)'s monetary policy outcome scheduled for Thursday. Globally, negative trend in overseas markets after US-China trade war fears re-ignited, also contributed to the losses. The Sensex ended at 33,019, down 351.56 points, while the broader Nifty50 closed at 10,120, down 124.80 points.

In the broader market, the BSE Midcap and the BSE Smallcap indices slipped 1 per cent each. Market breadth, indicating the overall health of the market turned negative. On the BSE, 1,191 stocks rallied, 1,442 stocks declined, while 151 stocks remained unchanged.

The six-member Monetary Policy Committee (MPC), headed by RBI Governor Urjit Patel, kicked off its two-day policy meet earlier this day, and will announce the policy outcome on Thursday.

Heavy selling was seen in global stock markets and commodities, with US stock futures sliding 1.5 per cent, soybean futures plunging 3.7 per cent and the dollar briefly extending early losses. China’s yuan skidded in offshore trade. Asian markets tanked 2.5 per cent in futures trade, while European markets were trading with the losses of up to 1.25 per cent.

On Tuesday, despite volatility in the global markets, the Sensex and Nifty closed Tuesday's rangebound trade session with appreciable gains led by healthy buying in banking, auto, oil and gas, and healthcare stocks. The Sensex ended at 33,370, up 115.27 points, while the broader Nifty50 settled at 10,245, up 33.20 points.

Meanwhile, foreign institutional investors sold equities worth Rs 376.51 crore, while domestic institutional investors bought equities worth Rs 479.18 crore.

The benchmark indices pared all intraday gains to end in red with the Nifty50 dipping below its crucial 10,150 mark as investors turned cautious ahead of the Reserve Bank of India (RBI)'s monetary policy outcome scheduled for Thursday. Globally, negative trend in overseas markets after US-China trade war fears re-ignited, also contributed to the losses. The Sensex ended at 33,019, down 351.56 points, while the broader Nifty50 closed at 10,120, down 124.80 points.

In the broader market, the BSE Midcap and the BSE Smallcap indices slipped 1 per cent each. Market breadth, indicating the overall health of the market turned negative. On the BSE, 1,191 stocks rallied, 1,442 stocks declined, while 151 stocks remained unchanged.

The six-member Monetary Policy Committee (MPC), headed by RBI Governor Urjit Patel, kicked off its two-day policy meet earlier this day, and will announce the policy outcome on Thursday.

Heavy selling was seen in global stock markets and commodities, with US stock futures sliding 1.5 per cent, soybean futures plunging 3.7 per cent and the dollar briefly extending early losses. China’s yuan skidded in offshore trade. Asian markets tanked 2.5 per cent in futures trade, while European markets were trading with the losses of up to 1.25 per cent.

On Tuesday, despite volatility in the global markets, the Sensex and Nifty closed Tuesday's rangebound trade session with appreciable gains led by healthy buying in banking, auto, oil and gas, and healthcare stocks. The Sensex ended at 33,370, up 115.27 points, while the broader Nifty50 settled at 10,245, up 33.20 points.

Meanwhile, foreign institutional investors sold equities worth Rs 376.51 crore, while domestic institutional investors bought equities worth Rs 479.18 crore.

Latest Updates

Why CLSA, MS, Jefferies are bullish on Dalal Street's second most expensive stock

This stock is drawing a lot of attention. Despite riding high, as far as price is concerned, it is still managing to generate investor interest. Eicher Motors share price rallied over 3 per cent on BSE after the auto major, which owns the iconic Royal Enfield (RE) motorcycle franchise, on Tuesday announced capex plan of Rs 800 crore for FY19 for various activities, including the construction of second phase of its Vallam Vadagal plant near Chennai.

Reacting to the news, Eicher Motors stock, the second most expensive on Dalal Street, gained as much as 3.5 per cent to Rs 29,050 on BSE. Most foreign brokerages such as Jefferies, CLSA etc raised target price on Eicher Motors following Tuesday's announcement. The highest target price came in at Rs 39,300 by CLSA, an upside of over 35 per cent from the current levels.

Markets at day's low

At 13:50 pm, the Sensex was trading at 33,126, down 243.99 points, while the broader Nifty50 was ruling at 10,163, down 81.25 points.

The fall came after China on Wednesday said it was ready take countermeasures in retaliation against the new round of tariffs imposed by US President Donald Trump, expressing firm opposition to the new duties targeting USD 50 billion worth of Chinese products.

The Trump administration yesterday published a list of about 1,300 Chinese exports that could be targeted for tariffs. The US plans to apply the tariffs to about USD 50 billion worth of goods to punish China for its alleged theft of trade secrets, including software, patents and other technology. Trump is demanding that China cut down USD 375 billion trade deficit by USD 100 billion in about a month.

China reacted sharply to the new tariffs, again raising fears of a trade war between the two largest economies of the world.

Mishra Dhatu Nigam rallies 2% post tepid listing

Mishra Dhatu Nigam (MDNL) made a tepid debut on the bourses with the stock listing at Rs 87 on the BSE and NSE, a a discount of 3.33 per cent over its issue price of Rs 90. The stock gained 2 per cent over its listing price to hit an intraday high of Rs 90.90 on the BSE. "Listing gains were not expected on the stock, however, risk reward looks favourable for Mishra Dhatu in the short-term," told Avinash Gorakssakar, HoR, Joindre Capital to Zee Business. The initial public offering (IPO) of mini-ratna Mishra Dhatu Nigam (Midhani), which was oversubscribed by 1.21 times, was opened for subscription from March 21 to March 23.

ICICI Securities share price makes tepid debut

ICICI Securities made a negative debut on the bourses with the stock listing at Rs 431.10 on the BSE, a 17 per cent discount to the issue price of Rs 520. On NSE, the stock listed at Rs 435. Avinash Gorakssakar, HoR, Joindre Capital belives the tepid listing for ICICI Securities was expected as the public issue was richly priced. Gorakssakar, however, is bullish on the stock for the long-term.

"I don't see any risk reward on the stock in the short-term, however, the stock looks good for the long-term as it comes out with its quaterly numbers. Investors can enter into the stock around Rs 425 levels. I believe the stock will stabilise around Rs 475 to Rs 450," said Gorakssakar.

F&O Watch

Among Nifty April series put options, 10000 strike witnessed maximum OI action, which may act as a support zone in near term. Among Nifty March series call options, 10500 strike witnessed maximum OI action, which may act as a resistance zone in short term.

Auto sector witnessed buying. Major gains were contributed by Mrf, M&M, Mothersumi, Apollotyre, Exideind, Tatamotors and Amarajabat.

Nifty PSU bank Index down by 1.65%. Main gains were contributed by Syndibank, Bankindia, Unionbank, Bankbaroda, Sbin, Orientbank, Canbk and Indianb.

Index options PCR at 0.88 and Stock options PCR at 0.42. India VIX ended at 15.2550 down by 0.60%.