How did Yahoo! fall from $125 billion to $5 billion in 15 years?

It was all down hill from 2000 for Yahoo as one wrong decision after another continued to haunt the company.

One of the most iconic old horses of the dot com boom has ended its reign.

Yahoo! has decided give itself up to telecom major Verizon for $4.8 billion.

Verizon on Monday announced the acquisition of beleaguered web company Yahoo Inc for $4.8 billion. The fate of the company was finally sealed after months of speculation and struggle to find a buyer with mounting pressure from investors including Starboard Value LP.

That Yahoo! will be sold off was known for a while. But what has shocked and awed people is the price at which the deal has been stuck.

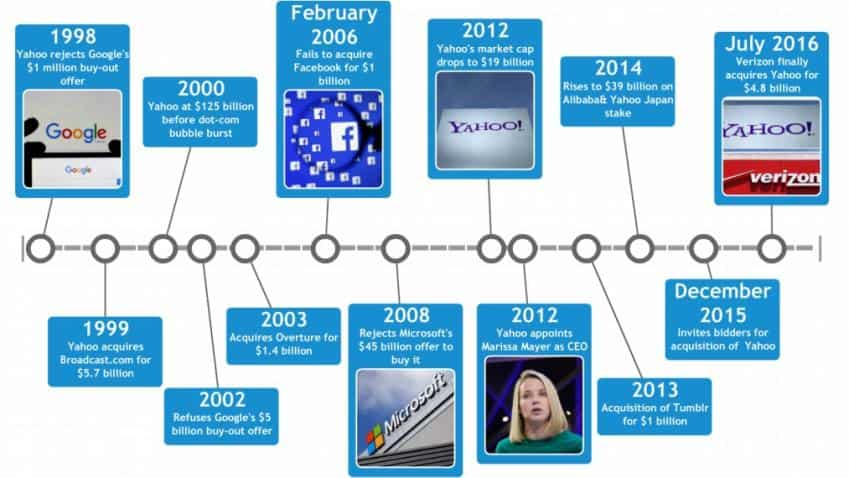

Here's how the story unfolded.

Yahoo! was valued at over $125 billion at its peak in January 2000.

It was all down hill from 2000 for Yahoo as one wrong decision after another continued to haunt the company.

Yahoo! had the opportunity to buy Google for a paltry $1 million in 1998.

Today, Google's parent company Alphabet is valued at over $500 billion.

The opportunity came back in 2002 but Google's $5 billion price was too high for Yahoo!.

Instead, Yahoo! acquired Broadcast.com in 1999 for $5.7 billion.

This was pitted as the worst acquisition deals at the time, according to Econsultancy.com.

Yahoo!, in 2003, bought pay-per-click company called Overture for $1.4 billion. It lost that race to Google AdWords.

Even acquisition of Flickr and Delicious failed to save the company's plummeting trajectory.

Reports suggest that in 2006, the company came very close to buying Facebook for $1 billion. The deal didn't go through.

The company's value dropped to approximately $45 billion in February 2008 when Microsoft offered to buy Yahoo's outstanding shares and thereby getting a hold of 61% stake in the company. However, it refused to take the offer.

By 2012 Yahoo!'s market cap dropped to below $19 billion.

This was when Yahoo! brought on Marissa Mayer as the CEO from Google, to save the ship from sinking.

While Mayer's appointment initially seemed to have worked as Yahoo's value in 2014 increased to $39 billion, however on taking a closer look it was the gains from its stake in Alibaba and Yahoo Japan that resulted in the hike.

She, too, turned to acquisitions and bought Tumblr for over $1 billion in 2013. The company, earlier this year, wrote-down most of this money.

What's left of Yahoo!?

Yahoo! owns 24% in Alibaba.

The value of Alibaba in 2014 had sky-rocketed to $153 billion.

The company also owns 25% stake in Yahoo Japan which was valued at $32.3 billion in 2014.

In fact, by 2013 Yahoo started to receive more revenues from its investments in Alibaba and Yahoo Japan than its core business. The stakes in Alibaba and Yahoo Japan had brought the company around $900 million during 2013 in comparison to just over $450 million from the rest of Yahoo.

Following the sale, Yahoo will be left with about $41 billion it invested in the Chinese e-commerce company Alibaba as well as Yahoo Japan.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

04:55 PM IST

End of the road or new beginning for Yahoo?

End of the road or new beginning for Yahoo? Watch top 5 stories of this night; From Verizon acquiring Yahoo to RBI penalising Bank of Baroda & HDFC Bank

Watch top 5 stories of this night; From Verizon acquiring Yahoo to RBI penalising Bank of Baroda & HDFC Bank Full text: Here's Marissa Mayer's letter to employees on Verizon's acquisition of Yahoo

Full text: Here's Marissa Mayer's letter to employees on Verizon's acquisition of Yahoo End of a legacy; Yahoo Messenger to be discontinued

End of a legacy; Yahoo Messenger to be discontinued Twitter holds merger talks with Yahoo CEO Marissa Mayer: Reports

Twitter holds merger talks with Yahoo CEO Marissa Mayer: Reports