Reliance Industries' Q1FY18 net profit rises by 28% to Rs 9080 crore

Before announcing the financial result, the company announced that Reliance Jio to sell rights shares to raise Rs 20,000 crore.

Reliance Industries on Thursday announced its financial result for the quarter ended on June 31. The company reported a consolidated net profit of Rs 9,080 crore, a rise of 28% as against Rs 7077 crore during the same period last year.

On quarterly basis, in the fourth quarter of the last fiscal the company had reported a net profit of Rs 8053 crore. The total income in Q1FY18 stood at Rs 92,661 crore, a drop of 2.2% as against Rs 94,825 crore in Q4FY17. However, in the Q1FY17, the total income was 73,829 crore.

Increase in revenue is primarily on account of increase in prices and volumes of refining and petrochemical products partially offset by lower prices and volumes from E&P business. Revenue was also boosted by robust growth in retail business which recorded a 73.6% increase in revenue to Rs 11,571 crore. Brent crude oil price averaged $49.9/bbl in 1Q FY18 as compared to $45.6/bbl in the corresponding period of the previous year.

Cost of raw materials increased by 17.7% to Rs 44,117 crore ($ 6.8 billion) from Rs 37,469 crore on Yo-Y basis primarily on account of increase in crude prices and higher volume of crude processed.

Employee cost increased by 16.3% at Rs 2,455 crore ($ 380 million) as against Rs 2,111 crore in corresponding period of the previous year due to increased employee base and higher payouts.

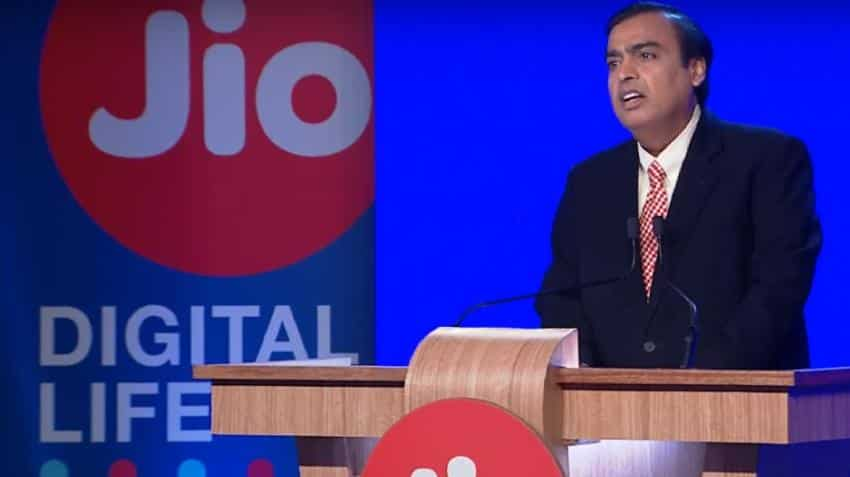

Commenting on the results, Mukesh D. Ambani, Chairman and Managing Director, Reliance Industries Limited said “Our Company recorded yet another strong quarterly performance with net profit of Rs 9,108 crore, up 28% Y-o-Y. Our industry leading portfolio of assets in the refining and petrochemicals business contributed to considerable improvement in our earnings for the quarter. Retail business also witnessed accelerated growth momentum with YoY revenue growth of 74%. Jio has revolutionised the Indian telecom and data consumption landscape. This digital services business has been built to address the entire value chain across the digital services domain with smart applications to make life simple, beautiful and secure."

Operating profit before other income and depreciation increased by 11.9% on a Y-o-Y basis to Rs 12,554 crore ($ 1.9 billion) from Rs 11,223 crore in the previous year. Operating profit was led by robust performance from petrochemicals business and sustained strength in refining business. This was partially offset by losses in Oil & Gas business due to lower volumes and weak domestic price environment.

Cash and cash equivalents as on 30th June 2017 were at Rs 72,107 crore ($11.2 billion) compared to Rs 77,226 crore as on 31st March 2017. These were in bank deposits, mutual funds, CDs and Government Bonds and other marketable securities.

Refining and marketing business

During 1Q FY18, revenue from the Refining and Marketing segment increased by 18.3% Y-o-Y to Rs 66,945 crore ($ 10.4 billion). Segment EBIT (including exceptional item of Rs 1,087 crore) increased by 13.4% Y-o-Y to a record level of Rs 7,476 crore ($1.2 billion).

1Q FY18 revenue from the Petrochemicals segment increased by 22.9% Y-o-Y to Rs 25,461 crore ($ 3.9 billion), primarily due to increase in prices of PP, PVC, PTA and Polyester and increase in volumes due to addition in capacity of PX at Jamnagar.

While announcing the financial result, the company announced that Reliance Jio to sell rights shares to raise Rs 20,000 crore.

The shares of the company ended at Rs 1528.70 per piece, down 0.31% or Rs 4.80 on BSE.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

06:30 PM IST

Mcap of top-10 most valued firms slumps Rs 4.95 lakh crore; TCS, Reliance hardest hit

Mcap of top-10 most valued firms slumps Rs 4.95 lakh crore; TCS, Reliance hardest hit 6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit

6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week

SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week Reliance Industries shares drop nearly 4%; market valuation erodes by Rs 77,606.98 crore

Reliance Industries shares drop nearly 4%; market valuation erodes by Rs 77,606.98 crore  Gas price for Reliance hiked to $10.16; CNG, piped cooking gas rates unchanged

Gas price for Reliance hiked to $10.16; CNG, piped cooking gas rates unchanged