GST to mask real growth trends in FMCG, says Credit Suisse

Goods and Service Tax (GST) regime sited to come into effect in another two weeks will be a game changer for India in many ways, however analysts say that growth trends comparison will become harder to read.

Key Highlights

- Down-stocking in FMCG sector to impact Q1 sales of businesses.

- Wholesalers may not down-stock, depending on anticipation of hike in prices of goods.

- Up-stocking in the second quarter may not compare to down-stocking in Q1.

The Goods and Service Tax (GST) regime sited to come into effect in another two weeks will be a game changer for India in many ways, however growth trends comparison will become harder to read.

“It will be very hard to get any sense of end-consumer demand or even relative performance between companies for the next 3 quarters,” Arnab Mitra and Rohit Kadam of Credit Suisse said in a report dated June 12.

The reason for this, as cited in the report, would be because GST would ‘mask’ real growth trends.

“1Q will see down-stocking, 2Q will see up-stocking but weakness in wholesale and in 3Q the base quarter had demonetisation,” the report said.

Destocking or down-stocking:

Many retailers and a few wholesalers have already started clearance sales before the dawn of GST. Retailers have been destocking goods as presumptive credit post GST is expected to be below excise paid on most products. So in order to minimise losses, clearance sales are being held.

The main reason for businesses lessening the stock in stores or ‘down-stocking’ will be if businesses anticipate lowering of prices of goods post GST.

“Closing stock for the FMCG sector on 30 June will suffer a loss under GST transition rules of 60% presumptive credit by 4-7% on paid taxes,” the report said.

However, the report added, “This may not fully reverse post GST as companies may take this opportunity to make the pipeline leaner.”

Wholesalers may not down-stock

Wholesalers may not necessarily down-stock pre-GST, the report said as they may anticipate a rise in prices post-GST.

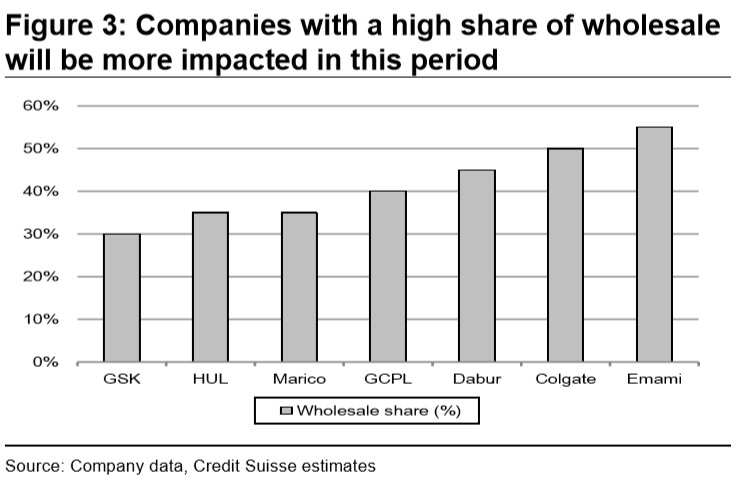

Companies with a higher share of wholesale like Colgate is expected to be more impacted while ITC and HUL will have a weaker impact on sales.

This is expected to hit Q1 sales as well.

UP-stocking

The report by Credit Suisse said that increasing stock of products will take place in the second quarter but it may not be able to cover the tracks of destocking and down-stocking in the preceding quarter.

“Up-stocking will happen but not to the extent of destocking,” the report added stating that its impact will differ from company to company.

Also Read: GST will not hurt second quarter sales, retailers say

Demonetisation

The third quarter growth in sales will not be able to be compared to its preceding quarter as November 2016 marked the demonetisation phase where many businesses had to destock and lose out on margins.

“3QFY17 – Base had demonetisation related down-stocking and wholesale shut-down,” the report said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

06:14 PM IST

States not in favour of bringing ATF under GST, says finance minister

States not in favour of bringing ATF under GST, says finance minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman  GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred

GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred  55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered

55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC

GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC