Why car sales are still far from recovery of demonetisation impact

Despite SIAM showing a recovery in passenger vehicle sales in January, a closer look shows the recovery is only for the top 5 car makers in India.

Passenger car sales showed signs of recovery with a 10.83% growth in sales during January from the biggest fall a month ago in December (since April 2014), according to recent data by the Society of Indian Automobile Manufacturers (SIAM). Total domestic passenger vehicle sales too grew by 14.40% during the month, as 2,65,320 units were sold in January this year as against 2,31,917 units sold during January 2016.

It seems that domestic passenger vehicle sales in the country which was shaken due to the impact of demonetisation in November and December 2016 has managed to recover quickly. This leaves only two-wheelers and commercial vehicle sales still trying to heal the wounds left by demonetisation.

However, this is not entirely the true as 7 out of the of the 15 automobile manufacturers in India posted a month on month decline in sales. This shows that the automobile industry has some way to go before it is fully on the road to recovery.

If this is the case then you may be wondering how come SIAM's sales figures posts such a large growth in sales during the month. First, it has to be noted that these are year on year figures. Even year on year saw a decline in sales of 6 manufacturers. However, month on month sales shows a much clearer picture of the impact of demonetisation and if the automobile companies have recovered.

The high sales in passenger vehicles is chiefly due to the high sales of the market leader Maruti Suzuki (which has 51% market share) during January. The top 5 carmakers in India have a massive 85.18% market share. This leaves the rest 10 automakers with less than 15% of the market and hence their growth and decline has a marginal impact on the overall sales growth numbers of car manufacturers in India.

All the top 5 car companies in India saw a month on month growth in sales from December 2016 to January 2017. While Maruti Suzuki saw a 25.7% MoM growth in sales in January, Hyundai at No.2 spot saw a nearly 5% MoM growth. Mahindra saw a 21.8% MoM growth in sales during January, Honda Cars posted a 54.8% MoM growth in sales and Tata Motors grew by 18.9% MoM in January.

Except for Hyundai all the other car makers posted huge double digit growth in sales. This pushed up the overall sales growth of passenger vehicles during the month.

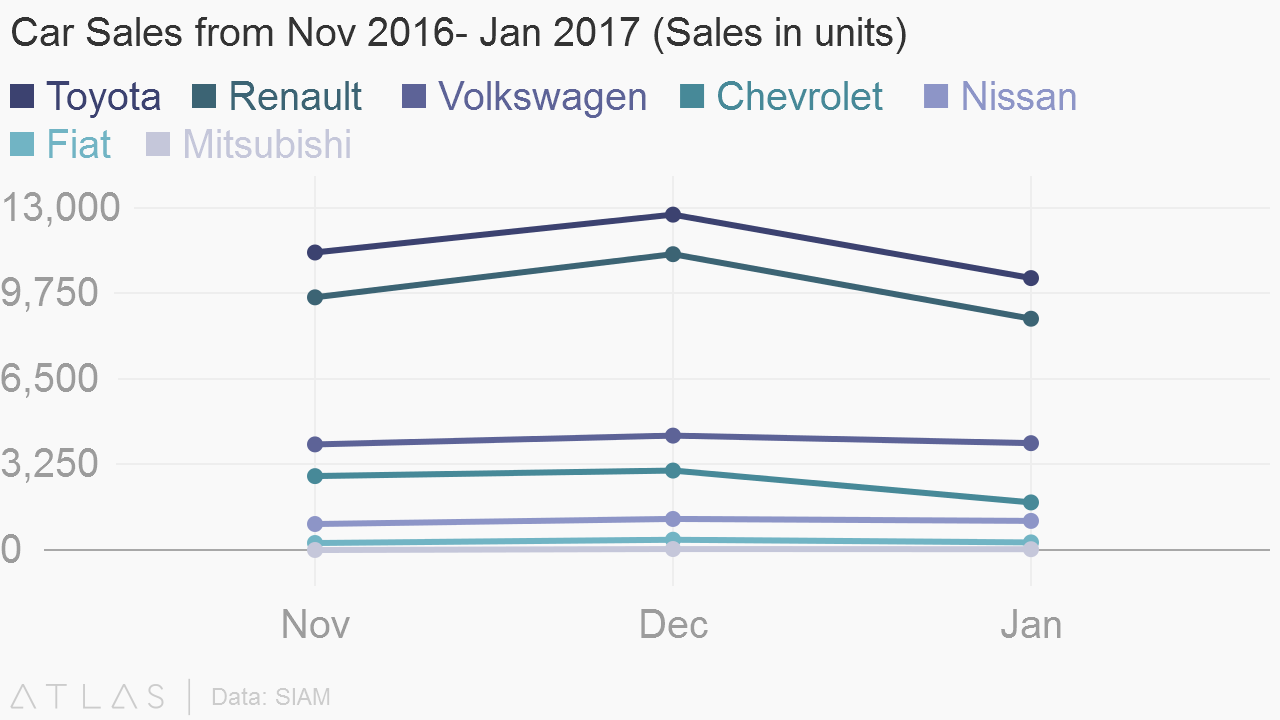

However, the seven car makers which saw a decline in sales include Toyota, Renault, Volkswagen, Chevrolet, Nissan, Fiat and Mitsubishi. While Toyota saw a 23.2% MoM decline in sales, Renault declined by 27.9% MoM, Chevrolet saw 67% decline in sales, Nissan declined by 6.6%, Fiat by over 100% and Mitsubishi over 300%.

This shows that many of the car makers are yet to see any improvement in their month on month sales.

In December when the automobile industry was hit the hardest due to demonetisation the sales of the top 5 car makers had seen a drop or flat sales. For instance, market leader Maruti Suzuki posted a large 18.6% decline in sales MoM, which had a big impact on the overall passenger vehicle market. Others such as Tata Motors too saw a 17.4% MoM decline in sales and Hyundai's sales MoM stayed flat. Only

Mahindra and Honda managed to post a small MoM growth in sales during the month.

Questions to Toyota, Volkswagen, Chevrolet, Nissan and Mitsubishi went unanswered till the time of the publishing of this article.

Kevin Flynn - President and MD, Fiat-Chrysler Automobiles (FCA) India said, "We realigned our pricing strategy on our Fiat range in early January 2017. After the announcement we witnessed an uplift in inquiries and our dealers are working on converting them. Purchase decision to retail takes time and we expect higher sales over the next 2-4 months, hoping GST is implemented well. In fact, passenger vehicle retail sales across the industry are down in Jan by approximately 30% and this In part is due to customers postponing their purchases due to the effect of demonetisation. The Union Budget announcement on Feb 1 also played a role in many customers deferring their purchase decisions. Until GST is implemented and its impact on the market is understood, we anticipate a conservative number of retails across the next few months."

This shows that the passenger vehicle segment recovery in January is due to the growth of only a few top automobile players and not the rest. Which means that the industry is far from recovery in terms of sales growth.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Retirement Planning: SIP+SWP combination; Rs 15,000 monthly SIP for 25 years and then Rs 1,52,000 monthly income for 30 years

Top Gold ETF vs Top Large Cap Mutual Fund 10-year Return Calculator: Which has given higher return on Rs 11 lakh investment; see calculations

Retirement Calculator: 40 years of age, Rs 50,000 monthly expenses; what should be retirement corpus and monthly investment

SBI 444-day FD vs Union Bank of India 333-day FD: Know maturity amount on Rs 4 lakh and Rs 8 lakh investments for general and senior citizens

EPF vs SIP vs PPF Calculator: Rs 12,000 monthly investment for 30 years; which can create highest retirement corpus

Home loan EMI vs Mutual Fund SIP Calculator: Rs 70 lakh home loan EMI for 20 years or SIP equal to EMI for 10 years; which can be easier route to buy home; know maths

12:02 AM IST

UK plans to remove insurance barriers for self-driving cars

UK plans to remove insurance barriers for self-driving cars Volkswagen to recall 3.4 lakh cars in India

Volkswagen to recall 3.4 lakh cars in India  Automakers, suppliers team up to share costs of self-driving cars

Automakers, suppliers team up to share costs of self-driving cars Luxury cars sales likely to drop as IT dept asks dealers for sales numbers since demonetisation

Luxury cars sales likely to drop as IT dept asks dealers for sales numbers since demonetisation 24 lakh people have income above Rs 10 lakh but 25 lakh cars bought every year

24 lakh people have income above Rs 10 lakh but 25 lakh cars bought every year