Smart start to FY19! Sensex ends near day's high, up 286 points; Nifty regains 10,200

The benchmark indices kicked off the financial year 2018-19 on a smart note with Nifty50 reclaiming its crucial 10,200 mark tracking gains in global equity markets, while auto stocks such as Tata Motors, Maruti Suzuki gained after posting strong sales numbers for March. The Sensex settled at 33,255, up 286.68 points, while the broader Nifty was ended at 10,211, up 98.10 points.

In the broader market, the BSE Smallcap index outperformed to gain over 2 per cent, while BSE Midcap rallied over 1 per cent. Market breadth, indicating the overall health of the market, turned positive. On the BSE, 2,101 stocks rallied, 538 stocks declined, while 172 stocks remained unchanged.

Back home, the India Meteorological Department on Sunday warned that the average temperatures in most parts of India is expected to be "above normal" between April and June, the period it considers the actual summer season. The IMD, however, said the temperatures in east, east-central and southern India, which include Odisha, coastal Andhra Pradesh and Telangana, are likely to be lower than the usual, indicating that the onset of monsoon will be on time.

Among Asian markets, MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3 per cent. South Korea’s KOSPI gained 0.6 per cent and Japan’s Nikkei advanced 0.55 per cent. Hong Kong’s Hang Seng added 0.25 per cent and Shanghai was up 0.4 per cent.

Wall Street surged last Thursday as technology stocks rebounded, ending a tumultuous first quarter on a high note. Many major financial centers were closed for the Good Friday Easter holiday. The Dow Jones Industrial Average rose 254.69 points, or 1.07 per cent, to close at 24,103.11, the S&P 500 gained 35.87 points, or 1.38 per cent, to 2,640.87 and the Nasdaq Composite added 114.22 points, or 1.64 per cent, to 7,063.45.

MSCI’s world equity index ended up 1.2 per cent last week. But it lost about 1.5 per cent in the first quarter, pushed away from record highs as tensions over global trade escalated, turmoil in the White House deepened and market-leading technology firms wobbled on fears of regulation and other issues.

The benchmark indices kicked off the financial year 2018-19 on a smart note with Nifty50 reclaiming its crucial 10,200 mark tracking gains in global equity markets, while auto stocks such as Tata Motors, Maruti Suzuki gained after posting strong sales numbers for March. The Sensex settled at 33,255, up 286.68 points, while the broader Nifty was ended at 10,211, up 98.10 points.

In the broader market, the BSE Smallcap index outperformed to gain over 2 per cent, while BSE Midcap rallied over 1 per cent. Market breadth, indicating the overall health of the market, turned positive. On the BSE, 2,101 stocks rallied, 538 stocks declined, while 172 stocks remained unchanged.

Back home, the India Meteorological Department on Sunday warned that the average temperatures in most parts of India is expected to be "above normal" between April and June, the period it considers the actual summer season. The IMD, however, said the temperatures in east, east-central and southern India, which include Odisha, coastal Andhra Pradesh and Telangana, are likely to be lower than the usual, indicating that the onset of monsoon will be on time.

Among Asian markets, MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3 per cent. South Korea’s KOSPI gained 0.6 per cent and Japan’s Nikkei advanced 0.55 per cent. Hong Kong’s Hang Seng added 0.25 per cent and Shanghai was up 0.4 per cent.

Wall Street surged last Thursday as technology stocks rebounded, ending a tumultuous first quarter on a high note. Many major financial centers were closed for the Good Friday Easter holiday. The Dow Jones Industrial Average rose 254.69 points, or 1.07 per cent, to close at 24,103.11, the S&P 500 gained 35.87 points, or 1.38 per cent, to 2,640.87 and the Nasdaq Composite added 114.22 points, or 1.64 per cent, to 7,063.45.

MSCI’s world equity index ended up 1.2 per cent last week. But it lost about 1.5 per cent in the first quarter, pushed away from record highs as tensions over global trade escalated, turmoil in the White House deepened and market-leading technology firms wobbled on fears of regulation and other issues.

Latest Updates

Top gainers/losers

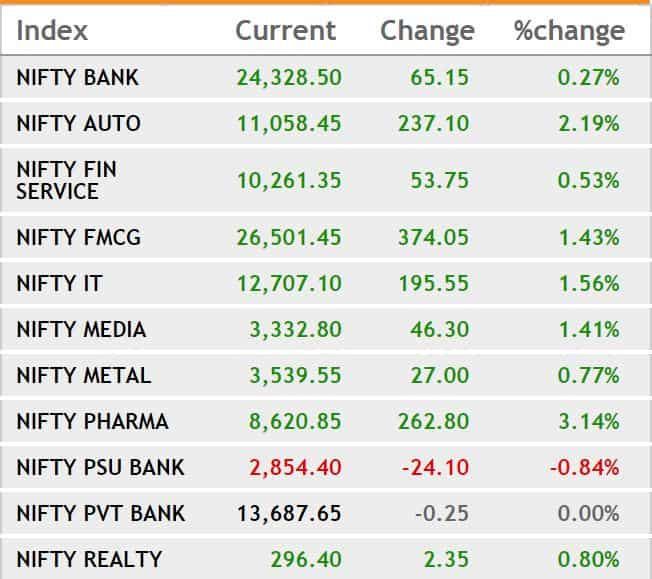

Banking stocks were the leading losers. ICICI Bank tanked over 5 per cent, Axis Bank dipped over 2 per cent, while SBI slipped 1.5 per cent on the BSE. Gainers include Adani Ports (up 4.5 per cent), Kotak Mahindra Bank (up 4.3 per cent) and Tata Motors (3.8 per cent).

Reliance Infrastructure share price rallies 5%; here's why

Reliance Infrastructure share price surged nearly 5 per cent on Monday after the company won an engineering, procurement and construction (EPC) contract for Rs 441 crore from the Ministry of Road Transport and Highways for the upgrading of National Highway 66 in the Kashedi Ghat section which includes execution of three by three lane twin tunnels of total length 3.44 km, a company statement said here on Monday.

ICICI Bank faces investors heat over Rs 3,250 cr Videocon loan

Chanda Kochhar, one of the most influential names in India, with even Fortune describing her as being among the ‘Most Powerful Women in Business’, is facing very tough times. After a 34-year banking career, Kochhar now faces alleged charges of favoritism in a loan sanctioned to household-electric compliance maker Videocon Group. Controversy that erupted is over the CEO & MD of largest private-lender ICICI Bank having made personal gains in regards to loan given to Videocon in which her husband Deepak Kochhar's name has cropped up. Even though the top management of ICICI Bank tried to protect dignity of Chanda Kochhar and showed faith in her work, yet investors and government regulatory boards have started the process of looking into the matter. The the share price of the bank has tumbled over 7% on Monday trading session.

ICICI Bank share price plunges whopping 17%, but analysts expect 39% upside

Even as ICICI Bank share price has fallen sharply amid a slew of negative news, broking firms remain positive on its future propspects. The stock has fallen 17 per cent year-to-date as entire banking pack came under pressure following the financial fraud in Punjab National Bank (PNB) in the Nirav Modi and Mehul Choksi case, while recent controversy over alleged conflict of interest involving its CEO Chanda Kochhar and her husband Deepak Kochhar put further selling pressure on the ICICI Bank stock.

Nifty outlook by Angel Broking

With a near-term view, the tide has certainly turned lower post the union budget and is likely to continue for some time as well. For this week, 10,230 – 10350 would be seen as a strong resistance zone; whereas, on the lower side, 10049

followed by 9951 would act as a crucial support zone. As long as Nifty remains within this range of 10230 – 9951, we expect the consolidation to continue, during which lot of individual stocks would provide better trading opportunities.

ICICI Bank under pressure

ICICI Bank share price dipped over 6 per cent to Rs 260 after RBI imposed Rs 58.9 crore penalty on the bank for non-compliance with regulatory directions on direct sale of securities from the bank’s Held To Maturity (HTM) portfolio and specified disclosure in this regard.

Stocks in focus

- Aurobindo: Gets U.S. FDA approval for Zumandimine tablets ANDA

- Canara Bank: Calls off sale of stake in Can Fin Homes.

- Dilip Buildcon: Says awarded Hybrid Annuity by NHAI

- Punj Lloyd: Wins order worth 8.06b rupees from NHAI

- Tata Motors: Says March local sales rose 35% y/y to 69,440 units

- Tata Power: Okays engineering unit sale to Tata Advanced Systems

- UltraTech Cement: Gets CCI approval for Binani Cement bid

- Vedanta: Says it has agreed to acquire Electrosteel Steels

Asian markets today

Asian stocks began the new quarter on Monday with mild gains following a strong performance by global equities last week, while the dollar held steady ahead of key economic indicators. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.3 percent.

South Korea’s KOSPI gained 0.6 percent and Japan’s Nikkei advanced 0.55 percent. Hong Kong’s Hang Seng added 0.25 percent and Shanghai was up 0.4 percent.

Wall Street surged last Thursday as technology stocks rebounded, ending a tumultuous first quarter on a high note. Many major financial centres were closed for the Good Friday Easter holiday.

MSCI’s world equity index ended up 1.2 percent last week. But it lost about 1.5 percent in the first quarter, pushed away from record highs as tensions over global trade escalated, turmoil in the White House deepened and market-leading technology firms wobbled on fears of regulation and other issues.

(Source: Reuters)

Titan, ICICI Bank among 10 Buy and Sell trading ideas for Monday's trade

1) Titan (Buy)

Target: Rs 958

Stoploss: Rs 935

- Titan, Grasim, Bajaj Finserv included in Nifty

- Ambuja, Bosch, Auro Pharma excluded from Nifty

China imposes additional tariffs in response to US duties on steel, aluminum

China has slapped extra tariffs of up to 25 percent on 128 U.S. products including frozen pork, as well as on wine and certain fruits and nuts, in response to US duties on imports of aluminum and steel, China’s finance ministry said. The tariffs, to take effect on Monday, was released late on Sunday and matches a list of potential tariffs on up to $3 billion in US goods published by China on March 23.

China’s Ministry of Commerce (MOFCOM) said it was suspending its obligations to the World Trade Organization (WTO) to reduce tariffs on 120 US goods, including fruit. The tariffs on those products will be raised by an extra 15 percent.

Eight other products, including pork, will now be subject to additional tariffs of 25 percent, it said, with the measures effective from April 2.

Source: Reuters