RBI's Viral Acharya says immediate need to resolve bad loans

"Since the RBI initiated the Asset Quality Review (AQR) of banks in the second half of 2015, it appears that possibly up to a sixth of public sector banks’ gross advances are stressed (non-performing, restructured or written-off), and a significant majority of these are in fact non-performing assets (NPAs)," said Acharya.

Reserve Bank of India's (RBI) Deputy Governor Viral Acharya in a Indian Bank Association speech on Tuesday said stressed on the need to resolve NPAs and bad loans.

Acharya said that there is an immediate need to find possible ways to decisively resolve Indian banks' stressed assets.

Stressed assets is a combination of NPAs and restructured loans, which has been a huge challenge under banking system for many years now.

"Since the RBI initiated the Asset Quality Review (AQR) of banks in the second half of 2015, it appears that possibly up to a sixth of public sector banks’ gross advances are stressed (non-performing, restructured or written-off), and a significant majority of these are in fact non-performing assets (NPAs)," said Acharya.

He added, "For banks in the worst shape, the share of assets under stress has approached or exceeded 20%."

Presently, to reduce its non-performing assets, banks have resolution mechanisms, namely; Lok Adalats, Debt Recovery Tribunals (DRT), invocation of SARFAESI ACT, Asset Reconstruction Companies (ARCs) and Scheme for Sustainable Structuring of Stressed Assets (S4A).

However, the recent financial stability report (FSR) published by RBI on December 30, 2016 stated that the public sector banks (PSBs) are nowhere near revival when it comes recovery to bad loans.

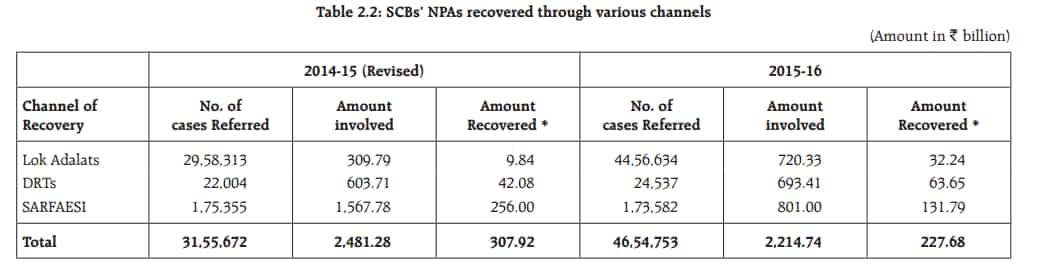

Amount recovered by SCBs lowered to Rs 22,768 crore compared to Rs 30792 crore recovered in 2014-15. The slowed down in recovery was due to 52% reduction in amount recovery under SARFAESI channel, RBI said.

Recovery through Lok Adalats increased to Rs 3,224 crore from Rs 984 crore and that of DRTs stood at Rs 6,365 crore versus Rs 4,208 crore in 2014-15.

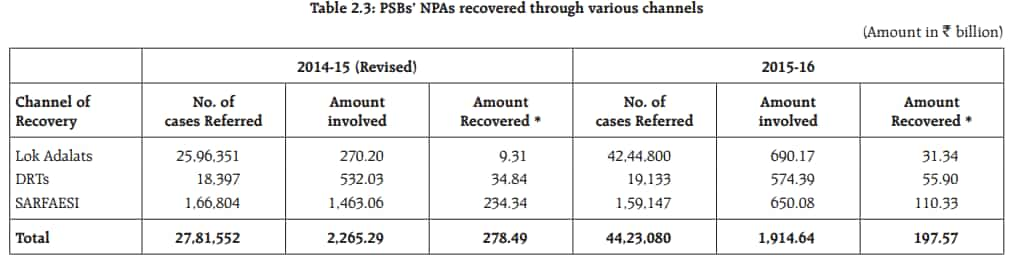

From the above, it is noted downward trend under SARFAESI was the major reason for slowdown in PSBs' NPA recovery.

For PSBs, amount recovered under SARFAESI was at Rs 11,030 crore in 2015-16 against Rs 27,849 crore in 2014-15. That of Lok Adalats and DRTs increased to Rs 3,134 crore and Rs 5,590 crore from their earlier Rs 931 crore and Rs 3,484 crore, respectively.

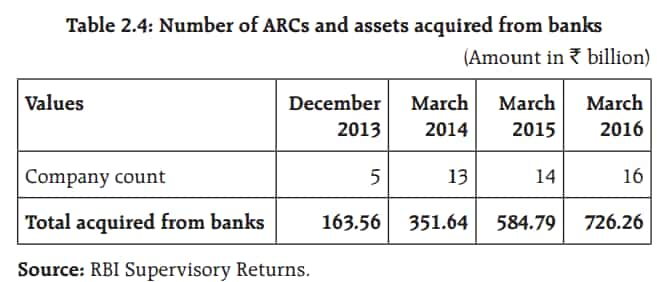

As per FSR report, although the number of companies acquired by ARCs rose by only 2 from March 2015 to March 2016, the total consideration for the same increased from Rs 58,479 crore to Rs 72,626 crore in the same period, registering a rise of 24.19%.

While only two companies Hindustan Construction Company (HCC) and Jaiprakash Power have entered the S4A scheme. Both the companies have alloted about 25.20 crore equity shares and 305.8 crore equity shares to its lenders under S4A scheme.

During the monetary policy meet, Acharya has said "The NPA numbers are out there and the problem is quite large. It requires a significant recapitalisation in the banking systems especially the public sector banks." He added, "If the stressed asset resolved would probably could help in restoring the utilisation capacity in this sector while further creating healthy investment in the system and at the same time would also support banks to again start lending in the same sectors again."

As per the Economic Survey, gross NPAs climbed to almost 12% of gross advances for public sector banks at end-September 2016.

There are at least fifteen more state-run banks with gross NPAs above 10% which include UCO Bank (17.19%), United Bank of India (14.29%), Punjab National Bank (13.75%), Central Bank (13.52% ) and Bank of India (13.38% ) and Indian Overseas Bank with 20.48% Gross NPAs).

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

12:42 PM IST

Viral Acharya's resignation: RBI union moots collegium of experts to select governors, deputy governors

Viral Acharya's resignation: RBI union moots collegium of experts to select governors, deputy governors Why RBI deputy governor Viral Acharya resigned: Here's official RBI response

Why RBI deputy governor Viral Acharya resigned: Here's official RBI response RBI deputy governor Viral Acharya resigns, may return to the US: Sources

RBI deputy governor Viral Acharya resigns, may return to the US: Sources Urjit Patel quits in shock move! Viral Acharya next?

Urjit Patel quits in shock move! Viral Acharya next? RBI vs Centre: Urjit Patel in spotlight, markets on watch

RBI vs Centre: Urjit Patel in spotlight, markets on watch