Reliance Industries ex-bonus: Shares touch fresh high; analysts set new target price

In past six days, Reliance Industries has gained by nearly 8% on the back of consistent buying due to appetite for bonus shares.

Reliance Industries (RIL) touched a new 52-week high of Rs 832.70 per piece on stock exchanges as the company has started trading ex-bonus from Thursday (September 07, 2017) onwards.

For the past six-consecutive days, the share price has been rallying and gained by neary 8%. The stock price which stood at Rs 1,532 per piece on August 29, 2017 - reached to Rs 1,645 per piece on September 06, 2017.

September 06, was the last day for those who wanted bonus shares in RIL.

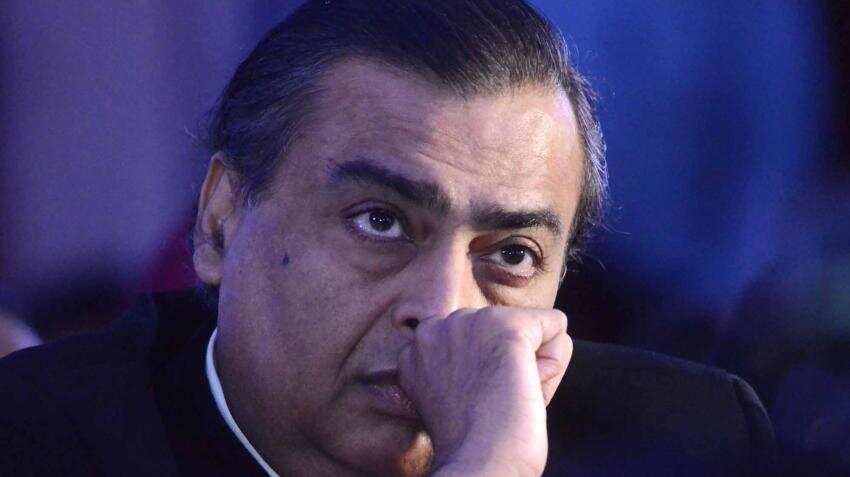

On July 21, at the occasion of its 40th AGM, Mukesh Ambani, Chairman and Managing Director , Reliance Industries said, "Free share issue to be largest ever by any Indian company. It reflects my confidence in company. Reliance to share prosperity with all shareholders."

The company announced that it will give "one free share for every share held".

RIL had decided September 09, 2017 as the record date for determining members eligible for bonus shares of the company.

Analysts are very optimistic about the stock performance of RIL on the back of its strong business portfolio.

Mayank Maheshwari and Rakesh Sethia analysts at Morgan Stanley said, "Refining margins are reaching cycle highs, chemical margins recovering to mid-cycle, clarity on telecom is improving. We expect windfall profits in the upcoming earnings season. More importantly, these trends should sustain in 2018 implying earnings surprises again driven by energy."

Following this, Morgan Stanley has set its price target at Rs 1,823 for Reliance. It said, "RILis an integrated refining and petrochemical player with operating assets similar to

global peers’,and hence we expect it to trade in line with them."

On September 06, Reliance acquired Gujarat-based Kemrock Industries & Exports Limited after it participated in an on-line e-bidding process held recently by Allahabad Bank being leader of the consortium of 11 Banks to sell or dispose off assets.

RIL said, "The assets will pave the way for Reliance to foray into new materials (Composites and Carbon Fibre) and further strengthen its petrochemicals business portfolio."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

12:11 PM IST

Mcap of top-10 most valued firms slumps Rs 4.95 lakh crore; TCS, Reliance hardest hit

Mcap of top-10 most valued firms slumps Rs 4.95 lakh crore; TCS, Reliance hardest hit 6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit

6 blue-chip firms lose Rs 1.55 lakh crore mcap in a week; RIL worst hit SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week

SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week Reliance Industries shares drop nearly 4%; market valuation erodes by Rs 77,606.98 crore

Reliance Industries shares drop nearly 4%; market valuation erodes by Rs 77,606.98 crore  Gas price for Reliance hiked to $10.16; CNG, piped cooking gas rates unchanged

Gas price for Reliance hiked to $10.16; CNG, piped cooking gas rates unchanged