Increasing internet penetration to boost revenue from data services for telcos

An emerging trend in the telecom industry may be noticed as the attempt of companies to earn more from data services over voice calls.

Key highlights

- Currently voice calls dominate Indian telecom industry revenues at ~70%.

- Data services contribute merely 20% of telco's revenues.

- Increasing internet penetration especially in rural areas to boost revenue earned from data services.

Telecom operators will now turn to data services to fatten profit margins as increase in use of internet bodes well with mobile subscribers.

In a webinar on emerging trends in the telecom sector on Friday, sector analyst Bhagyashree Bhati of Care Ratings said data services was the ‘next major source of revenue’ for telcos on the back of higher internet usage.

“Data usage is the next major source of revenue earner for telecom companies after voice call services. The use of data services is on a rise,” Bhati said.

Voice calls still formed majority part of telcos revenue up to 70% until the December 2016 quarter.

Airtel’s voice calls formed 71% of its revenue and Idea’s voice calls was 72.8% of total revenue in that quarter (Q3FY17), the analyst said.

“As per the March 2017 quarterly results of Bharti Airtel, data services accounted for 21.5% of mobile India revenues and data services for Idea Cellular accounted for 18.3% of the overall service revenue,” the report by Care Ratings said.

Mobile data consumption is expected to witness a four-fold jump in the next five years, a report by ratings agency CRISIL said on July 25.

“Mobile data consumption in India has grown 24 times in the past 5 fiscals. CRISIL Research expects that number to multiply four-fold in the next five years through fiscal 2022, given low penetration and an expected doubling of data subscribers to more than 900 million (90 crore),” the report read.

After the launch of Reliance Jio digital services in September last year, the industry has faced headwinds that lead to mounting losses.

Zeebiz had earlier reported how Jio’s launch accelerated bundled data matrices.

“Jio’s entry is a major reason for telecoms’ shift in the pricing paradigm’s focus to data instead of voice; however this can also be attributed to increase in penetration of 3G and 4G services,” Gaurav Dixit, Care Ratings’ telecom analyst told Zeebiz in a report dated March 23.

Following Jio’s example of doling out unlimited voice calls for free, Airtel, Idea and Vodafone have also started bundling free voice calls with data packs.

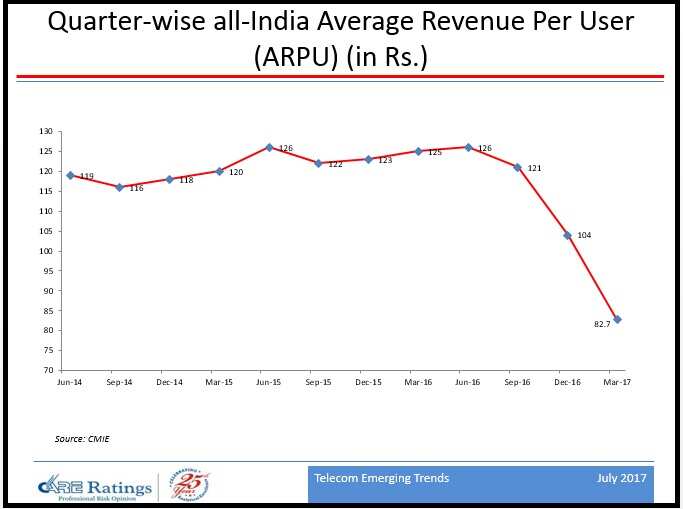

Care Ratings research showed that industry average revenue per user (ARPU) fell drastically quarter on quarter post Jio’s launch in September.

Industry ARPUs began to decline from June when it was at a high of Rs 126 to Rs 121 in September and Rs 82.7 in March. These estimates were taken with

Reliance Jio’s recently launched 4G enabled feature phones is expected to increase the tele-density in the rural areas as well as increase internet penetration.

Although mobile data revenues for the incumbent telcos remained low in Q1FY18 this is expected to increase as experts anticipate higher usage of internet especially in the rural areas.

Also Read:

- How Reliance Jio bundled the telecom sector into 'one plan'

- Mobile data consumption to grow four-fold but Wi-Fi may ground operator revenues

- Can Mukesh Ambani's Reliance Jio force rural India to do what other telecom companies couldn't?

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

08:08 PM IST

Telecom authorities make collaborative efforts to enhance user experience

Telecom authorities make collaborative efforts to enhance user experience  How much mobile data every Indian is consuming per month? Find out

How much mobile data every Indian is consuming per month? Find out Privacy at high risk in compiling users'' mobility data: Study

Privacy at high risk in compiling users'' mobility data: Study How to save mobile data on WhatsApp - step-by-step guide for Android, iOS

How to save mobile data on WhatsApp - step-by-step guide for Android, iOS More than half smartphone users in India remain offline once a day due to poor connectivity

More than half smartphone users in India remain offline once a day due to poor connectivity